XRP tests ascending a triangle resistance – can bulls reach a level of $ 2.40?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

XRP has emerged as one of the most powerful assets in recent weeks, defying wider fluctuations in the market and uncertainty in the macroeconomic economy. After a approximate start for this month, XRP recovered sharply, achieving 32 % profit from the lowest level last Monday. The elasticity of the distinctive symbol attracted the attention of analysts and investors as it continues to outperform many of its peers in the altcoin area.

Related reading

Many of this force is due to the increasing optimism that total economic tensions – especially on global trade policies and inflation – begin to mitigate. If this trend continues, XRP may be in a good position to drive the next station of the encryption recovery.

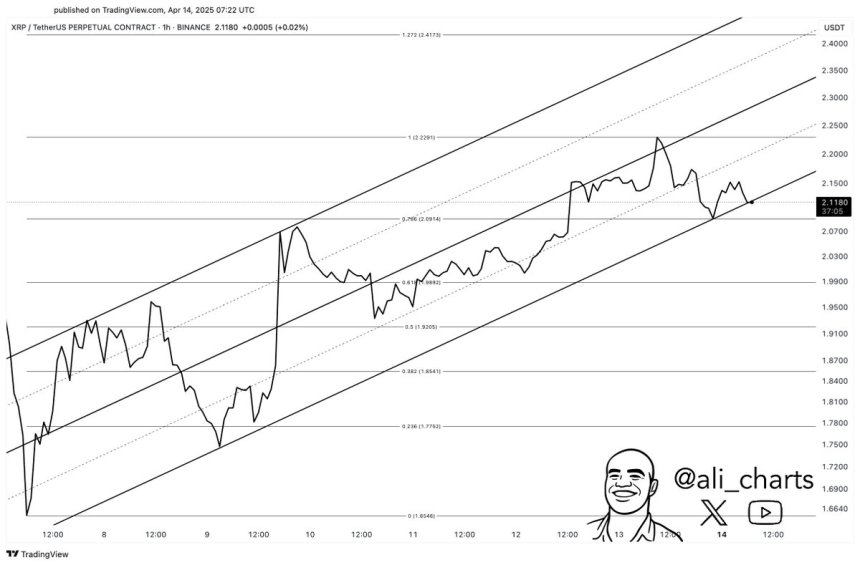

The upper encryption analyst Ali Martinez added to the bullish narration, sharing a technical analysis that shows that XRP is currently being circulated within an ascending triangle – a pattern that is usually associated with bullish outputs. Martinez sets $ 2.22 as a critical resistance level to watch. If the bulls can press over this line, the door can open to move to higher price levels.

With alignment to build momentum and technical indicators, it appears that XRP is approaching a pivotal moment. The next step can determine whether this gathering has a larger space for operation – or if the resistance will stop the collapse.

XRP Bulls Eye Breakout while the market is looking for the direction

XRP revolutions gain confidence as the market shows signs of stability after weeks of fluctuations. As global tensions continue, the broader encryption environment remains unconfirmed – but XRP managed to stick to its land, and is constantly trading over the level of $ 1.80. This fixed performance makes analysts optimistic that the distinctive symbol can prepare for a higher strong step, especially if the macroeconomic pressure begins to mitigate in the coming weeks.

The expectations surrounding potential monetary policy and inflation expectations can create a more convenient environment for risk assets such as XRP. Some market participants are betting that with the return of clarity to the global economy, the high condemnation assets will lead these-and XRP fees in that list.

However, not all analysts agree that the gathering will be smooth. A more careful view indicates that the market may need another correction to create a solid foundation. This scenario will include a lower decrease than the current levels to determine a new request area before the next stage start.

Meanwhile, Select Martinez Main style reveals: XRP is traded within an ascending triangle – preparation of upward continuation. According to Martinez, the resistance level of $ 2.22 is the decisive threshold. A certain collapse above this level can lead to an increase to $ 2.40, which is likely to achieve the beginning of a wider upward trend.

While traders see a price procedure closely, the XRP ability to obtain the main support and test of the top of the triangle can be determined by its next big step. The coming days may prove a pivotal in forming the future in the short term for this high -level altcoin.

Related reading

The upcoming daily price is tilted after recovering the main averages

XRP is currently trading at $ 2.14 after a strong step that witnessed that the distinctive symbol regains both the 200 -day moving average (MA) at $ 1.89 and the average SIA movement for 200 days (EMA) at $ 1.95. This upscale development indicates a possible transformation in the direction, as the XRP bulls now carry a short -term momentum feature. Adherence to these main indicators is essential to maintaining rising pressure and building confidence in a wider healing.

The next main obstacle is located in the daily supply area of $ 2.60. Clean interruption can open above this level door for a continuity that targets higher resistance areas. Currently, Bulls will need to maintain strong purchase interests and size to test and break this level in the end.

However, negative risks remain. If XRP fails to obtain $ 2.00 psychological support, a deeper correction may be revealed. This would slow down the last penetration and may send the distinctive symbol to a $ 1.80 or less region, depending on the wider market conditions.

Related reading

Currently, all eyes are on whether XRP can merge the gains of more than $ 2.00 and maintain enough momentum to challenge the next supply area. Merchants should monitor size and broader market signals to confirm.

Distinctive image from Dall-E, the tradingView graph