Xag/USD its gains, will the gathering continue?

- As silver prices rise, we included the technical levels of the Xagusd husband. Discover the prediction of silver prices.

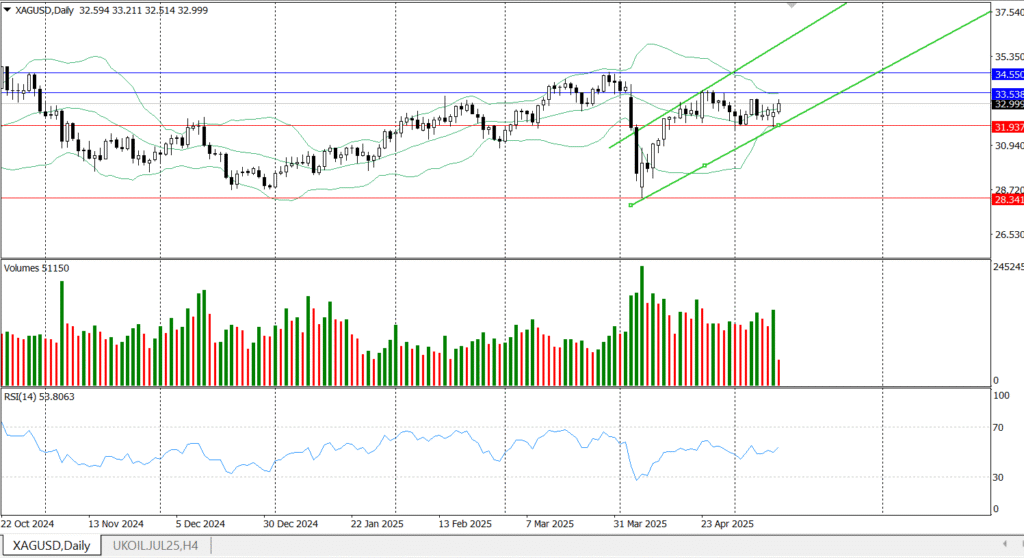

Silver PRICE allows biological expectations today, Tuesday, May 13, and has extended its gains to trade at the time of writing this report, or approximately $ 33.00 per ounce. According to the technical expectations of this precious metal, Xagusd, it continues to circulate within the style of an upward channel.

Technically, the silver price is now trading above a strong support level of $ 31.93, which may pay the price to reach the resistance level at $ 33.53. Any break above this resistance level can attract buyers and support silver to approach seven months height at 34.55 dollars. Silver price is 2025-2040

On the downside, the silver price may test the support level of $ 31.93, so any collapse of this level may offer the silver price to the landfill and press the Xagusd pair to test the lowest level in the eight months of $ 28.00, on April 7.

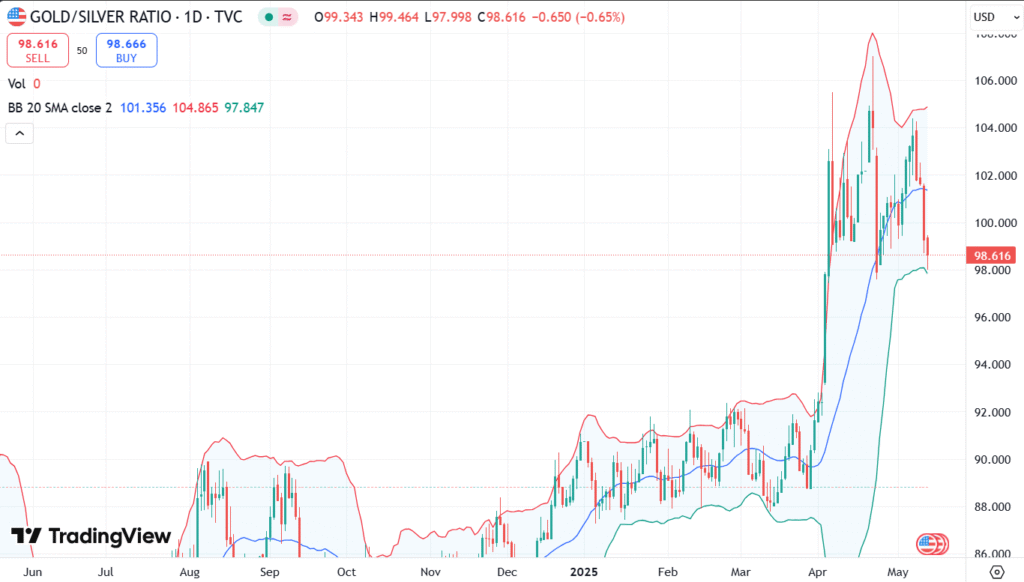

The percentage of gold and chaos

This percentage tells investors with an ounce of silver required to buy one ounce of gold. The increase in the increase may indicate that gold has become more expensive than silver, while a decrease in the opposite.

Now, ratio 98: 1, which means that it takes 98 ounces of silver to buy one ounce of gold. As of early July 2024, the ratio was 87: 1, and historically, this percentage usually ranged between 40: 1 and 60: 1, which indicates that the current percentage is relatively high, indicating that silver may be its value compared to gold. What does this indicate?High percentage can indicate high silver prices and continue to collect them.

See too

It is always useful to verify the percentage of gold silver, but please note that it is not a crystal ball. It is one tool between many of them and must be used alongside other basic analyzes

What are the factors that affect silver prices?

There is a wide range of factors that affect silver prices. Like factors such as geopolitical uncertainty or fears can make silver prices rise, because it is a safe advantage.

Low interest rates may also raise silver prices. Its movements depend on the strength of the US dollar. Therefore, high interest rates will enhance the dollar and weaken silver. Other factors, such as demand and supply on mining, can affect silver prices and recycling rates as well. Watching all these factors may help investors while predicting silver prices.