Will XRP gain support and decrease to less than $ 2?

XRP decreased by 5 % during the past week, as it struggled to restore momentum as technical indicators flash mixed signals. The RSI has decreased to less than 50, and the price remains stuck in a narrow range between the main support levels and resistance levels.

At the same time, the Ichimoku cloud has turned from green to red, with a thick cloud that approaches increased pressure. With the pressure of fluctuation and the fading of momentum, the XRP approaches a critical point where the collapse or collapse is increasingly.

XRP is struggling to restore momentum with a decrease in the relative strength index to less than 50

XRP (RSI) is currently sitting at 44.54, after recovering from the lowest level of the day 40.67. Only yesterday, it was at 51.30, with a highlight of the short -term fluctuation.

RSI is an indicator of momentum that measures the speed and size of the recent prices to assess excessive conditions in peak or sale.

The above readings usually suggest that the original may be overlooked, while readings of less than 30 indicate that it may be excessive.

With XRP RSI at 44.54, it is currently in a neutral area, no strong purchase or pressure.

However, the fact that it has not crossed the peak doorstep of 70 since March 19 – one month ago – indicates a decrease in the continuous upward budget. This may mean that XRP is still in a unification stage, as the market is waiting for a clearer direction.

If the RSI continues to climb about 50 and beyond, this may hint on the construction of momentum, but without the outbreak of over 70, the upper trend may remain limited.

XRP faces uncertainty as the declining trend begins to expand

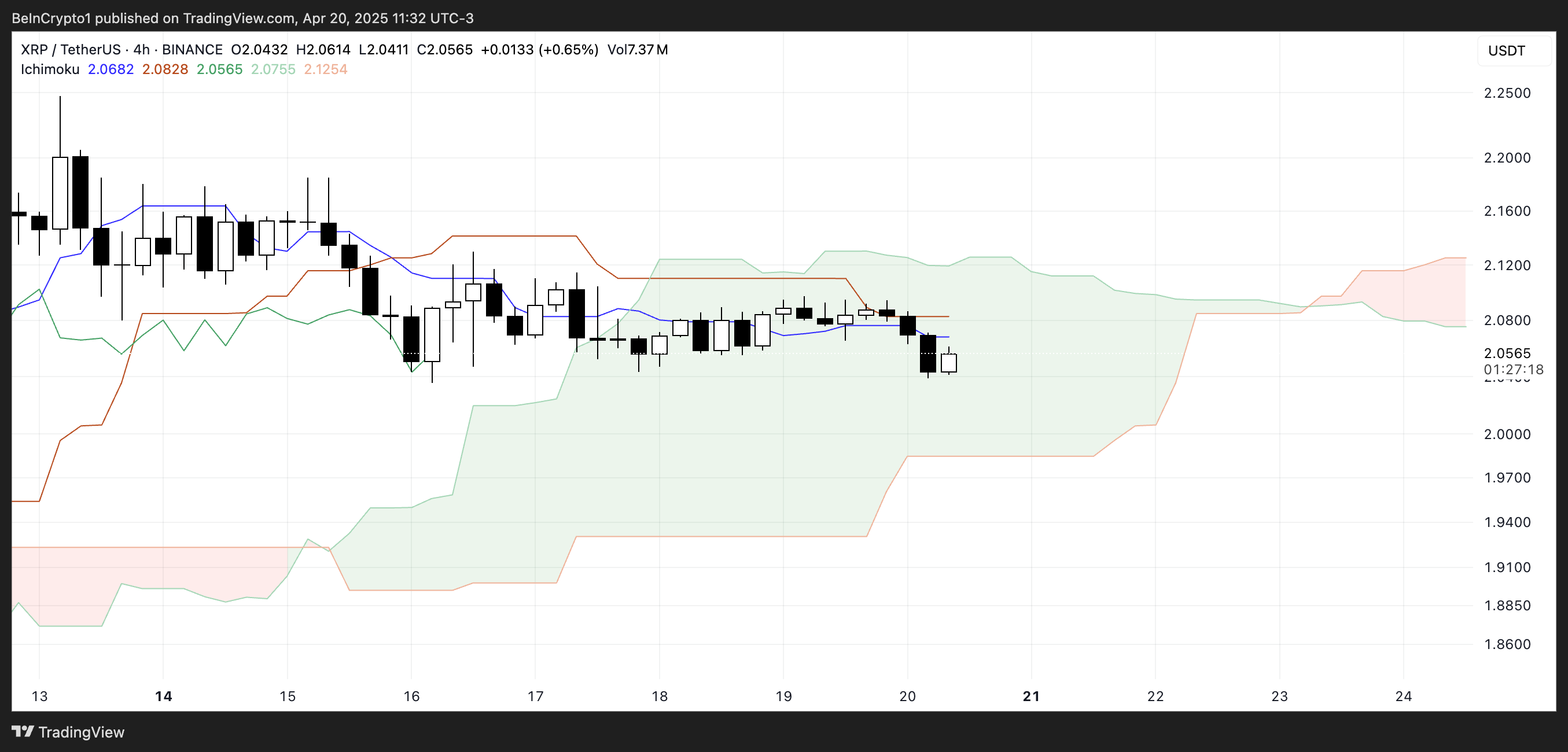

XRP is currently trading within Ichimoku Cloud, the frequency of the sign and the neutral direction.

Via Tenkan-Sen (blue line) below the Kijun-Sen (Red Line), which is a downward signal, but with no price inside the cloud, it lacks full confirmation.

The cloud itself works as a support and resistance area, and XRP is now moving sideways inside that area.

Looking forward, the cloud has turned from green to red – a sign that the landfill may be built. The most important is that the red cloud expands, indicating an increase in the declining pressure in the near future.

The red como often refers to the strongest general resistance and a potential continuity of a declining direction if the price is broken under the cloud.

Until the XRP explodes decisively in either direction, the market remains in waiting and vision, but the growing red cloud tends to be biased towards caution.

XRP pressure area: The price can be sent to $ 2.50 – or much lower

The XRP price is currently trading within a narrow range, discovered between the main support level at $ 2.05 and resistant at $ 2.09. This narrow channel reflects the uncertainty in the short term, but the crucial step in either direction can put a tone of the next.

If the support of $ 2.05 fails, the next level of viewing is $ 1.96. The collapse below can lead to a sharp decrease of about $ 1.61, which represents the first closure of less than $ 1.70 since November 2024 – a declining sign that can accelerate the pressure pressure.

Recently, veteran analyst Peter Brandt warned that a large correction could reach XRP soon.

On the other side, if the bulls regain control and pay XRP over a resistance of $ 2.09, then the next goal lies at $ 2.17. The collapse that exceeds this can open the door to a move of about $ 2.50, which is the price level that has not been seen since March 19.

In order for this to happen, XRP will need a clear return in the momentum and the size of the purchase.

Until then, the price remains trapped in a narrow area, with the potential of the upward trend and the negative side on the table.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.