World Liberty Financial is gained from Trump 200 meters from WLFI icons after withdrawing $ 10 million

World Liberty Financial (WLFI), an encryption project with deep political ties, took a high -level step in February, where she got 200 million of its original symbols.

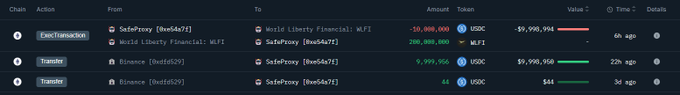

The purchase, which remained an unknown amount, followed a $ 10 million withdrawal of Binance, adding on constant speculation about the WLFI assets strategy.

This last deal, which was first reported by the lens on the chain on the series, indicates a shift in the WLFI approach, with a focus on the accumulation of the direct symbol.

6 hours ago, a newly created multiple portfolio #trumpGlobal Freedom Financing (WorldLIPERTYFIWithdrawing 10 million dollars $ USDC from # And bought 200 meters $ WLFI. Address: 0xe54a7f3714c8d104783b2079d6d9985cd68539 data @NANSEN_AI

The financial activities of the project drew the audit, especially given its relations with the Trump family, which maintains a controlling share of WLFI revenues.

With the lack of concrete Defi lending services yet, the questions continue to rotate at the end of WLFI – whether it is a legitimate financial project or a camouflage political fund.

He raised $ 455 million, but where is the utility?

Despite the brand itself as a decentralized lending platform (Defi), WLFI has not yet been offered essential financial products.

According to Putting researchThe project raised amazing symbolic sales of $ 455 million as of February 9, 2025.

The first public sale of WLFI achieved $ 319 million by selling 21.3 billion icons at a price of $ 0.015 each, while the second round is at a price of $ 0.05 for each symbol received an additional $ 136 million.

These numbers highlight the important investor interest, but with the lack of lending functions or borrowing that have been launched, the actual use of the symbol remains unclear.

Instead of focusing on Defi services, WLFI gave priority asset accumulation.

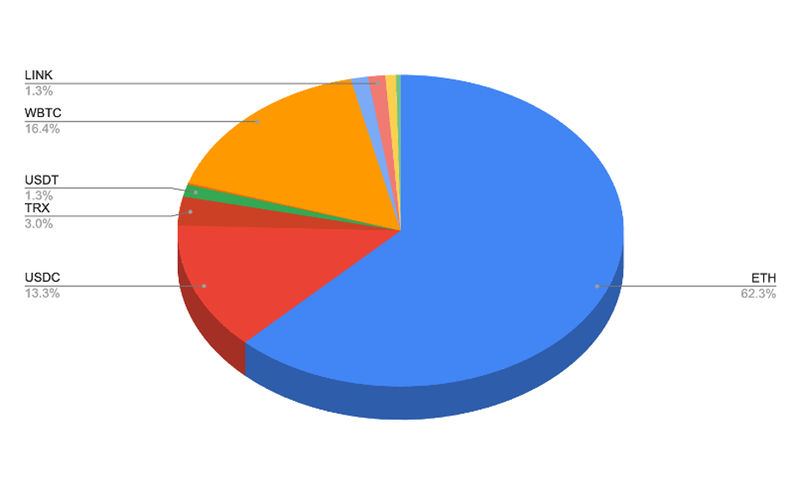

The project now owns an estimated 327 million dollars of digital and central drainage assets, indicating a strategy that focuses on the market situation instead of practical benefit.

source: Portrait

Allocating WLFI assets raises fears

WLFI’s Treasury Administration approach sparked discussion, especially because of the concentration of funds in specific assets.

Before the last purchase, WLFI had $ 47.49 million in Stablecoins and made $ 307.4 million to Coinbase Prime, a step indicating the preference for storing the organized guard.

Platform investments also prefer the real world assets (RWAS) and Defi protocols. His exposure to Bitcoin and Ethereum remains large, and is in line with wider trends in the encryption sector.

Market analysts argue that the WLFI assets strategy lacks transparency, especially given its political affiliation and control practiced by the Trump family on symbolic revenues.

In addition to the conspiracies, Justin Sun, the founder of TON, appeared as the largest institutional investor in WLFI, which contributed $ 75 million.

SUN’s participation in WLFI’s existing encryption networks, but also raises more questions about the project goals.

WLFI has directed $ 63.41 million to sun -related assets such as TRX and Bitcoin wrapped, which enhances speculation that its financial ecosystem may be more about monotheism from decentralization.

Politics on Devi?

WLFI’s close association with the Trump family led to many as a financial innovation and more as a political charge.

The Trump family has more control over 75 % of the revenues of selling the distinctive WLFI code on whether the project is a legitimate Defi or merely mechanism to benefit from the political impact to achieve financial gains.

While political -backed political financing is not new, WLFI’s approach varies in size and implementation.

Through the accumulation of vast reserves and align itself with high -level characters such as Sun, the project presents itself as a force player in both financial and political fields.

Without a clear road map of the product, its position remains as a large theoretical lender.

Since the encryption industry is struggling with organizational scrutiny, the following moves of WLFI will be decisive in determining its long -term life’s ability.

Whether the project will finally provide real Defi services or continue to accumulate its assets, it still must be seen.

But with the collection of $ 455 million, a growing list of influential investors, direct relationships with a high -level political dynasty, WLFI is unlikely to fade from the spotlight any time soon.

Trump -backed World Liberty Financial gets Trump -backed WLFI codes after $ 6 million, first appeared on Invezz