Today’s encryption rate

Bitcoin has had a volatile session, trading between $ 81362 and 83,654 dollars over the past 24 hours, amid the increasing uncertainty in the market before a new tariff during the era of President Donald Trump’s administration.

The total encryption market remained fixed, as the total capitalization slipped by 1.3 % to $ 2.79 trillion during the late Asian trading hours on Monday.

Feelings remained in the territory of fear in 34 years, as Bitcoin tested the lowest local levels frequently.

As BTC continues to mode, most Altcoins followed, with just a few of the best 99 distinctive symbols that manages two numbers.

Why bitcoin decreased today?

Bitcoin’s recent decline is driven by a mixture of geopolitical tension and economic satisfaction.

Market anxiety increased after US President Donald Trump announced a new wave of definitions by 25 % on imported cars, with the potential drug sector at the intersection.

In addition to uncertainty, Trump’s repeated signals on April 2 as “liberation day”, when the United States is expected to appoint a new “mutual tariff” in various countries.

These comments have rocked the investor confidence across Crypto and traditional markets, which led to a wider wave of risk feelings.

In the encryption space, this transformation translated into a decrease in demand in instant markets and a clear decline in future trading activity.

Traders hesitate to open new sites, and instead choose to cancel the risk amid uncertainty in the macro.

Fear throughout the market was clear in the instant Bitcoin ETF flows, which rose more than 70 % from the previous week.

The broader economic image also did not help.

Last week, the PCE report revealed a more hot rise in inflation, while March data from the Conference Council showed us consumer confidence in its lowest point in 12 years.

After the opening of a declining drop, BTC continued to re -test the support at 81 thousand dollars several times all day before it even rose to above 83,000 dollars at the time of the press.

However, analysts have been not sure whether the price could settle this level in the short term.

Will Bitcoin rise?

In the comments on Invezz, Kadan Stadelman, the chief technology official in Komodo, warned that “the economy is in an unstable position”, pointing to market signals such as the US dollar weakness, decreased returns for two years, and the rise in gold prices, now hovering near $ 3,150 for adults.

Stadelemann indicated that even the main figures within the Trump administration, including Trade Minister Howard Lottenic, suggested that the recession may be a “reasonable comparison” to move to the broader economic agenda of the administration.

This has sparked a safe capital towards safer assets such as gold and fillets.

Bitcoin, although it is often seen as a hedge, still behaves more like the origin of the current climate.

According to Stadelemann, if the American economy has stolen, the resulting global shock “may put great pressure” on Bitcoin.

“In the event of a collapse in the stock market, this negative aspect may be great,” he added.

However, some have been optimistic about the Bitcoin path in the short term.

For example, analyst Merlijin Trader referred to a potential outbreak of 89 thousand dollars, describing it as a “heavy heat” area where short parking can face block boxes.

According to the common heat map in its publication, the region has an increasing number of financial leverage parking that can lead to pressure as soon as bitcoin pushes this range.

The move towards this level can force the sellers exposed to closing the positions quickly, which increases the upper direction.

“You will not survive this region,” he wrote, adding that it is “not a matter if, but when.”

Meanwhile, the market commentator Satoshi Fleber also drew an emerging image, indicating that bitcoin may be on the brink of great collapse.

By exchanging a daily scheme for BTC/USDT, it highlighted a descending wedge pattern, and the preparation is often associated with the ups and the ups and immemorial calm with a goal of up to 110 thousand dollars.

$ BTC/Usdt Daily Tick Tock, Tick Tock

When writing, Bitcoin was trading at 83,542 dollars, an increase of 1 % over the past day.

Altcoin markets see small gains

Over the past 24 hours, the maximum Altcoin market has decreased by 2 %, as it decreased from $ 1.04 trillion to $ 1.02 trillion at the time of this report.

The Altcoin season index remained fixed at the age of 17, confirming the dominance of the market on Bitcoin.

The leading altcoins such as ETHEREUM (ETH), BNB, Solana (SOL) and Tron (TRX) have spread modest gains between 1 % and 3 % during the same period, after Bitcoin’s progress largely.

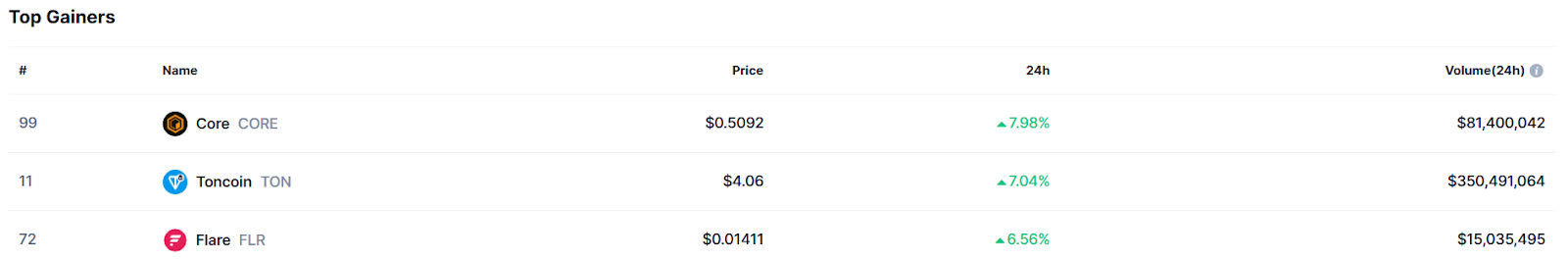

Among the best performers, Core (Core), Toncoin (TON), FLERE (FLR), each of the two single numbers as Bitcoin was stable above 83 thousand dollars.

source: Coinmarketcap

CORE has followed a new governance proposal to control double defense rates, a mechanism that enables users to enhance rewards by locking both BTC and Core Tokens.

Toncoin (TON) is also distinguished, as it recorded an increase in large transactions. The height indicated an increase in the activity of the whale, drawing attention from merchants and the broader society.

Meanwhile, FLARE (FLR) got a boost where the tinnitus has grown around the new software development group after its display during Hackathon recently. It is allowed to create Blockchain applications with artificial intelligence.

Post -encryption prices: Bitcoin remains successive amid stagnation fears, and Altcoins Core and Ton Lead appeared first on Invezz