Will the bears dominate the ETH price?

The Federal Reserve decided not to change interest rates on May 7, keeping them by 4.25 % to 4.50 %. This made encryption assets more attractive to investors. As a result, the market rises today, as Bitcoin is $ 100,000. Ethereum also rises, but experts believe that Sths may soon sell profits. This is supported by a decrease in the main activity on the chain, which may lead to a reflection of prices soon.

ETH MVRV ratio to turn on the reflection

During the past 24 hours, the encryption market witnessed a strong increase. Bitcoin returned to the level of $ 100,000, which the last time reached in February. Ethereum also rose above $ 2000, recovering from the losses related to previous tensions between the United States and China.

According to Coinglass, more than $ 175 million of Ethereum sites were filtered during this period. From that, buyers closed $ 27 million in positions, while sellers witnessed $ 148 million in forced liquidation. The ETHEREUM price has also led to a 18 % jump in open interest, as it is now 24.8 billion dollars.

Also read: Altcoin Season here: XRP, Ada, SUI and Eth Rally

Ethereum partially earns the last due to the increased interest from older investors since April. Coinshares has informed two consecutive weeks of money flowing to the air -based investment funds. Some also believe that Pectra, which was launched on May 7, helped boost the price.

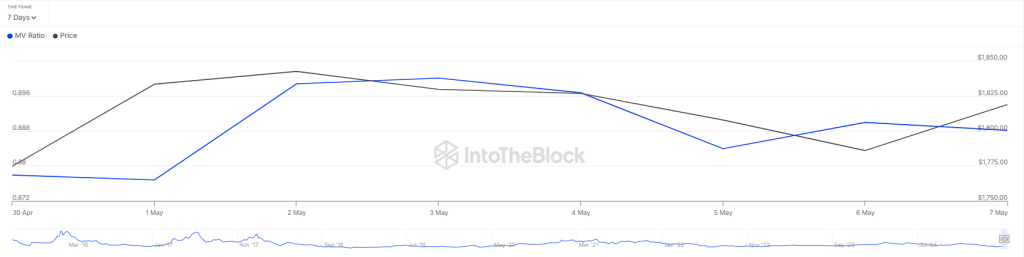

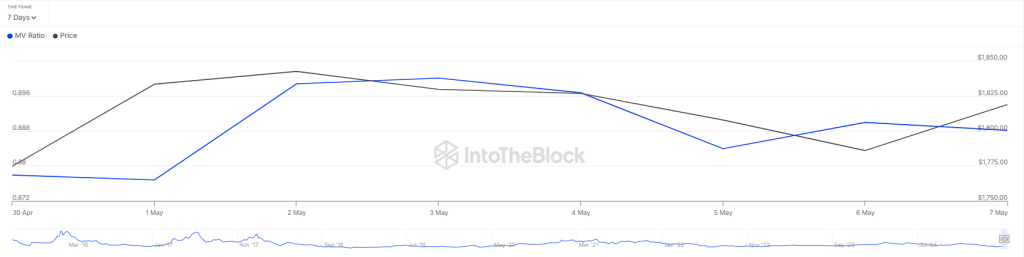

The current demand for purchase in the encryption market may not last for a long time. Data from InTothheblock shows that the MVRV ratio has decreased to 0.888, which means that many investors are selling confused despite the high prices. This type of panic sale can encourage more sale and lead to contraction.

However, some of the main players (“smart money”) buy. Wintermute has made great purchases over the past 24 hours, and perhaps to take advantage of the mutation and gain market making fees. Likewise, Lokonchain reported that Abraxas Capital withdrew more than 41000 ETH ($ 75 million) from Binance and Kraken. Despite the high prices, nearly half of the Ethereum portfolios, about 65.5 million, are still confused.

What is the following for the price of ETH?

Seller people face a difficult time to push the ether to less than their moving averages, indicating that there is not much pressure for sale during the upscale gathering. Buyers keep the price around the immediate resistance line. As of the writing of this way, the ETH price is trading at $ 2048, with more than 13 % in the past 24 hours.

Buyers can use this as an opportunity to penetrate the resistance at $ 2,109. If it succeeds, the ETH/USDT pair may gain momentum and go above the level of $ 2500. There is a smaller hostel at the FIB level of 23.6 % directly, but it is expected to overcome.

On the other side, sellers are likely to try to pull the price without the moving averages. If this happens, ETH can decrease to $ 1734. Buyers may intervene there, but if they cannot keep this level, the price may decrease to the main support at $ 1542.

Since the RSI is circulating within the peak area at the 78 level, the price of the ETH is about to decline in the short term.