XRP sees an abnormal purchase activity amid the sale of $ 795 million coding boxes

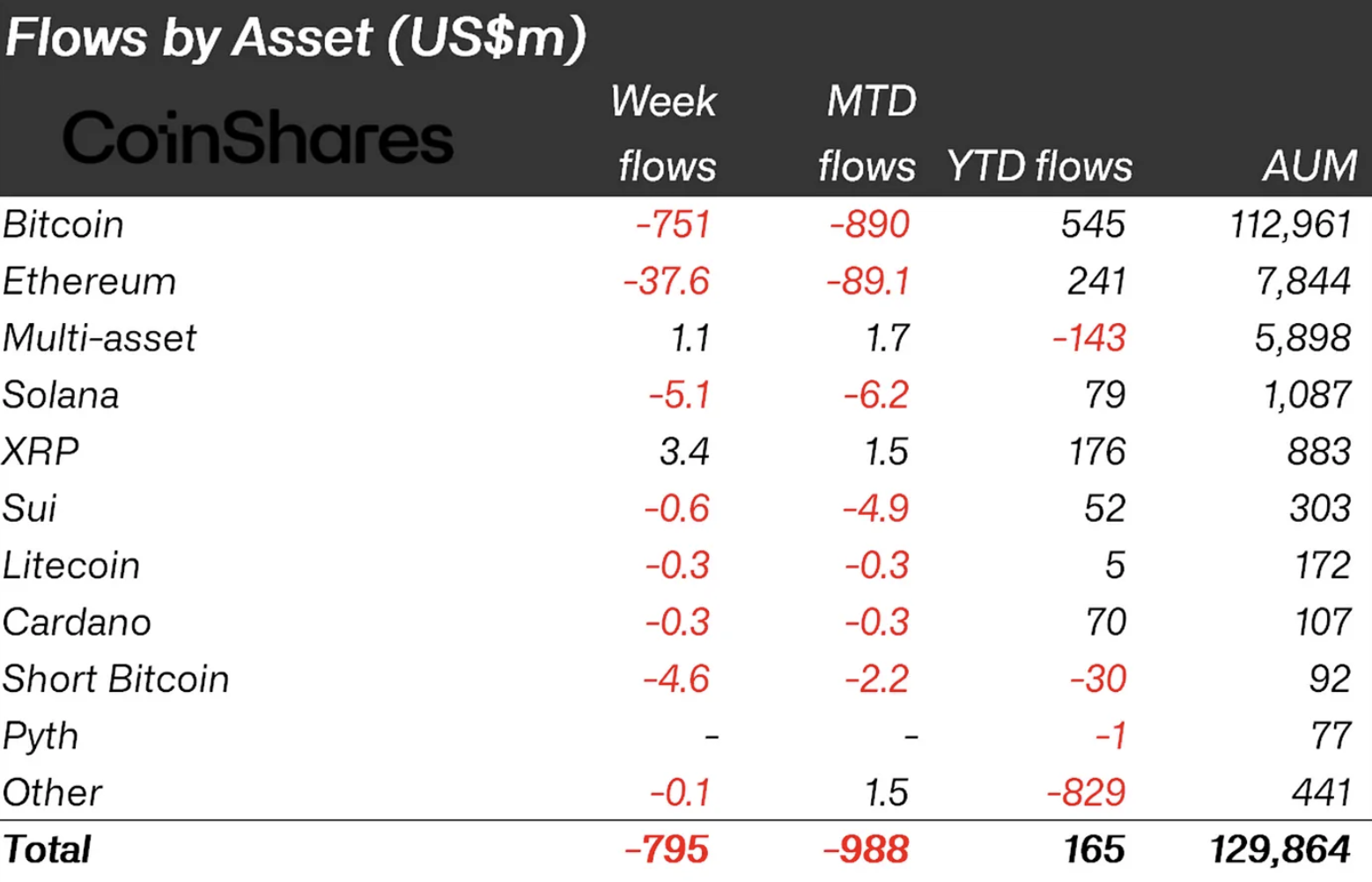

While the investment area in digital assets continued to lose capital for the third week in a row, where it published 795 million dollars in external flows and withdrawing the monthly number near the billion marks sign, some assets were able to reject the direction-and in the top of that short list was XRP, which attracted $ 3.4 million in curiosity while everything else had traveled.

This type of difference usually does not appear clearly, especially in a week like this where somewhat negative emotions everywhere at the same time.

The flows decreased across the countries, the bottom through service providers and across all major assets, with the exception of a handful of the small altcoins-but XRP not only avoided the strike, but also led all icons other than bitcoin in net flows, as mentioned by by Coinshares.

In a week, the United States witnessed $ 763 million from Crypto Etps alone, this highlights.

List the largest market has not changed much. Since early February, when the external flows have already chosen, the sector has witnessed the withdrawal of 7.2 billion dollars, which now wiped all the net gains made earlier in the year, raising only a year to 165 million dollars.

Bitcoin (BTC) again witnessed the most pressure with $ 751 million in external flows, followed by ETAREUM with $ 37.6 million. Solana (SOL), Sui and Litecoin was not much better, as all the losses and even short Bitcoin in external flows – indicating that the hippos bets were also not binding.

However, despite the pressure, the total amount of assets actually increased – not because of the flows but thanks to the price recovery at the end of the week after the declining temporary tariff gave the market some breathing room, prompting the number to up to 130 billion dollars.