XRP eyes collect to $ 66 this year, here is how

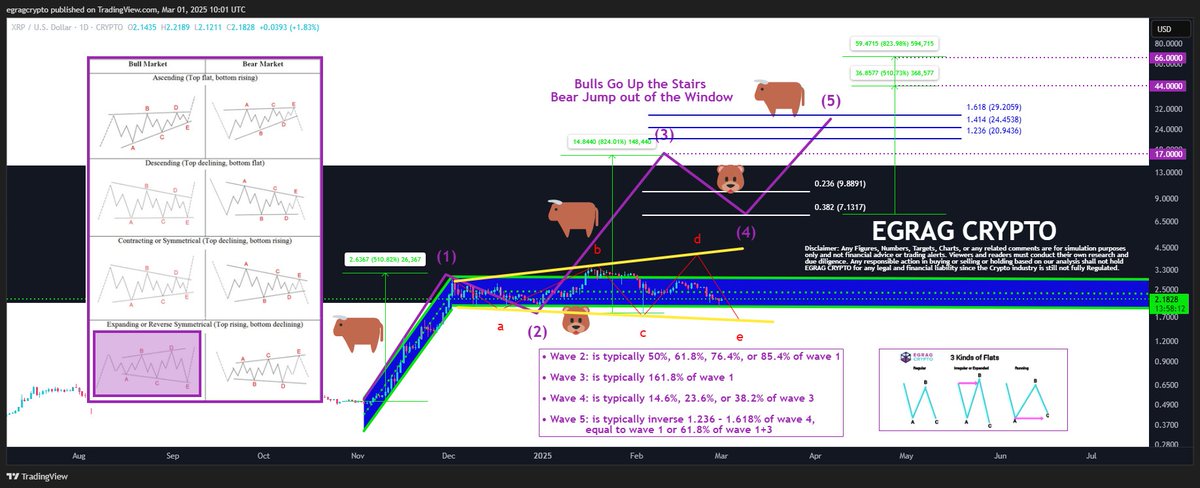

Egrag Crypto predicted that the price of XRP could gather to $ 66 this year, providing an upward coding look. The analyst alluded to the Elleott Wave theory to explain how XRP can reach this ambitious price.

How XRP will collect to $ 66 this year

in X postEGRAG Crypto predicted that the price of XRP could collect between $ 20 and $ 66 this year. He stressed that his analysis is based on sports principles instead of speculative noise. Then the analyst explained how Elliot Wave theory predicts that XRP could reach $ 66.

The superpower of the XRP analyst, like another analyst, Dark Defender, is expected that XRP will reach $ 8 regardless of the results of the Ripple SEC status.

Egrag Crypto note that the 1 wave showed a noticeable increase of 510 %. He stated that this percentage is the basis line for the subsequent wave accounts.

The encryption analyst then moved to the wave 2, where he noticed that he still evaluates the nature of the corrective formation. Egrag Crypto saw that XRP is experiencing an irregular and expanded flat correction. Usually, for expanded or irregular composition for play, the wa wave must exceed the starting point for the wave, which it referred to in this case.

Regarding how this corrective wave is running, EGRAG Crypto expects that the E wave will drop to less than $ 1.77, which leads to the creation of a potential bear trap. However, before concluding the wa wave, note that there should be a bull trap targeting about $ 3.7 to $ 3.9. The market participants warned that this correction may exceed 50 %.

How can wave 3 and 4 play

For wave 3, EGRAG Crypto notes that, as the most rush wave, it clearly highlights with overwhelming upscale feelings. According to the Elliot Wave theory, the analyst indicated that the 3 wave usually extends to 1.618 twice the wavelength 1. Since the price of XRP rose 510 % on the 1st wave, the encryption can witness 800 % to 1000 % on the 3 -wave, which will send it to between $ 17 and 20 dollars.

For the corrective wave movement, the encryption analyst indicated that XRP usually restores between 14.6 % and 38.2 % of the 3 wave. During this period, EGRAG Crypto note that new purchase opportunities arise with standardizing prices aside. He pointed out that the folder usually decreases, which makes this period a good purchase point for those who expect the paid step 5.

An analyst predicts that XRP can decrease between $ 6 and $ 7 because it tests a decline of about 38.2 %. He warned that this might frustrate the merchants due to the movement of the long sides.

How XRP will reach $ 66 on the wave 5

Depending on the Elliot Wave theory, the 5 wave represents the final rise in this upward trend, sending the XRP price to $ 66. Egrag Crypto indicated that during this stage, there will be great positive news and the feelings of the market.

The analyst derived the price of $ 66 based on different standards from the 5 -wave number. Meanwhile, the 510 % increase, similar to those experienced in the wave 1 put the price of XRP at about $ 44.

Finally, 61.8 % of the 1st wave and wave 3 XRP position at about $ 66. The planned plan suggested that the encryption reach this price of $ 66 between March and May.

Interestingly, the legal expert, Matt Hogan, expects to conclude the rippal suit between April and May. Therefore, this catalyst for this equivalent gathering can be the XRP price.

Responsibility: Is market research before investing in encrypted currencies? The author or post does not bear any responsibility for your personal financial loss.

partner: