Will XRP be disrupted less than two dollars in March? The latest ideas

XRP corrects approximately 30 % at the last 30 days, with prices trading less than $ 3 for about a month. The DMI movement index (DMI) shows a strong declining direction, as the average trend index (ADX) rises above 35, indicating an increase in the declining momentum.

However, a possible reflection can occur if the Supreme Education Council drops a lawsuit against XRP, and may cause a march towards the main resistance levels.

XRP DMI shows that there is no clear direction

The directional movement index of XRP (DMI) reveals that the average trend index (ADX) is currently at 36.98, a significant increase of 15.89 just four days ago.

ADX is the directional strength indicator that does not indicate the direction of the direction but measures its severity. The ADX value is usually higher than 25 indicating a strong direction, while the value of less than 20 indicates a weak or unlimited market.

With the ADX height of XRP sharply above 35, it indicates that the current declining trend is gaining momentum.

This increase in ADX indicates that market participants show stronger condemnation, making the current trend more likely to continue.

Meanwhile, XRP’s +DI (a positive directional indicator) in 11.4, a decrease from a height of 15.1 two days ago, indicates twice the oud pressure. On the other hand, the -di (the negative trend index) decreased to 21.6 from 37.2 on February 2, indicating a decrease in the declining momentum.

Although the declining pressure is low, the -di remains higher than +DI, which confirms that the downward trend is still intact. The widening gap between ADX and direction indicators indicates that the declining trend is strong and continuous.

In order to cross +Di above -Di, which indicates a possible reflection of the direction, it is possible that XRP will remain in a declining stage.

XRP active headlines recover after reaching their lowest level in 3 months

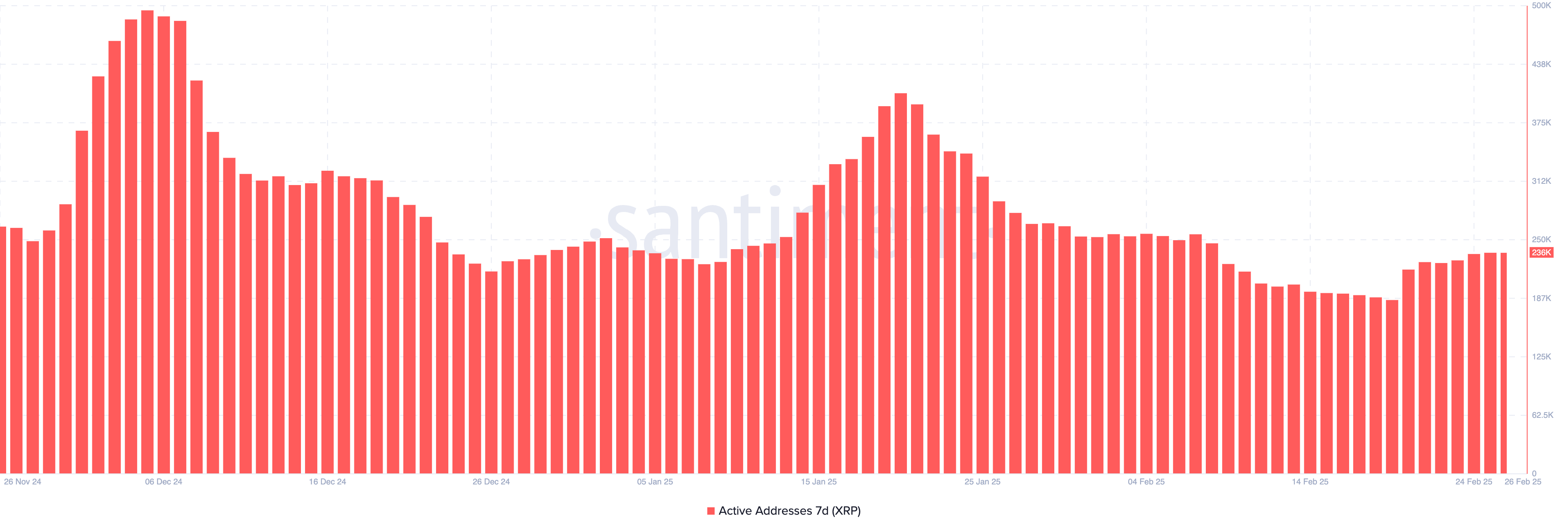

The number of active headlines decreased from XRP for 7 days from 407,000 on January 20 to about 186,000 on February 19, the lowest level since November 2024.

This scale is important because it measures the user’s participation and network activity, which reflects the demand for XRP. The decline indicates a decrease in attention and a declining feeling, while the increase indicates the increasing participation and potential purchase pressure. The sharp decrease indicated the investor’s interest in decline, which contributes to the declining XRP expectations.

Recently, the XRP active headlines began to recover, reaching 236,000 – an increase of 26.8 % last week. This increase indicates the growth of the user’s activity and renewed interest in the network.

Historically, the increased active addresses can precede the price recovery because the participation leads to high demand. If this trend continues, it may support a potential recovery of prices, but continuous growth is needed to confirm the bullish shift.

The direction of XRP is largely dependent on the SEC and Ripple suit

XRP’s EMA lines currently display a phone preparation, with short -term lines less than long -term lines. The price has been traded less than $ 3 since February 1.

This alignment indicates the continuation of the declining momentum, as Emas is shorter reflects the recent downward feelings. If the declining direction persists, XRP can test two strong support levels at $ 2.15 and $ 2.06.

If you lose, the XRP price may decrease to $ 1.77, which is less than $ 2 for the first time since November 2024.

However, the reflection of the trend is possible, especially if the Supreme Education Council dropped a lawsuit against XRP in March. Recently, SEC has dropped issues against Gemini, Uniwap, Robinhood and Coinbase, indicating a shift in organizational pressure.

If the lawsuit is dropped, this may lead to a bullish direction, with XRP test resistance at $ 2.36 and $ 2.52. If these levels are broken, XRP may continue to rise about $ 2.71, which may reflect the hybrid view.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.