ethereum stalking storms despite the decline in the market

The price of Ethereum remained under great pressure over the past month, however the activity increased.

The data on the series shows a noticeable increase in the quantity of the eth closed in the stokeing contracts, even as altcoin is struggling to restore the upward momentum.

Staking ETH grows while ETF external flows reached $ 524 million

Since it dropped to its lowest level on February 16, the amount of Eth Staped has risen. With 33.98 million ETH is currently closed in stokeing contracts, this number increased by 1 % over the past month.

This has happened despite a significant decrease in ETH value in the past thirty days. Trading at $ 1897 at the time of the press, the ETH price has decreased by 30 % since February 16.

The difference indicates that many investors continue to see the currency as a long -term origin rather than a short -term trading opportunity. They prove confidence in the performance of the future prices of ETH by imprisoning their coins instead of selling amid modern winds.

Moreover, this increasing ETH can indicate an increase in institutions and retail interest in the negative return, even with no short -term procedures.

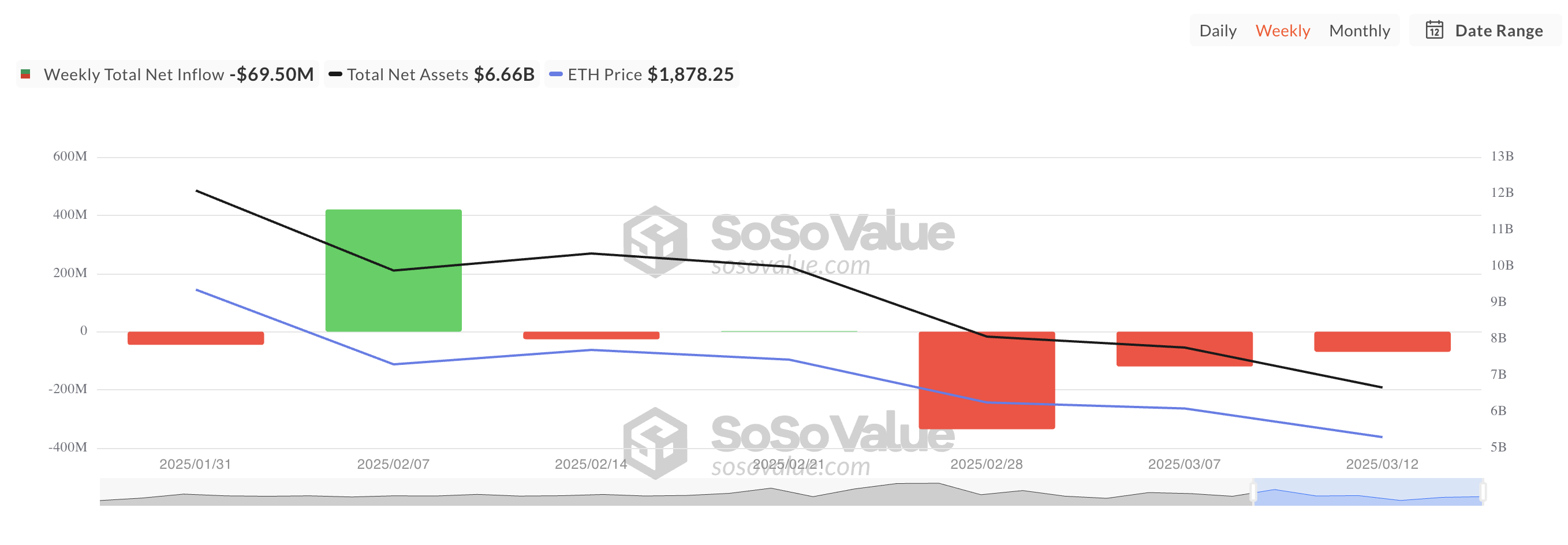

However, this bullish position contrasts with the recent decrease in the flow of the box circulating in ETH ETH (ETF), which raises questions about the broader market morale. Data from Sosovalue shows that these funds have recorded external flows totaling $ 524.68 million in the past three weeks.

When you see ETH ETFS net external flows like this, investors withdraw more money than they put it. This indicates a declining feeling towards the currency and puts more downward pressure on its price.

ETHEREUM eyes is the deepest withdrawal – or a bullish reflection?

ETH is trading at $ 1897 at the time of the press, less than the main support formed at $ 1924. Negative readings of energy balance (BOP) reflect the continuous sale activity between ETH holders.

As of the writing of these lines, this indicator, which compares the power of bulls against bears, is less than zero at -0.27. When BOP is negative, its sellers are more control over the price procedure, confirming the low pressure on the price.

If this trend continues, ETH may continue to decline in trading at $ 1758.

On the other hand, if the feelings turn and become completely optimistic, this may lead to the price of the ETH to the highest resistance of $ 1924 and 2,224 dollars.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.