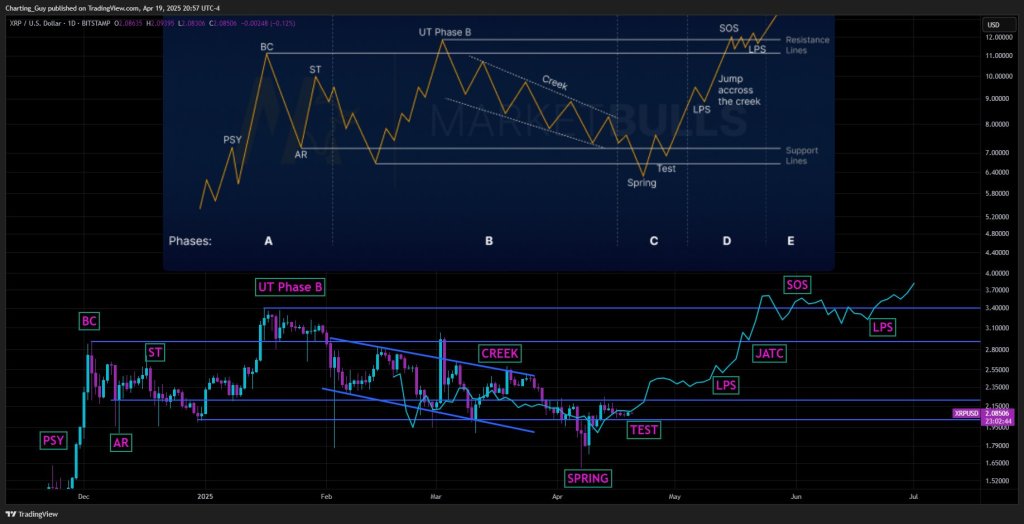

XRP Wyckoff Pattern Maps Run to $ 3.70 this summer

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

Crypto Analyst Charting Guy (Chartingguy), which was published on April 20, set the XRP/US dollar diagram on Bitstamp on a WyckfF textbook and argues that the style has now become advanced enough to ensure a summer discrimination towards towards – it is likely to exceed $ 3.70.

“Wyckoff style ignites xrp bull condition

the table The five -month base that started with the initial show (PSY) in late November. The vertical increase carried a price at the peak of $ 2.68 (BC) in early December, followed by an automatic reaction (AR) that was washed to approximately $ 1.90, proving the lower limits of what will become the scope of trading in the stage A. In mid -December, a secondary test (ST) was reviewed by the $ 2.72 region, and completing the initial “stopping work” sequence of Wyckoff.

The phase B until January: The request was rebuilt, which led to the production of (UT) in stage B, which briefly penetrated 3.40 dollars in mid -January before the offer is re -supply. From that peak, XRP follows a low -angle channel – “Creek” – with a decrease in its highest levels and decreased in early April. During this landing, the hypocrisy of the man who plans for the internal test of Wyckoff shows, indicating a weak distribution instead of the real distribution distribution.

Related reading

On April 7, the support under the market, the knives to about $ 1.61, and its capacity immediately: a classic Spring of the C. A Sprinkle Test in Spring follows approximately $ 2.00, which satisfies the requirements of Wyckoff for the bullish confirmation. From that point, the expected path turns into the analyst.

Phase D begins with what Wyckoff called the last support point (LPS) between $ 2.35 and $ 2.55 in early May, followed by a more slope that leads to the February Summit. This is a jump across the Creek (JATC) – a decisive payment by the top of the descending channel and the horizontal resistance of about $ 2.70.

The model then shows the outbreak of prices above the mid -January height at $ 3.40 will constitute a sign of power (SOS) about $ 3.40 in late May, with the completion of the transition to the E.

Related reading

In the E stage, planning accelerates, taking XRP to a $ 3.70 region by early July – a goal that sits one mark above the resistance range of $ 3.40 on the analyst’s price axis. With the price of the idea at $ 2.12 at the time of publication, the road map involves a possible increase of about 74 % during the next two and a half months.

However, drawing a man warns that “this does not mean now up to some extent – the evaluation may be a little far away,” which confirms the possibility Wyckoff. However, the accurate alignment of real world prices with classic re -accumulation stages – taking advantage of PSY, BC, AR, S and UT, Spring, Test, LPS, JATC and SOS. If the market respects these technical monuments, XRP may soon work with prices that have not been seen since its peak in the last session.

At the time of the press, XRP was traded at $ 2.11.

Distinctive image created with Dall.e, Chart from TradingView.com