Zebec a network of 440 % – can the march continue in June?

ZBCN has increased by 440 % over the past thirty days, making it one of the best performance in the market. Despite the latest cooling in momentum indicators, Zbcn continues to hold ups of upward lands, with the support of strong technical structures.

Although the short -term monotheism is possible, Zbcn is still in its position for the potential continuation of the resistance levels with condemnation.

Zbcn uptrend is still

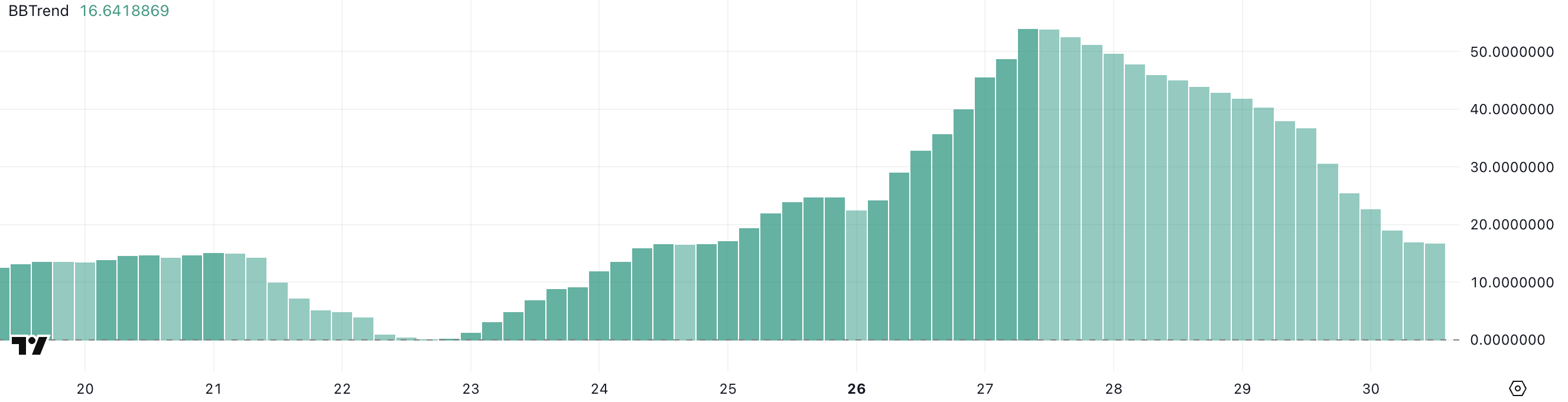

The BBTREND index of the Zbec network is currently 16.64, while maintaining positive lands over the past 13 consecutive days – a sign of the continuous upward budget.

Just three days ago, BBTRand reached its peak at 53.9, indicating an increase in volatility and strong directional strength at the time. Although the current reading is much lower, it still reflects the continuation of the conditions of the upward trend, albeit with a possible slowdown in the momentum.

The fact that BBTRand is still higher than zero after nearly two weeks indicates that the upper trend is sound, although the bulls may breathe after the last boom. Zbcn has increased more than 106 % in the past seven days, making it one of the best performance in the past weeks.

It measures BBTREND, or Bollinger Band Trend, the strength and direction of price movements by analyzing the spread of Bollegerer. When BBTRand is higher than scratch, it usually indicates the upward trend, and the higher the value, the stronger the momentum.

Read below zero refers to homosexuality. The BBTREND of zebec indicates in 16.64 that the original is still in the upward lands, but with a decrease in strength compared to the earlier of the week.

If the BBTREND continues to decrease, it may indicate the exhaustion or possible unification stage before the next main step. On the contrary, the bounce will confirm that the upward pressure is the reconstruction.

Zbcn momentum slows down, but the negative side pressure is still minimal

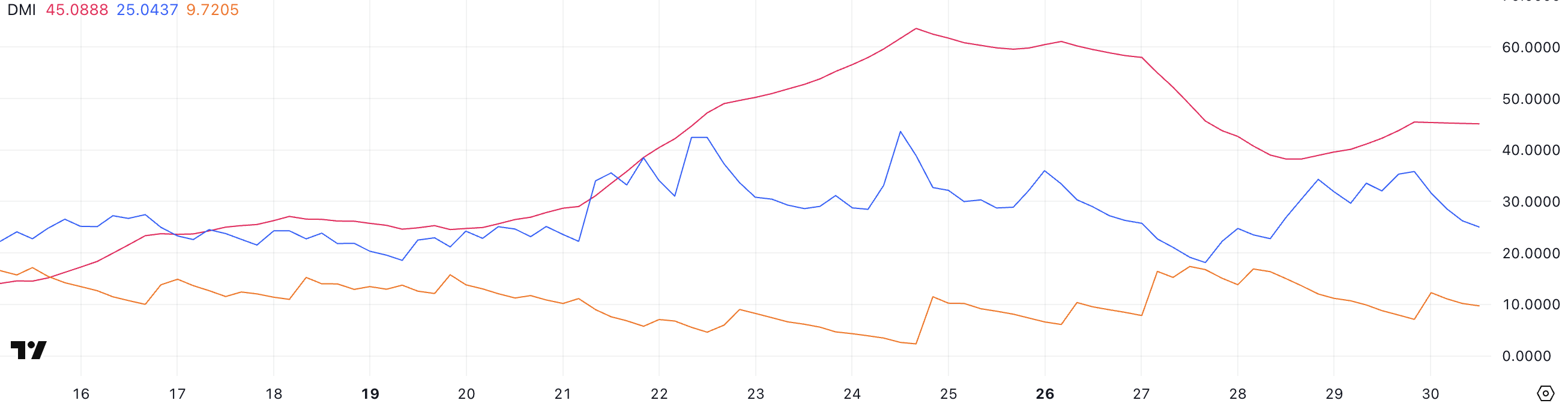

The DMI scheme of the Zebec Network reveals that ADX is currently in 45 years, indicating a strong direction, although it slightly decreased from the peak 57.9 that was recorded three days ago.

After a decrease to 38.2 two days ago, ADX settled, indicating that although the strength of the trend may cool from its peak, it is still intact.

ADX, or an average trend index, measures the strength of the direction regardless of the direction – that exceeds 25 indicates a strong direction, and readings above 40 indicate a very strong trend momentum.

The current ADX’s ADX’s reading indicates that the continuous trend still has a large traction on the market.

Support this bias in the direction, the Di +line – which tracks the upscale momentum – is on 25, although it slipped from 35.8 the day before. Meanwhile, the -Di is still low at 9.7, and it has almost changed from yesterday, indicating that the declining pressure remains minimal.

The combination of the strong ADX and A +DI, which still exceeds that the price of the zebec network may remain in the direction of ascending, even if the upscale density has been temporarily cooled.

If +Di settles or starts to climb again, this may indicate that buyers are preparing power; However, if it continues to decrease during the ADX decrease, it may indicate a potential shift towards monotheism or weakening the bullish momentum.

Zebec Network UMA structure is still optimistic as the price of the price erupted

The EMA structure of the zebec network is currently upward, as the short-term transportation has been placed much higher than that long-term and a noticeable gap between them-a reference to a strong upward momentum.

This preparation reflects the consistent pressure of purchase and directional strength, indicating firm control of bulls.

If ZBCN is able to pay the resistance at $ 0.0069, the road to penetration can pave about $ 0.0080, which represents its highest level ever and confirming continuous upright domination in the market.

However, the shift in feelings can lead to the risks of the negative side. If the support is tested at $ 0.00536 and fails to keep it, this may lead to a deeper correction, which sends Zbcn to $ 0.00384.

In the event of constant declining pressure, the price may decrease about $ 0.00196, with an extended step that may reach $ 0.00146.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.