Will it expect to decrease the bills for gathering?

Docusign (NASDAQ: Docu) exceeded Wall Street’s expectations for the first quarter, but the company’s shares still decreased this week. The directions of cautious bills for the entire year and new concerns about the momentum of long -term growth were the main causes of sale, which witnessed the share of more than 14 % during the trading extending on Thursday.

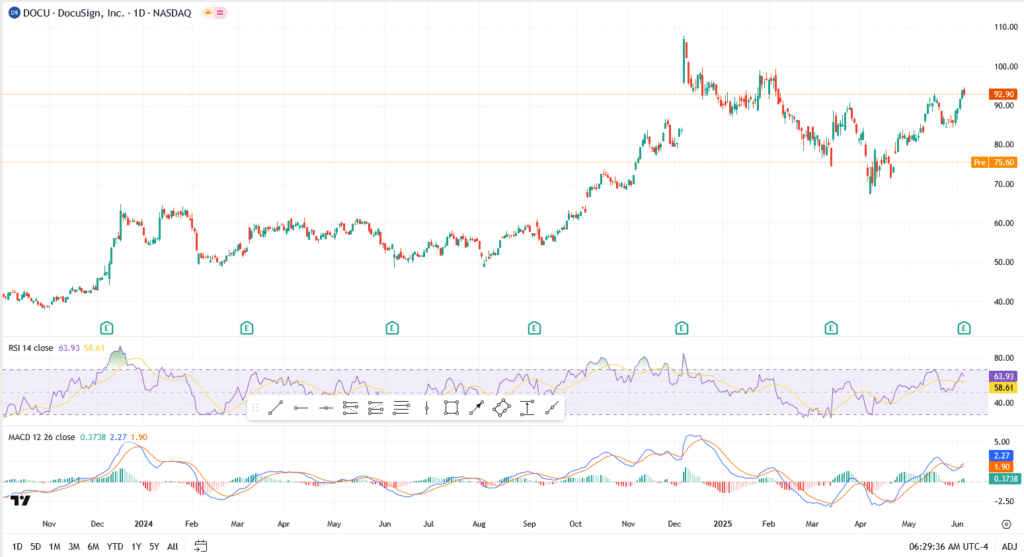

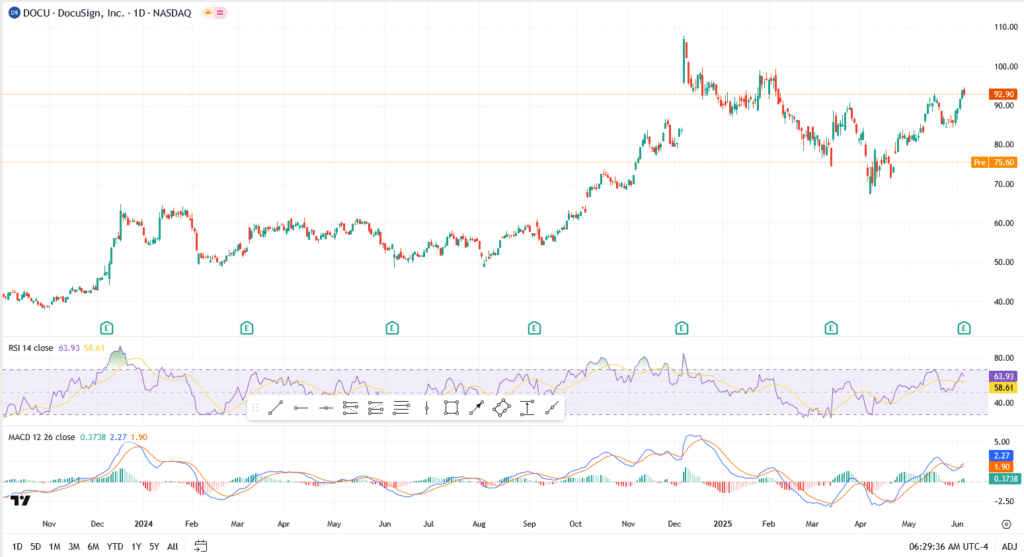

The stock closed the regular session near 92.90 dollars, not far from its last height, but soon turned south as the traders’ reaction to the forecasts of the updated bills and signs of premature renovations were.

A strong quarter of the soft guidelines

Docusign has published a modified profit of $ 0.90 per share, easily overpowering the consensus of the analysts of $ 0.83. Revenue increased by 8 % year on an annual basis to $ 763.7 million, before expectations as well. The subscription revenues led the gains, which amounted to $ 746.2 million, but a decrease of 40 % in professional services revenues withdrew the total image outside the balance slightly.

Billings, a main aspiration scale, increased by 4 % to $ 739.6 million, but missed the expected range of the company of $ 741 million to $ 751 million. This, in addition to a declining review of the entire year’s bills (now at 3.285 billion dollars to 3.339 billion dollars), began the warnings on the market.

Jeffrez analysts reduced this deficiency, describing it as a timing problem due to fewer early renovations. But Morgan Stanley was not tolerant, as he reduced the price of Docu shares from $ 92 to $ 86, citing the challenges in sales productivity and executive spin.

Smith analysis: bulls on monitoring

- RSI sits at 63.93, on the verge of excessive peak level

- MACD is still in upward lands, although the graphic bars began to shrink

- The main support is seen at $ 75.60, which is the last minimum in May

- The resistance is still strong near $ 100, and the level in which the sellers appeared after the wealthy

See too

Despite the decline on Friday after the market, the upward trend has remained intact. The arrow has recovered more than 23 % since its lowest level in March, and technical signals still prefer to re -test $ 100 if the bulls defend the current levels.

Take final: correction or exercise?

The decline may be less than a structural collapse and more than the transformation of feelings. Although Docusign shares have achieved good performance so far this year, merchants have become more important as the company continues to rise and continued macro fears.

The trend is still positive if the stock remains above $ 88 to $ 90. However, the violation below may restore the level of support from 75 to 76 dollars. Expect fluctuation until it continues until the clarity returns.