Energy Suzlon’s share price is 14 % after the results of the fourth quarter: Will $ 80 will be removed soon?

Suzlon Energy shares rose nearly 14 percent on Friday, overcoming the wider market and capturing a short -term decline. This increase came after the company published the strongest quarter of March in years, which sparked the investor’s confidence. The stock reached $ 74.30 during the session, and its earnings during the day since June 2023.

This was not just a technician. Suzlon made a net profit of 1,180.98 rupees in the fourth quarter, more than four times what she published a year ago. Revenue reached 3773.54 rupees, an increase of 73 percent year on an annual basis. With the improvement of profits in all fields and management, FY26 solid growth is directed, Rally had a lot of fuel.

At the time of reports, Suzlon was trading at $ 71.59, still exceeding 9 percent for this day. The size of the size increased sharply, with a change of more than 5.15 rupees, compared to an average of two weeks of only 1.17 rupees. The stock has now increased by 28 percent this month alone, and nearly 60 percent rose last year.

Strong FY25 results and confident expectations

For the full fiscal year, Suzlon recorded a clear profit of 2,071.63 rupees, representing a 213.7 percent jump from last year. Revenue increased by 34.6 percent to 3,141.74 rupees, while Ebitda doubled to 677 rupees. The margins expanded by 130 basis points to 17.1 percent.

According to the Vice Chairman of the Board of Directors of Girish Tanti, the company’s performance reflects “high -contract profitability, strong cash position, and fixed implementation. Suzlon Total Wind Fort terms for Fy25 336 MW, with another 371 megawatts ready to assign. The net net criticism of the company reached 1,943 rupees from March 31, and the net value improved to 6100 rupees.

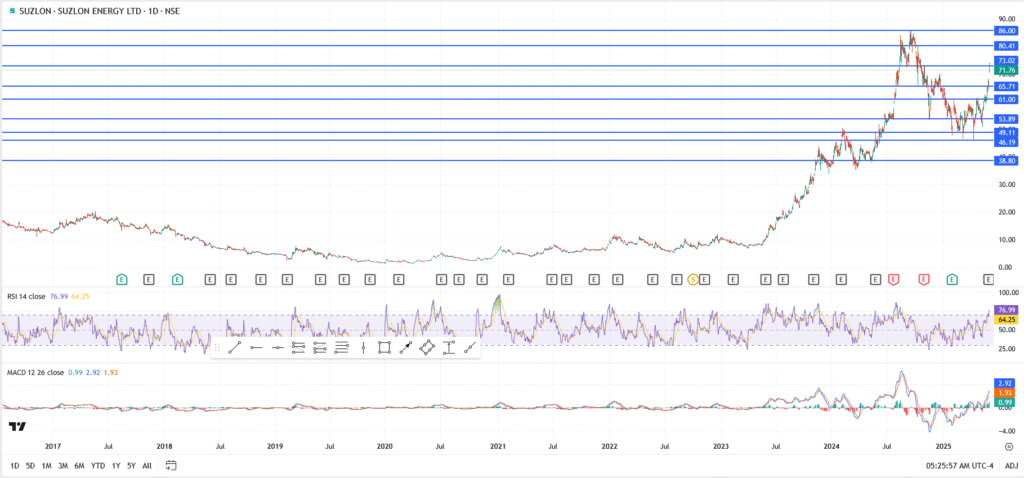

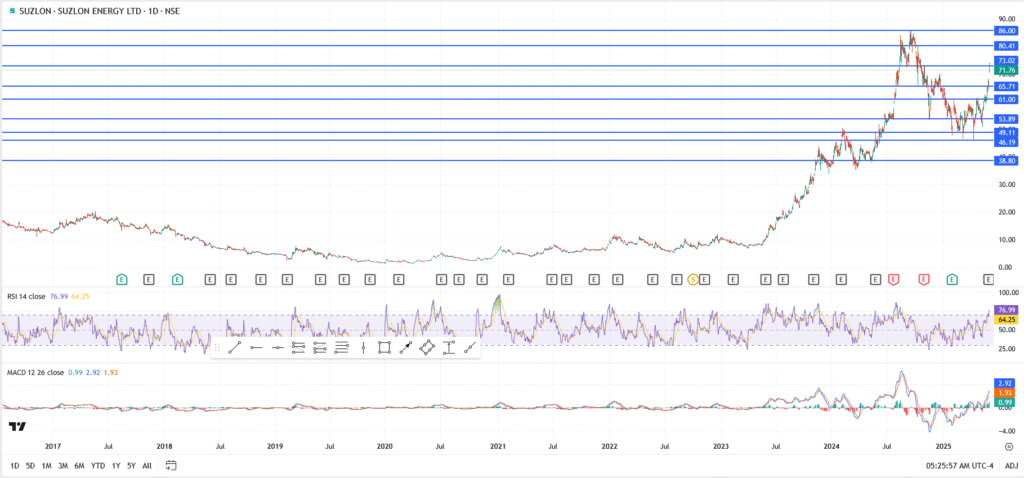

Planning Analysis: Skin Energy Work at a glimpse

- The price has been disinfected 71.76 dollars and is now more than $ 73

- RSI is high in 76.99, shows a strong momentum but is close to the peak

- MACD is still optimistic with a wide separation and an upward slope

- The closest support sitting in $ 65.71, followed by $ 61.00 in a deeper decline

- The collapse of more than $ 74 can open the door to $ 80.41 and re -test $ 86.04 (52 weeks).

What does this mean for investors

Suzlon is no longer trading like a transformation story anymore; It moves like stock in a strong cycle. Management is confident, requests book grows, and levels of cash increased. With the analyst’s goals now, now exceeding $ 80 and returning to renewable energy shares, Suzzlon is still focused. For investors looking for the subject of clean energy in India, this is more than just the quarterly pop music. It is a possible leadership play.

The price of the energy shares in Sklon jumps by 14 % after the results of the fourth quarter: Will 80 dollars be removed soon? He first appeared in the United Kingdom on Investingcube.