Will the Haboodi measures pay the price of BTC less than 80 thousand dollars?

The last encryption market faded on Friday, as it is erased almost a sharp sale of all weekly gains. Investors have turned into caution amid concerns about the upcoming tariff for President Trump to be held on April 2, along with strong PCE data. As Bitcoin is present in the high pressure pressure to less than $ 85,000, it is on the right path for the worst quarter since 2018, allowing analysts to predict whether it may end under March less than the level of $ 80,000.

Bitcoin to face the worst Q1 since 2018

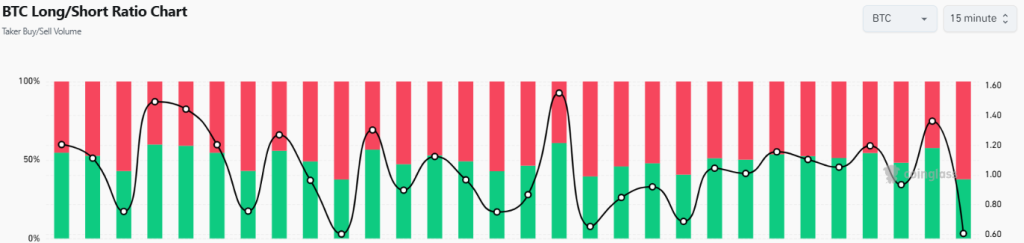

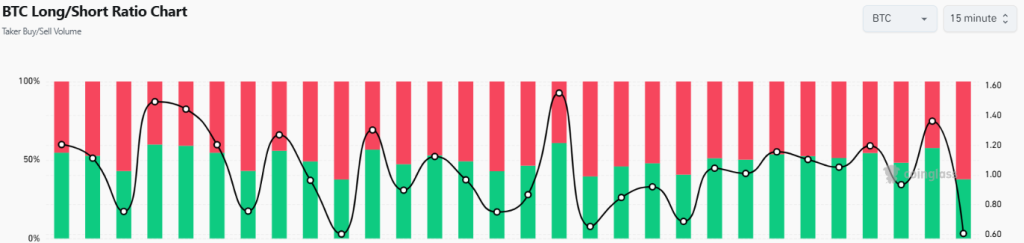

Bitcoin price has decreased sharply over the past few hours. According to Coinglass data, approximately 90.56 million dollars were filtered in BTC positions, including $ 79.3 million of buyers and about $ 11.25 million of sellers.

Bitcoin’s recent low price is on the right track of the worst Q1 performance since 2018. Data from Coinglass It indicates a decrease in bitcoin about 11.86 % in the first quarter of 2025, which is a little worse than a 10.83 % loss in the first quarter of 2020, although the sharp 49.7 % decreased in the first quarter of 2018.

Bitcoin’s open interest has decreased by approximately 4.5 % over the past 24 hours, approaching a decrease of about $ 54 billion. The decrease in the open interest indicates a decrease in trading activity between BTC trading, which may lead to a decrease in fluctuations and the most careful market behavior in the short term.

In addition, the long/short percentage witnessed a remarkable decrease, currently located at 0.6051. This scale reveals that approximately 62.3 % of merchants are now betting on a decrease in Bitcoin prices, while only about 38 % hope for possible recovery. In general, these numbers indicate increasingly vulgar feelings among merchants.

Also read: Bitcoin ETF flow breaks after a 10 -day increase

In addition to the Haboodi feelings, the investment funds circulated in Bitcoin have seen noticeable external flows, and perhaps BTC pushed near the level of $ 80,000. FIDTC from Fidelity alone witnessed $ 93.16 million of external flows on Friday, as it ended a series of 10-day flows-the longest this year. It is worth noting that FBTC has received $ 97.14 million of flows only the previous day, according to Sosovalue. Trading volume in all investment funds in Bitcoin in the United States increased slightly on Friday, with a total of about $ 2.22 billion.

What is the next BTC price?

Bitcoin recently witnessed the increase in the sale pressure, causing its price down below the large Fibonacci support levels and a decrease of about $ 81,644. Nowadays, Bitcoin is trading near $ 82,289, a decrease of about 1.7 % over the past 24 hours.

The sellers actively maintain decisive resistance at $ 85,000, in order to prevent the price from decline. Nevertheless, buyers remain designer and appear ready to pay another to restore this main level.

If buyers can recover 85,000 dollars, the market’s morale may turn positively, and the path may be paved for more bullish momentum towards the next main resistance near 90,000 dollars.

However, if buyers do not succeed in overcoming this decisive barrier, Bitcoin may experience increased sale pressure, and perhaps the price pulled back to the support area between 80,000 dollars and $ 78,000.