Will you reach $ 3000 and beyond?

- summary:

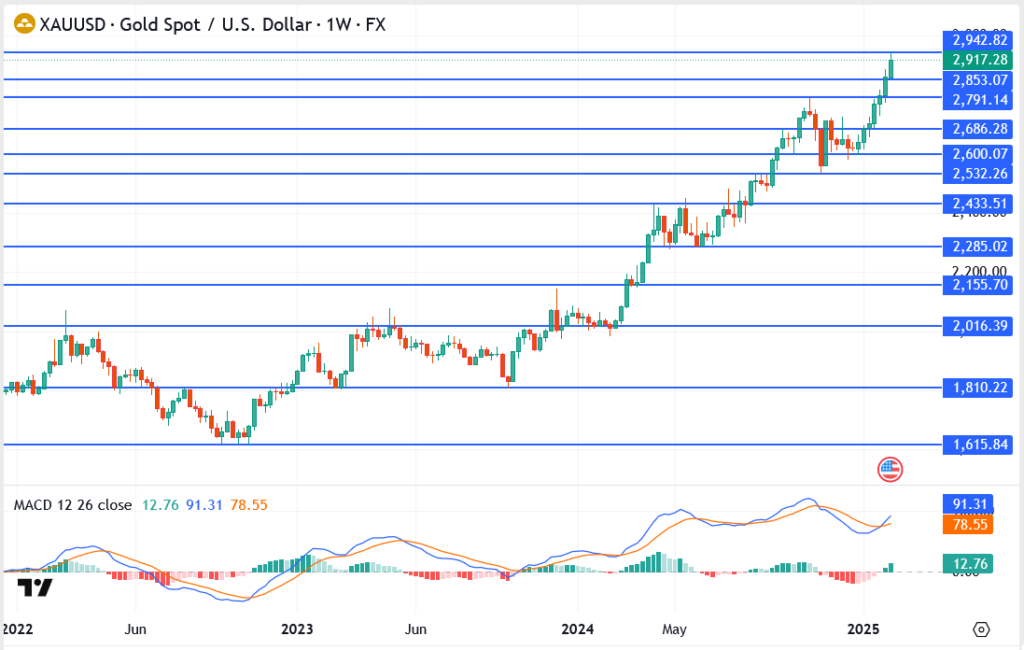

- Gold prices analysis 2024-2025: Xau/USD reaches the highest level ever at $ 2942. The main levels of focus as traders are 3000 dollars.

Gold prices It has seen a great escalating path, affected by the escalation of geopolitical tensions, fears of inflation, and emerging economic policies. In early 2025, prices rose to more than $ 2900 an ounce, leading to speculation that $ 3,000 may be imminent. With the collection of different factors to support gold, the question on the lips of many people is: to what extent can it rise?

Many current events, including American definitions and conflicts in the Middle East, have increased the investor’s interest in safe assets such as gold. This article analyzes the main factors that feed the current assembly and highlight what can be monitored in the coming months.

How to enhance the customs tariff

One of the main engine to increase gold is to announce the implementation of US tariffs on steel and aluminum on March 12. This customs tariff will increase the cost of imported minerals by 25 %, with the aim of protecting American manufacturers. Although this policy may provide a temporary advantage for American manufacturers, it is also expected to increase the expenses of the steel and aluminum sectors.

Industry experts suggest that this may negatively affect the macroeconomic economy in the long run, especially since the sectors of steel consuming greatly exceed the ones that make it. Investors seek to obtain gold as protection against possible economic turmoil caused by definitions.

Middle East tension adds more fuel to fire

In addition to economic issues, geopolitical threats contribute significantly to increasing gold prices. President Trump’s recent observations on Gaza and the Middle East strategy have increased uncertainty. His proposal to resettle Palestinian refugees in nearby countries and threats to cut military aid to Egypt and Jordan, the unstable markets.

Paying the increasing tension for investors to turn to gold for safety, increase demand and push prices up.

A strong American job market and high inflation

The salary salary report in the United States is not planted earlier this month is an amazing strong labor market. The unemployment rate decreased from 4.1 % to 4.0 %, wage growth increased by 0.5 %, significantly exceeding expectations.

With annual inflation by 2.9 %, many expected the Federal Reserve to intervene. However, it appears that political pressure and continuous changes in important administrative positions prevented the federal reserve from indicating the upcoming rate. This postponement in the application of monetary policy provided additional support for gold prices.

Gold prices analysis (2024-2025): major trends and technical expectations

Gold prices have shown great strength over the past year, as the main resistance levels were destroyed and new levels were struck at $ 2942 an ounce in the ounce of 2025. The bullish path is highlighted by the upright direction that is driven by global inadequacy, high inflation, and geopolitical risks. Let’s divide the main developments and technical levels:

1. 2024: The basis for upscale collapse

- From January to June 2024: Gold was traded between $ 1810 and $ 2,200, and unified after a strong recovery from its lowest level 2023. Test the price again and again resistance to $ 2200, but the bullish momentum was not strong enough to penetrate.

- July 2024: Gold finally erupted over $ 2200, which led to a continuous upward trend. This penetration represents a decisive turning point as it has cleared the multi -resistance level and paved the way for higher targets.

- From August to October 2024: Prices rose at about 2433 dollars and $ 2532, and unified in a narrow range before another emerging batch.

2. Late 2024 to early 2025: the mutation to higher levels

- November 2024: Gold violated a brand of $ 2600, confirming a strong strong continuation. This step was fueled by increased geopolitical tensions and increased inflation data from the United States

- December 2024 to January 2025: The bullish momentum collapsed when gold was broken over a resistance of $ 2,686 and rose about $ 2,853 and $ 2,917. The buyers maintained control, with no significant decline, indicating a strong demand.

- February 2025: Gold reached 2942 dollars, which led to a new rise ever. Continuous global uncertainty and changes in American policy continued to support the assembly, as traders are now targeting the psychological level of $ 3,000.

The main technical levels to watch

- Immediate support: $ 2,791 – Less break may lead to a correction of about $ 2,686.

- Main support areas: 2,532 dollars and $ 2,433 – these levels are major areas where buyers may interfere in the event of restoring prices.

- Resistance levels: $ 2,942 is the immediate resistance. Beyond that, the next psychological goal is $ 3000.

MACD and momentum

RSI: Currently near the peak peak area of the peak, indicating the possibility of obtaining short -term profits before the next station is higher.

MACD Index: Macd climb firmly, with a healthy positive momentum. However, the graph indicates some slowdown momentum, indicating that monotheism or brief withdrawal may be possible.

conclusion

Gold last year was really exceptional, as prices rose from $ 1810 to $ 2,942. The trend is still positive, supported by strong technical and basic elements. Although the short -term decline may happen, the total perspective remains optimistic as long as gold remains higher than important support levels.

Traders need to pay attention to $ 2791 as the main main level and monitoring global events that may affect the next gold path. The standard of $ 3,000 can now be achieved, and its overcoming may raise a new increase in the purchase of enthusiasm.