XRP should break $ 3 to nullify the decline and ascending ascending – analyst

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

XRP faces a pivotal moment after failing to test the resistance level of $ 2.60, with the price realization now towards critical demand. The symbol continues to trading sideways in a wide range, which reflects the increasing uncertainty as the broader encryption market faces for sale. Despite the strong performance in recent weeks, the bulls are struggled to maintain momentum, and the inability to pay the higher has left XRP vulnerable to more monotheism or the negative side.

Related reading

The feelings of the total market market make it difficult for altcoins like XRP to determine a clear direction. Investors are still cautious, and the bulls must now defend the main support areas to avoid a deeper correction. XRP is approaching the critical demand area that can determine its course in the short term.

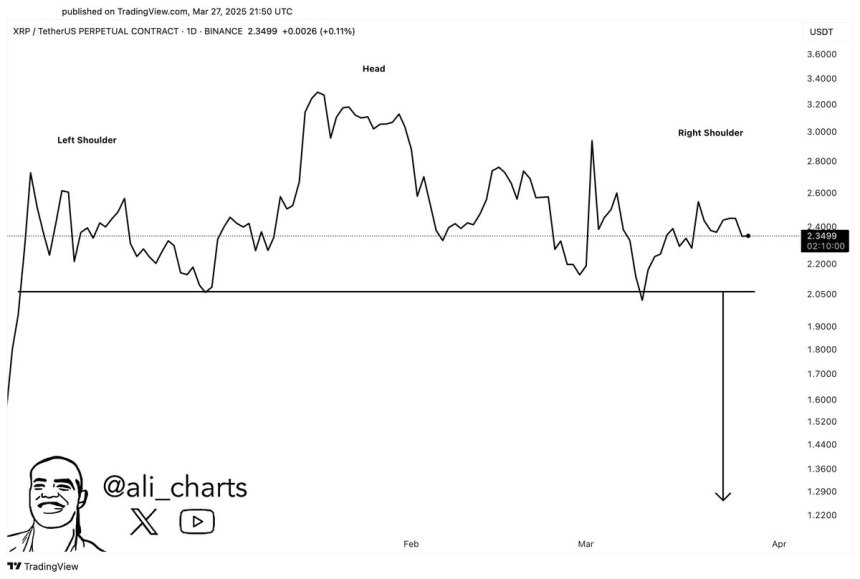

The encryption analyst, Ali Martinez, visions on X, referring to a possible bullish scenario if XRP is able to break the mark of $ 3. According to Martinez, such a step will nullify the current head and shoulder style that is formed on the graph, and effectively turns expectations for the bulls.

XRP faces the main penetration test amid uncertainty in the market

XRP is approaching a critical point in the price structure, where the collapse can lead higher than the main levels to a large upward trend. However, investors remain cautious, with great concern that the current setting may be a bull trap – especially given the unstable total environment. Since late January, the financial markets have faced the increasing turmoil, and are feared by the fears of the trade war and irregular policy behavior by US President Donald Trump. This uncertainty has been largely weighed on risk origins, including cryptocurrencies, and continues to prevent the formation of the clear trend in all fields.

The XRP price reflects this broader frequency in the market. Although the distinctive symbol showed flexibility, it is still closed in a wide range, unable to build a continuous upward momentum. The recent failure to break the resistance level of $ 2.60 added to the investor concern, as it seems that the selling pressure is due to the market.

Martinez was weighing to the situation, Highlighting the technical level The XRP path can be determined in the short term. According to Martinez, if XRP is able to break the mark of $ 3, this will nullify the current head and shoulder style that is formed on the graph-a pattern that is usually associated with direction’s implications. Such a move would turn the ups in the ups and open the door to a large gathering.

Until this penetration occurs, however, the structure of the head and shoulder remains to play, and negative risks cannot be ignored. Investors closely monitor as XRP is trading near critical support and resistance levels, knowing that the next collapse or collapse can constitute its direction for the coming weeks. Currently, XRP is still stuck in a narrow battle between the declining pressure and upward potential.

Related reading

The bulls defend the main support at $ 2.20

XRP is currently trading at $ 2.22 after losing the level of $ 2.40, which is in line with both the 4 -hour moving average (MA) and the SIA moving average (EMA). Weaken this collapse on a short -term momentum, put the bulls in a defensive position with the start of pressure in the building. The level of $ 2.20 is now standing as a major support zone that must be defended to avoid deeper correction.

To restore strength and convert momentum again in favor of bulls, XRP must restore $ 2.35 in the upcoming sessions. The move over this resistance area indicates the renewal of the purchase interest and may lead to a return to a range of $ 2.60. Until then, the price procedure remains fragile, as investors closely monitor to confirm.

Related reading

However, if XRP fails to get higher than $ 2.20, the market may see a sharp decrease towards a sign of $ 2.00 – a psychological and structural support level that keeps it in previous corrections. Such a step is likely to confirm the dominance of the short term and delay any possible outbreak. As the fluctuation continues to be adopted, the next few hours may be very important to the direction of the short -term direction of XRP.

Distinctive image from Dall-E, the tradingView graph