Crypto $ 1 billion in liquidation is offered: It’s time to buy DIP

Bitcoin and most Altcoins have crashed this week, reflecting the performance of the stock market, which led to more than one billion dollars of liquidation. BTC decreased to a decrease of $ 84,000, while currencies like Solana, Kardano, Sonic, Etheena, and Dujoulaf. So, is it safe to buy a continuous decline?

Crafts of coding qualifiers

Constant coding stagnation led to a wave of liquidation. These references were noticeable because they happened because most of the encryption investors were restarting the purchase spree after Donald Trump revealed his strategic coding plans.

They also bought these coins after Donald Trump announced that he would get the top of the first encryption in the White House. This summit will include senior executives in the encryption industry, including famous companies such as Coinbase, Oondo Finance and Gemini.

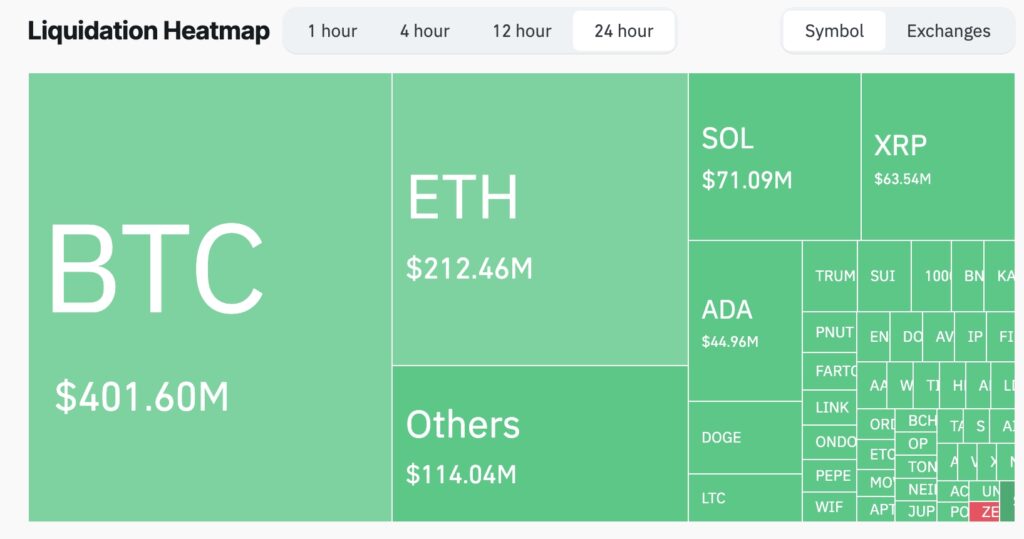

Most encryption prices were destroyed, which led to a large qualifier. The Bitcoin qualifiers have increased to more than $ 400 million in the past 24 hours. Ethereum qualifiers rose to more than $ 212 million, while Solana, Cardano and XRP jumped to more than $ 71 million, $ 44 million and $ 63 million, respectively.

Most references occurred in popular exchanges such as bybit, Binance, OKX, Gate.IO. References occur when exchanges are forced to close long or short sites when trade goes in the opposite direction.

More than 314,000 merchants have been filtered in the past 24 hours. The biggest was the BitFinex dealer whose location was filtered at $ 13 million.

Why Bitcoin and other encryption prices were crashed

Despite the good news in the encryption industry, there are three main reasons behind the collapse of Bitcoin and other encryption prices this week.

First, the incident is due to the ongoing trade tensions in the United States, as the customs tariff began on imports. Trump has implemented a 25 % tariff on goods from countries such as Canada and Mexico representing a third of all products that are shipped to the country.

These definitions will have significant effects, including the effect on growth and enhancement of inflation in the country. In general, it will lead to more fluctuations in the market and the federal reserve between the rock and the difficult place.

These concerns explain the reason for the decline in American stocks on Monday, as it was its worst day this year. Dow Jones decreased by 650, while the S&P 500 and NASDAQ indicators decreased by 100 and 500 points, respectively.

Moreover, the VIX index jumped to 22, while the encryption and fear -based coding index decreased to the fear area.

Historically, the prices of cryptocurrencies are often disrupted when there is a feeling of fear in the market because this drives many investors to the side lines.

Is it safe to buy Bitcoin and decline Altcoin?

There are some reasons why it makes sense to buy a decline in encryption this year. First, Donald Trump is closely watching the stock market and uses his performance to measure his approval in the United States. Therefore, the decrease in stock prices means that it will have to intervene in the coming days.

Second, customs duties were expected to be exposed since its announcement in January. As such, there is a possibility that the shares will eventually wear the investors. Most investors have already price them in these measures.

Third, there is a possibility that the courts will stop the customs tariffs on Canadian and Mexican goods because they interfere in the UsMCA policy that was voted by Congress and its signing in Trump’s law. As such, there is an argument about whether to cancel the deal unilaterally.

Moreover, with a tariff now and threatening to push the United States to recession, the next stage will be how to finish it. Trump often does something big and then moves to negotiations.

Therefore, there is a possibility that American stock indicators such as S&P 500 and Dow Jones and withdrawing encrypted currencies will also revive.

Crypto Post 1 billion dollars of reference