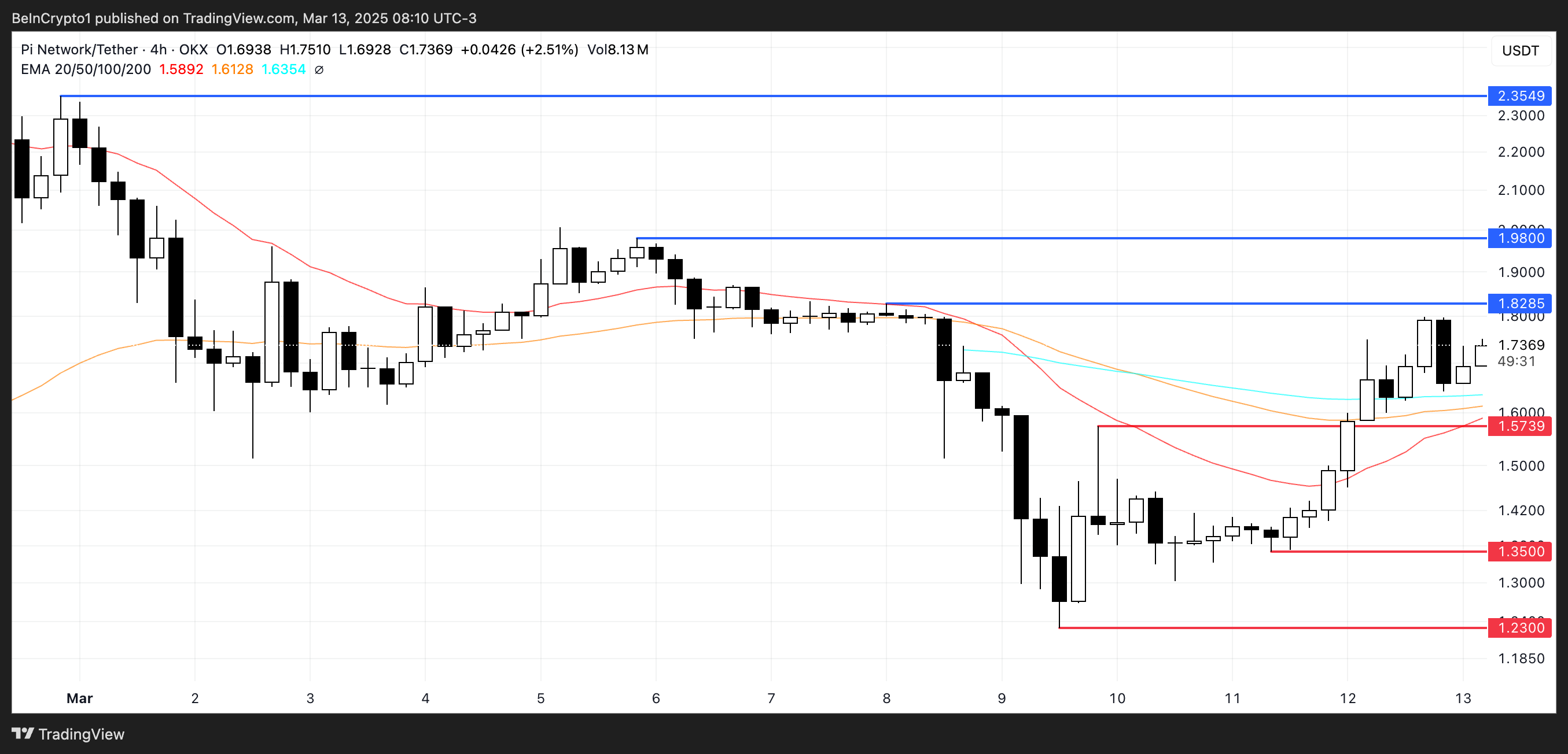

PI Network (PI) is struggling to restore $ 2

After its peak of $ 279 on February 27, the PI network has decreased by approximately 40 % in the past two weeks. Technical indicators indicate that PI momentum settles.

DMI explains that the purchase pressure has risen in the past two days, but ADX has decreased, indicating that the strength of the trend may be weak. Meanwhile, RSI has increased the excessive sales levels, approaching the excessive peak area, which can either unify or continue towards the main resistance levels.

Network DMI offers are still here

The DMI diagram from the PI indicates that the average trend index (ADX) has decreased to 30.6 from 36.5 during the past two days. ADX measures the strength of the trend, with values higher than 25 indicates a strong direction, while values that are less than 20 indicate a weak market or monotheism.

ADX’s height indicates the enhancement of momentum, while the declining ADX suggests a weak direction, even if the price continues in the same direction.

The current decline in ADX indicates that while the PI remains in the upward direction, the momentum behind this movement is softening.

Looking at the directional indicators ( +Di and -Di), Di +rose to 27.3 out of 12.3 days ago, but it has been stable since yesterday, while -Di decreased sharply to 14.9 out of 29.3. This shift indicates that the purchase pressure has increased significantly during the past two days, highlighting the previous sale of the sale.

However, with a decrease +Di stable now and ADX, the strong momentum of the purchase that was seen earlier may fade. This does not necessarily mean an immediate reflection, but it indicates that the upward trend may slow down or enter the standard of unification unless the renewable purchase force is pushing ADX backup.

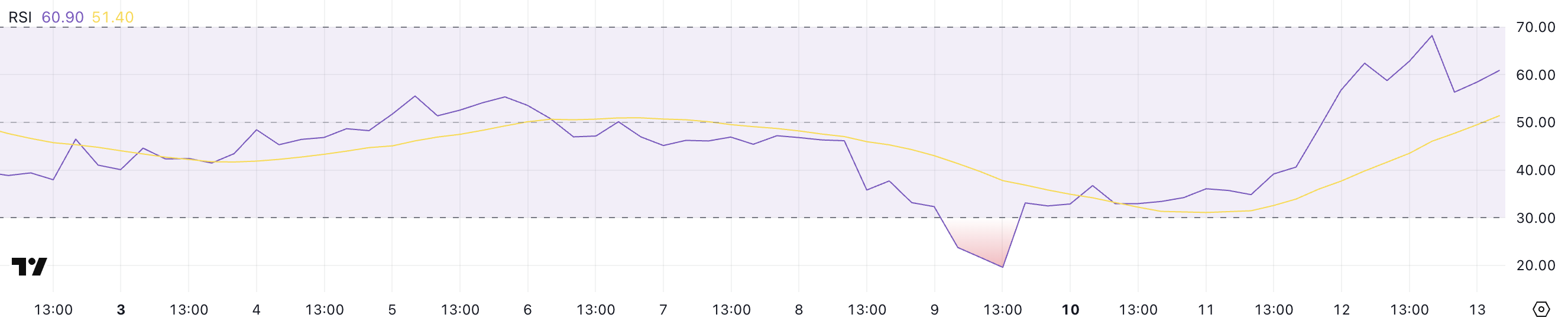

The PI Network RSI has increased in the last two days

The PI (RSI) relative index rose sharply to 60.90, from 34.8 yesterday and 19.5 four days ago. RSI is a momentum that measures the speed and size of price movements on a scale from 0 to 100.

In general, RSI values above 70 indicate excessive conditions, indicating the possibility of withdrawal, while values less than 30 of the signal sale conditions are often preceded by price recovery.

The rapid height of deep sales levels indicates approximately 61 to a strong transformation in the momentum, where buyers regain control.

With the RSI touch from PI 68 earlier and now sitting at 60.90, it approaches the peak purchase area but has not yet crossed the critical threshold of 70.

The fact that PI has not exceeded 70 since February 27 indicates that this level was historically as a barrier, which may lead to a temporary profit or slowdown.

If the RSI settles near its current level, you can unify the PI before making the payment another higher. However, if it exceeds the seventy of the last century, it will indicate the extreme bullish momentum, although this also increases the possibility of a short -term correction.

PI can restore $ 2.35 levels soon

PI PRICE is currently trading within a major range, and faces resistance at $ 1.82 while carrying support at $ 1.57. If the current upward trend continues and buyers can exceed $ 1.82, the next goal will be $ 1.98.

The rest over this level can open the door to a stronger gathering, especially if PI regains the positive momentum last month. In this scenario, the price can extend to a height of about $ 2.35, which enhances a more upward look.

However, disinfection of these levels requires constant purchase pressure and confirmation of collapse above $ 1.82.

On the negative side, if the PI direction is reflected, it can re -test its immediate support at $ 1.57.

Loss of this level would weaken the bullish structure and expose the price for more declines, and may test $ 1.35. In the event of condensation of the sale pressure, the PI can decrease to $ 1.23, which represents a deeper correction.

The support strength of $ 1.57 will be decisive in determining whether the current upward trend is carrying or if PI enter a more extensive decline stage.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.