Microstrategy may announce the purchase of a large bitcoin soon

The strategy, previously known as Microstrategy, may prepare to buy another important bitcoin.

Speculation about this step intensified after the company’s founder, Michael Sailor, dropped an accurate hint on social media.

Tinnah market on a Bitcoin follower in Silor

On February 23, Silor participated in the former X (Twitter), a move that preceded the historically major acquisitions. His hidden message indicated that the recent bitcoin transactions have not yet been reflected in the follower.

“I don’t think this reflects what I did last week,” Sailor books On x.

Looking at its history in sharing similar plans before the main acquisitions on Bitcoin, the Crypto community quickly speculated that the company is preparing for another purchase.

“Michael Sailor’s publication tracking BTC will follow again, which means that the strategy will announce another large purchase in Bitcoin tomorrow”, Nikolaus Hoffman He said.

Meanwhile, some speculate that the strategy may allocate up to two billion dollars to Bitcoin, as it is in line with its last movement to raise funds through transferred bonds.

These bonds, which are not of any benefit but can be converted to the company’s shares, will ripen in March 2030 and will serve as large obligations.

This capital increase is part of the “21/21 plan” of the strategy, which aims to secure $ 42 billion for BTC investments. The company seeks to raise $ 21 billion through stock sales and another $ 21 billion through fixed -income securities.

Once you are a software focusing company, the strategy has evolved into the largest company holder in Bitcoin. Its axis has greatly strengthened the interest of investors, as she got its shares in Nasdaq -100.

The last acquisition of Bitcoin occurred on February 10, when it bought 7,633 BTC for $ 742.4 million. Nowadays, the strategy has 478,740 BTC, at a value of approximately $ 47 billion, with a total investment of $ 31.1 billion.

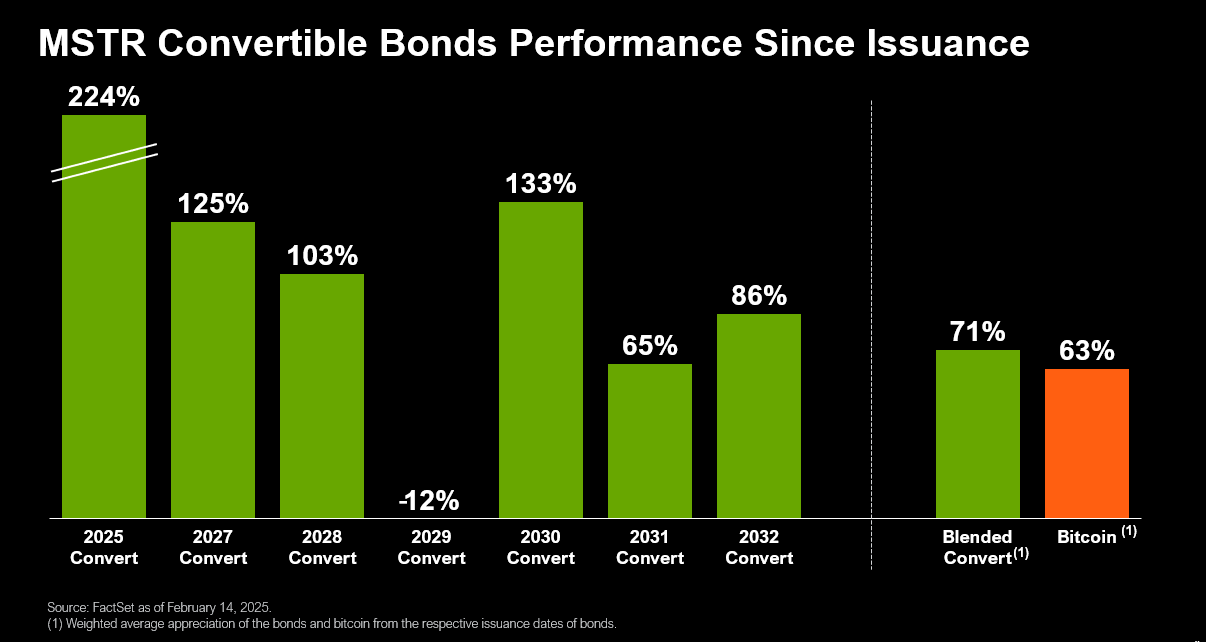

Meanwhile, the company recently highlighted that its convertible bonds from MSTR have returned 71 % since its release, beating Bitcoin itself.

Also, the BTC’s first strategy approach inspired other companies to follow. According to Hodl15 Capital, more than 70 companies circulated all over the world now have Add Bitcoin to their reserves is affected by the Silor strategy.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.