XRP futures traders are progressing with low prices

Since the beginning of February, the broader market has affected the price of XRP. The fourth largest encryption, according to the market value, has lost 10 % of its value during the past week and is now trading at $ 2.30.

This decrease has intensified from the homosexuality, prompting XRP Futures to increase their short positions against any possible recovery.

XRP faces a strong sale pressure with deepening of empty feelings

XRP continuously reinforced the declining bias against it by its traders in the future. The data on the chain reflects pessimism, as the long/short XRP ratio indicates that more traders are betting on the additional negative side instead of recovery this week. As of the writing of these lines, this ratio is 0.99.

The percentage of long/short assets compares the number of long situations (bets that will rise the price) to short sites (betting that the price will decrease) in the market. When the ratio is higher than 1, there is longer than short situations, indicating that more traders are betting on increasing prices.

This changes, as in the case of XRP, the percentage below indicates that traders are largely betting on low prices. This indicates a high -down feeling in the market, which enhances the possibility of more negative side.

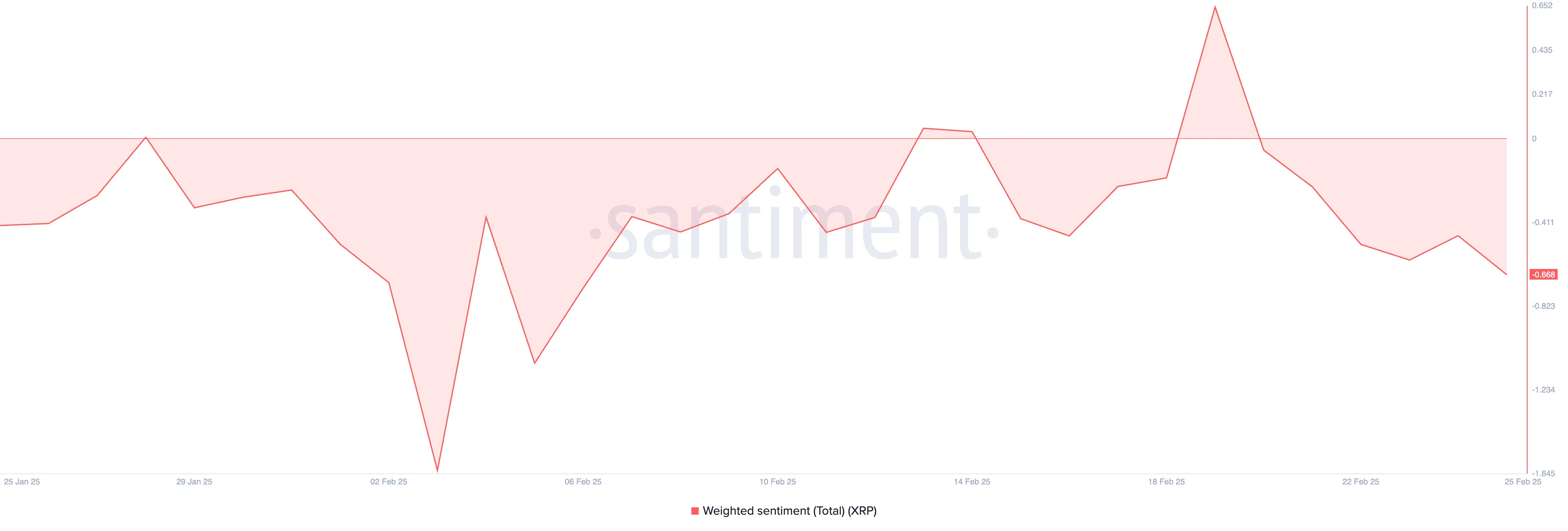

In addition, the weighted negative emotions of XRP emphasize this declining bias. At the time of the press, this scale is less than zero at -0.66.

The likely feelings of the origins measure their positive or negative bias in general, given that both social media and the feeling expressed in these signs. When it is negative, as in the case of XRP, it is a downward signal.

It indicates that XRP investors are increasingly skeptical in his short term, which leads them to trading less and exacerbate the low price.

XRP Teeers on the main support

Since reaching the highest level ever at $ 3.40 on January 16, XRP has been traded within a descending triangle. This declining pattern is formed when the origin price creates its highest levels while maintaining a strong support level, which leads to a declining direction line that is close to a horizontal base.

The pattern indicates that the sellers control, and the collapse without support may lead to further decreases. At the time of the press, XRP is trading at $ 2.30, a little higher than this supported support at $ 2.27.

If this line collapses, the XRP price may decrease to $ 2.13. If the pressure sale is gaining momentum at this level, the value of the distinctive symbol may decrease about $ 1.47.

On the other hand, if the market’s morale becomes upward, this will raise the XRP demand and may cause its price to reach the descending triangle to reach $ 2.81.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.