XRP slip into the Habboudia area amid weak trading signals

XRP only gained 2 % last week, indicating poor momentum and fading attention from short -term buyers.Technical indicators such as RSI, Ichimoku Cloud and EMA are all began to reflect the increase in pressure. Here is a detail of what the plans say and what can come after that to XRP.

XRP RSI shows buyers lose control

XRP (RSI) has decreased to 46.34, a noticeable decrease from 57.30 days ago. This sharp move indicates a clear transformation in the momentum, with a greatly pressure pressure in the short term.

When this relative indicators quickly fall, it can often indicate that traders get profits or began to rotate outside the place, especially after a period of modest gains.

Although XRP has not entered the high sale area yet, the decline below the 50 mark is usually seen as a declining sign, pointing to a possible shift in feelings from ascending to neutral or landing.

The relative strength index, or the relative strength index, is a widely used technical indicator that helps traders measure the strength of the price. It ranges from 0 to 100, with readings above 70 looking at the peak of readings and readings of less than 30.

When the RSI is above 50, the momentum is usually bullish, while the levels of less than 50 reflect the increasing decline. With the presence of XRP now in 46.34, it indicates that the original loses the upscale momentum and may be at risk of additional additions unless the interest purchase returns soon.

If the pressure pressure and RSI trends persist less, XRP can test the main support levels in the near future.

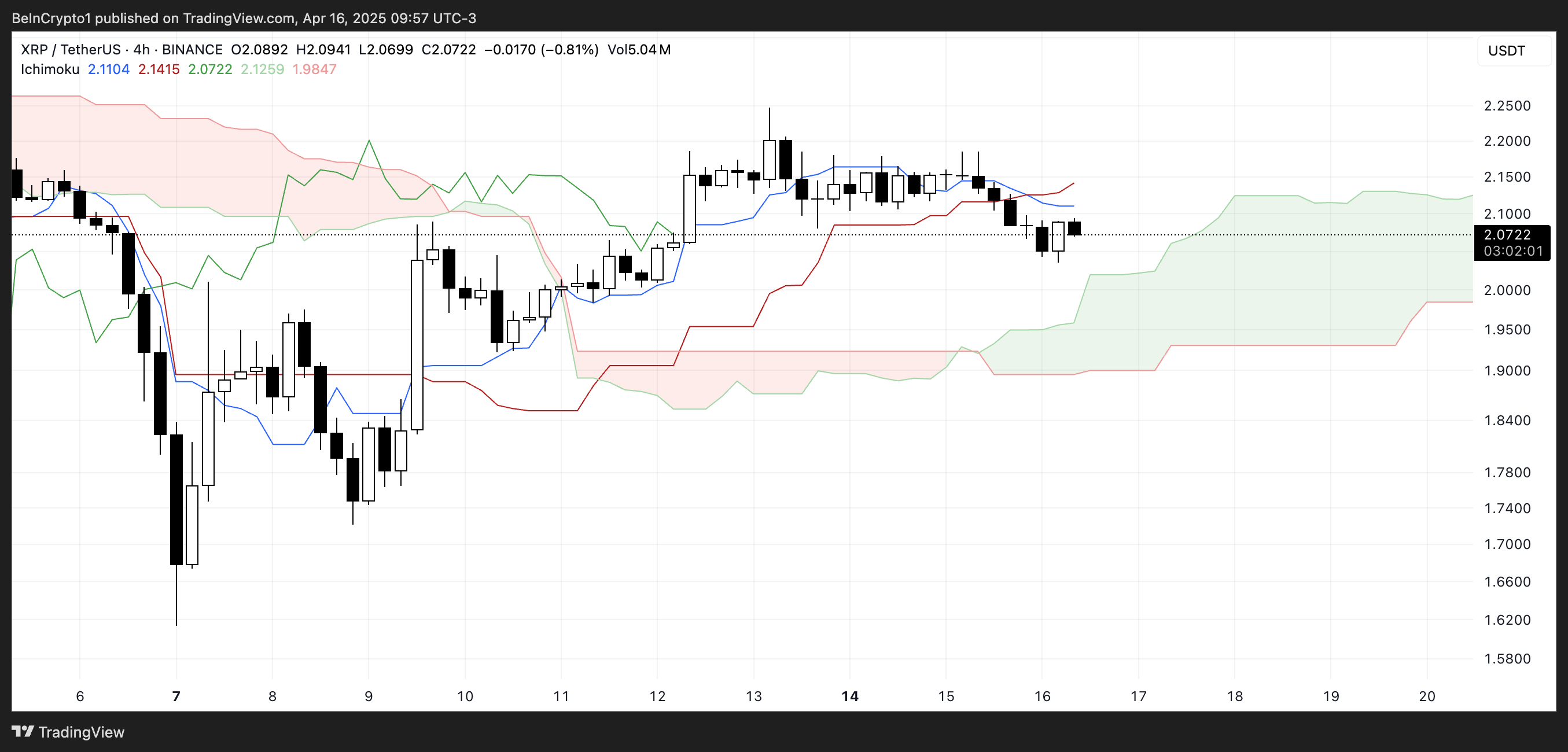

The XRP Ichimoku cloud appears momentum

The XRP cloud of the Ichimoku cloud currently shows a shift towards the short -term momentum.

The price has decreased to below both Tenkan-Sen (the transfer line) and Kijun-Sen Red (foundation), which is usually seen as a declining sign.

When the price is traded under these two lines, it often indicates the weakening of momentum and increased the risk of the negative side unless the rapid recovery is followed.

In addition, the price now enters the green cloud (Kumo), which represents an area of uncertainty or monotheism. The upcoming cloud is relatively flat and wide, indicating potential support but also the lack of strong upward momentum.

Senkou Green Senkou (pioneer A) remains higher than Red Senkou Span B (pioneer B), indicating that the broader trend is still slightly bullied – but if the price price remains inside or broken under the cloud, this trend may start to reflect.

In general, the Ichimoku setting indicates caution for bulls unless XRP recovers TINKAN and Kijun fonts convincingly.

EMA lines indicate that XRP may decrease to less than $ 2

XRP EMA lines offer weaknesses, as the XRP price has repeatedly failed to penetrate the resistance near $ 2.17 – even amid speculation about a possible partnership with Swift.

This repeated rejection at the same level indicates a strong sale pressure. Emas notes that the momentum fades because the shorter average bends down.

The potential death cross appears, as EMA crosses in the short term under the long term, forming. If this is confirmed, it may indicate a deeper correction in the future, as XRP may re -test support levels at $ 2.02 and $ 1.96.

The collapse below these levels may lead to a decrease of about $ 1.61. However, if Bulls managed to recover $ 2.17, the following resistance at $ 2.24 becomes the main goal.

A clean break above can lead to a stronger gathering, which may push XRP to $ 2.35 or even 2.50 dollars if the momentum accelerates.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.