XRP decreases by 12 % a week with a decrease in network activity

XRP under heavy sale pressure, a decrease of more than 5 % in the past 24 hours and more than 12 % in the past seven days. The last shrinkage was accompanied by increasingly declining technical indicators, including a sharp rise in the strength of the trend and the collapse of activity on the chain.

With the weakening of the price and the involvement of the user, fears of XRP are escalating to retain the main support levels. Unless the feeling turns quickly, it appears that the lower resistance path remains on the negative side.

The DMI scheme explains that the current downward trend is very strong

The direction movement index in XRP (DMI) is currently powerful, strong significant signals, with an average trend index (ADX) to 47.14 from 25.43 just one day ago.

ADX measures the strength of the trend, regardless of its direction, and the values of the highest 25 generally indicate that the trend acquires momentum.

Above 40 – Like the current level of XRP – it acquires a very strong trend in playing. Given that XRP is currently in the declining direction, this increased ADX indicates the intensification of the landfill and the market is strongly inclined towards more declines.

When drilling deeper into the DMI ingredients, Di, which tracks upward price pressure, decreased sharply from 20.13 to 5.76. Meanwhile, -Di, which tracks price pressure down, rose from 8.97 to 33.77.

This blatant difference enhances the declining direction, indicating that the sellers bear the power of control while the strength of the buyer fades.

As ADX emphasizes the strength of this step and directional indicators that tend greatly to the negative side, the XRP price may remain under pressure on the short term unless a significant reflection of the feeling occurs.

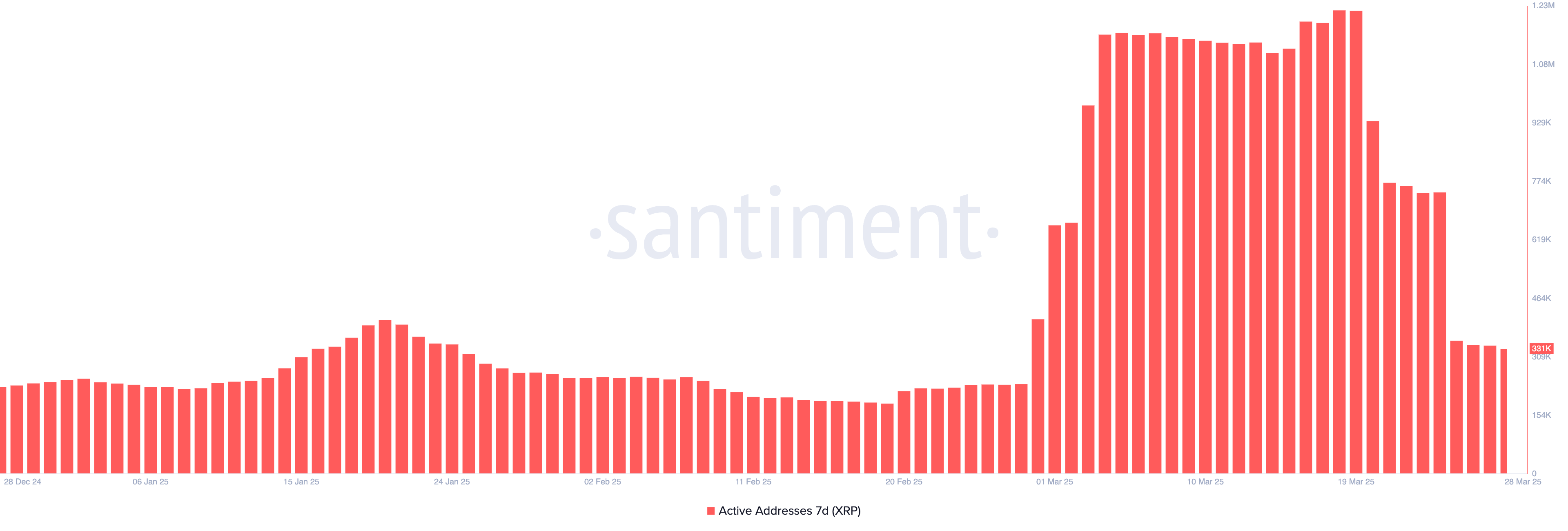

XRP active headlines decrease dramatically

The 7 -day active headlines of XRP witnessed a sharp decrease over the past week, after a modern increase to the highest levels ever. On March 19, the analogy reached its peak at 1.22 million, indicating the activity of a strong network and the participation of the user.

However, since then, it decreased to only 331,000 – a decrease of more than 70 %. This sudden fall indicates that interest in dealing with XRP may cool greatly in a short period of time.

Activist tracking is a major way to measure the activity on the series and the health of the comprehensive network. The increasing number of active addresses usually reflects the increased user participation, increased demand, and the potential investor interest – factors that can support the strength of the price.

On the contrary, a sharp decrease like XRP, which is currently suffering from poor momentum and dull benefit, can indicate additional pressure on the price.

Unless the user activity begins to recover, this decrease in the network’s participation may continue to influence the short -term expectations of XRP.

XRP can decrease to less than $ 2 soon

XRP currently refers to a strong declining direction, with EMAS in the short term at the bottom of the long-term lines-classic downcraft.

This preparation indicates that the last price momentum is weaker than the long -term average, and it is often seen during continuous corrections. If this landmark continues, XRP can re -test the support level at $ 1.90.

A break below can open the door to a deeper decrease of about $ 1.77 in April.

However, if the market morale and the XRP price is unlike the path, the first main level of its viewing is the resistance at $ 2.22.

A successful collapse above this point may push a renewed renewal momentum, which may lead to the price of the price to $ 2.47.

If this level is also breached, XRP can click on a $ 2.59 sign.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.