XRP FUTERES and relief for a lawsuit against Illinois

Coinbase has been presented to the American CFTC futures trading committee to launch futures for Ripple XRP code.

The move comes after a positive development of the encryption derivative market in the United States, which reflects the changing regulatory relations in the country.

Coinbase files for XRP Futures Trading with CFTC

Coinbase derivatives submitted files to create XRP futures. It will provide organized and effective capital for the market participants to gain exposure to XRP. The new contract can go as soon as April 21.

“We are excited to announce that Coinbase derivatives have submitted CFTC to form a self-XRP futures-which makes the nodes live on April 21, 2025,” Read Advertising.

At the same time, the official presentation It indicates that the XRP FUTERES contract will be a monthly trading connected to the money and addicted under the XRL code.

Each contract represents 10,000 XRP and will be settled in US dollars. Trading will be available for the current month and two months later. As a preventive measure, trading will be temporarily stopped if the instant XRP price moves over 10 % within an hour.

Coinbase also confirmed that it has participated with the Future Contract Committee merchants (FCMS) and other market participants. According to what was reported, each of the references expressed his support for the launch.

However, Coinbase is not the first US -based exchange of XRP futures. In March, Chicago -based Bitnomial launched what it announced as the first future XRP contract organized by CFTC.

For Coinbase, however, the audacity comes after CFTC has reduced the main organizational obstacles to the trading of encryption derivatives. As Beincrypto mentioned, this indicates a more absorbing position towards the sector.

“Action of the Committee for the Trading of the Futures of Commodities (“ CFTC ”or“ Committee ”) List 40.2 (A), Coinbase, LLC (“ exchange ”or“ currency ”) is cut under this residence in the field of self -multiplication in its initial inclusion of the future XRP contract that will be offered to trade in exchange … Shown.

This indicates that the transformation of the commodity organizer, which eliminates previous encoding guidelines, may enhance institutional confidence. For XRP, this development enhances confidence in the case of previously controversial assets after the recent organizational penetration of Ripple.

“COINBASE derivatives to CFTC to the CFTC formation aims to the legitimacy of XRP trading by providing an organized and effective capital product to investors,” one of the users. Note.

Futures contract may also help XRP ETF approval. Recently, SEC has delayed several applications to create one, and its condition is in a state of forgetfulness.

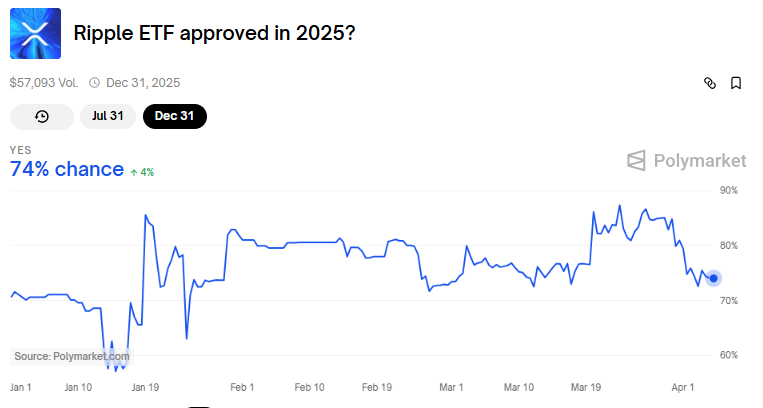

Data on polymarket He appears Celesals see a 74 % opportunity to obtain XRP ETF approval in 2025 and 34 % modest by July 31.

Organizational and legal developments prefer Coinbase

Elsewhere, the timing of this deposit is in line with the modern coherent organizational developments of Coinbase. Reports indicate that Illinois intends to drop a lawsuit against the exchange of services.

Up to 10 states presented a A lawsuit against Coinbase IIn June 2023, it is claimed that its rolling program is not registered in securities.

This last development makes Illinois the fourth country to withdraw legal measures against Coinbase. Fairmont, South Carolina, and Kantaki rejected their cases on March 13 and 27, And 31, respectively.

However, the cases remain active in Alabama, California, Maryland, New Jersey and Washington and Yistsen.

These legal retreats coincide with the United States SEC Resolution (Securities and Stock Exchange Committee) in February to abandon the federal lawsuit against Coinbase. Beincrypto mentioned that this Development represents a broader transformation in the organizational approach under the current administration.

“The organizers are losing Steam, and Coinbase are in the quiet courtroom. The future of Stokeing in the United States may return to the right track.” Stuck.

Illinois’s decision to drop the lawsuit comes at a time when the state submitted Bitcoin Strategic Bill. Specifically, the representative of Illinois John M. Capello The Law Bill 1844 (HB1844), with highlighting the capabilities of Bitcoin as a limited and decentralized digital origin.

“The strategic Bitcoin reserves are in line with Illinois’s commitment to enhancing innovation in digital assets and providing Illinois with enhanced financial security,” invoice Read.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.