XRP sizes by 20 % amid uncertainty in the market

XRP currently displays frequency marks, as it trades sideways with a limited momentum where traders wait a clearer sign. Over the past 24 hours, the XRP trading volume has decreased by 20.37 %, and it is now sitting at $ 2.4 billion – a decrease that reflects the interest of cooling in the short term.

Technical indicators such as RSI and Ichimoku Cloud indicate a neutral direction, with no powerful or strong domination of play. The price procedure remains limited to the main support levels and resistance levels, leaving the next direction still inaccurate.

RSI reciting neutral is suggested to XRP traders

XRP (RSI) is currently sitting at 46.82, indicating a neutral momentum in the market. This neutral area has continued since April 7, with no significant transformations in the region of Duzura or Traffic.

It is worth noting that the RSI was on 57.30 just three days ago, indicating that XRP has recently witnessed the purchase of purchase pressure.

The decrease indicates a cooling interest or a potential shift in feelings between merchants, as the origin is now hovering closer to the midpoint of the RSI scale.

RSI is a momentum that measures the speed and size of modern price changes, usually on a scale from 0 to 100.

The above readings indicate that the original has been clarified and may be due to its decline, while the readings of less than 30 indicate that they may be exaggerated and may prepare to wear. With XRP now at 46.82, the original does not pass anxiety or sale, which means that the frequency in the market.

This level, along with the last decrease of 57.30, may indicate caution or weakening the bullish momentum. This may indicate a slightly uniformity or pressure stage in the short term unless buyers respond with the conviction.

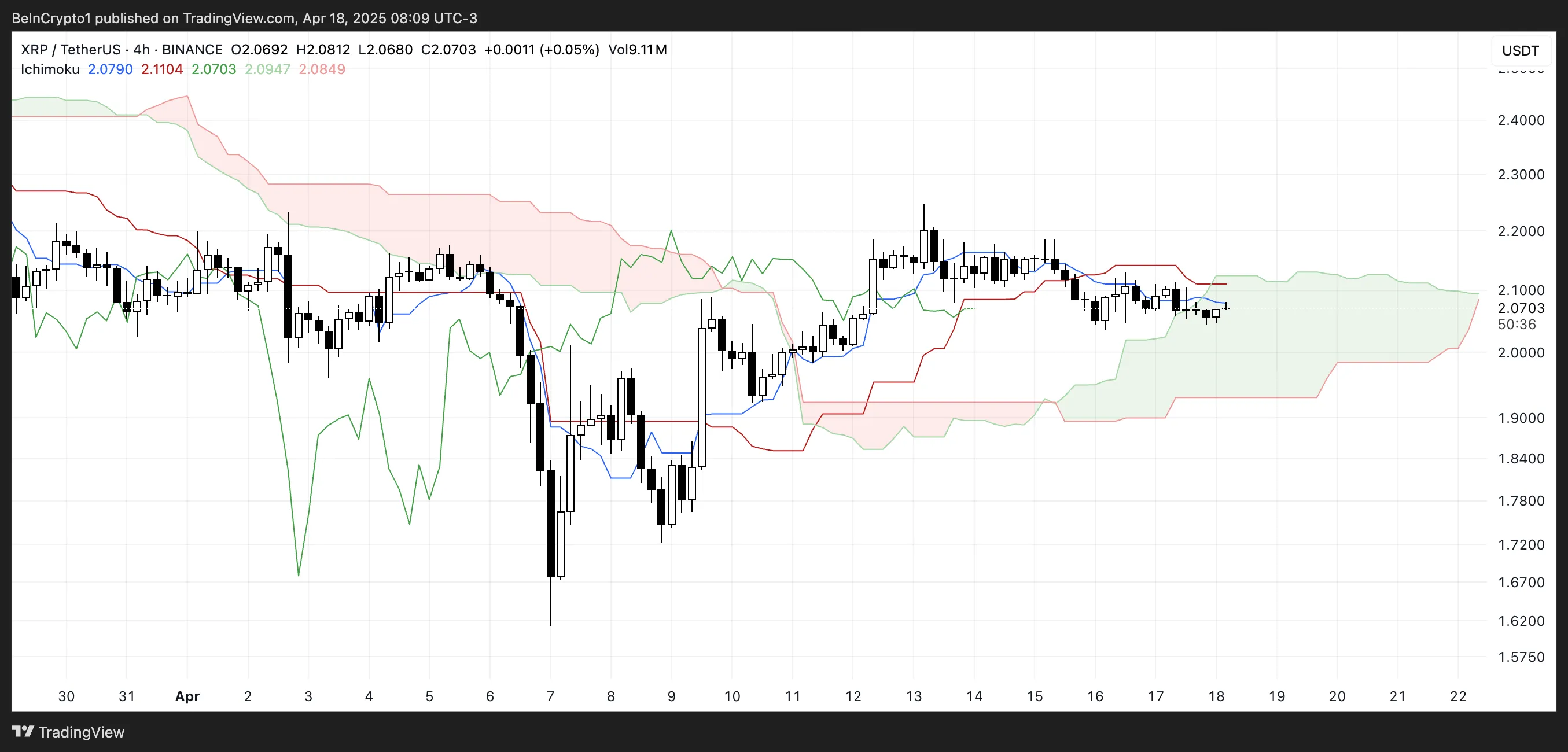

Ichimoku indicators show the frequency of the XRP price movement

XRP is currently trading inside the Ichimoku cloud, which reflects the state of frequency or monotheism.

Tenkan-Sen (blue line) and Kijun-Sen (red line) is closely flat, indicating poor momentum and lack of short-term direction.

Senkou Span A and B (the cloud borders) is also relatively flat, which usually indicates that the market is in a state of balance without strong pressure from buyers or sellers.

Ichimoku cloud, or Kumo, helps in conception, resistance and direction at a glimpse. When the price is higher than the cloud, the trend is optimistic; Under it, it is bound.

Inside the cloud, as XRP currently, the trend is neutral, and fluctuations often shrink. Fliping the leading edges of the cloud includes a standardization stage, and the fact that the price is not separated by a higher or less cloud that enhances the idea of uncertainty in the market.

Currently, a decisive outbreak indicates that XRP may remain associated with the range until it develops a stronger direction.

Support $ 2.03 and resistance 2.09 dollars bearing the next step key from XRP

The XRP price is currently trading within a narrow unification range, with major support at $ 2.03 and resistant at $ 2.09.

The price has been relatively concealed, but the EMA lines have begun to show signs of potential weakness, as a leader of death-where EMA is formed in the short term in the long term-its formation.

If this declining intersection is confirmed and XRP reduces $ 2.03 support, then moving to $ 1.96 becomes increasingly likely.

A strong continuity of the declining direction can lead to a sharp decrease. This may pay the price to 1.61 dollars if the sales pressure speeds up.

However, there is still a bullish scenario on the table. If buyers can pay XRP on $ 2.09 resistance, it can open the door to re -test 2.17 dollars and $ 2.35.

This would refer to the renewal of power and the transformation of momentum in favor of the bulls. If the combination of these levels is acquired, XRP can run about $ 2.50, which represents a large recovery.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.