Bitcoin price extends its decline but metrics point to an imminent reversal

- summary:

- Bitcoin’s price has fallen sharply from record highs near $110,000 to the brink of collapsing into the sub-six figures. But here is a case for reversal.

The price of Bitcoin fell on Thursday as the broader cryptocurrency market continued to consolidate. BTC is trading at $102,387 at the time of writing, down 1.2% on the daily chart. However, despite its extended loss, Bitcoin is still up 1.7% on the weekly chart and is at +9.5% year to date.

Bitcoin price signals reversal

Bitcoin price momentum is likely to fluctuate, as evidenced by its trading volume. According to cryptocurrency market data analysis site, CoinMarketCap, the coin saw a 17% drop in its trading volume in the past 24 hours. This indicates that investors are less inclined to sell the currency, and that continuing the same path could help it recover.

Despite the turmoil caused by the merger, institutional interest in Bitcoin remains strong. Notable large-scale buyers in recent days include MicroStrategy, which bought $1.1 billion worth of bitcoin, and BlackRock, which spent $600 million on the cryptocurrency.

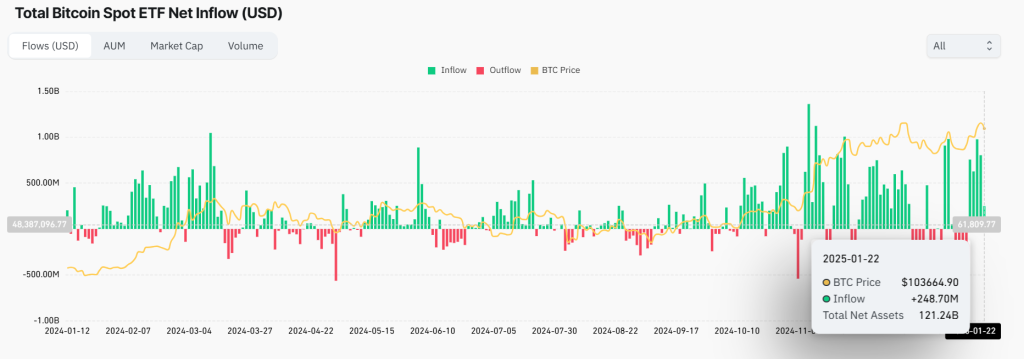

Also, the performance of Bitcoin ETFs remains strong, and has recorded positive net inflows in the last five consecutive trading sessions. According to Coinglass data, Bitcoin ETFs generated $247.7 million in inflows on Wednesday. This confirms the strong interest from institutional investors and the continuation of this trend will support the recovery of the Bitcoin price.

Elsewhere, it was widely reported this week that 12 US states – Florida, Alabama, Wyoming, Arizona, Texas, Ohio, Oklahoma, Pennsylvania, North Dakota, New Hampshire, Massachusetts and Utah – have begun processes to create a Strategic Bitcoin Reserve. The states have taken cues from US President Donald Trump’s accommodative approach towards cryptocurrencies. The success of these countries could add a significant boost to the price of Bitcoin in the coming weeks.

Bitcoin price forecast

Bitcoin price is trading at $102,880 and momentum suggests that sellers are in control. The BTCUSD pair is likely to move lower to the first support level at $100,970. If sellers extend their control, they could extend the decline to test the second support at $99,155.

Conversely, a move above $102,880 would shift momentum to the upside. This will likely see the first resistance level at $104,840. A break above this level will invalidate the bearish narrative. This could also pave the way for further gains to test the second barrier at $106,590.