Will Bitcoin decrease to less than $ 100,000 in the last week of the second quarter?

With the intensification of geopolitical tensions and the deterioration of the feelings of investors, the declining pressure continued to spread through the Bitcoin markets and its derivatives.

The uncertainty surrounding the stability of the global macroeconomic economy with many market participants led to the approach of risk, as the currency showed signs of weakness as the second quarter approached its end.

Bitcoin future contracts have turned into landing

With a currency that is struggling to mobilize the momentum on a $ 103,000 price sign, future traders in Bitcoin are increasingly put against the currency.

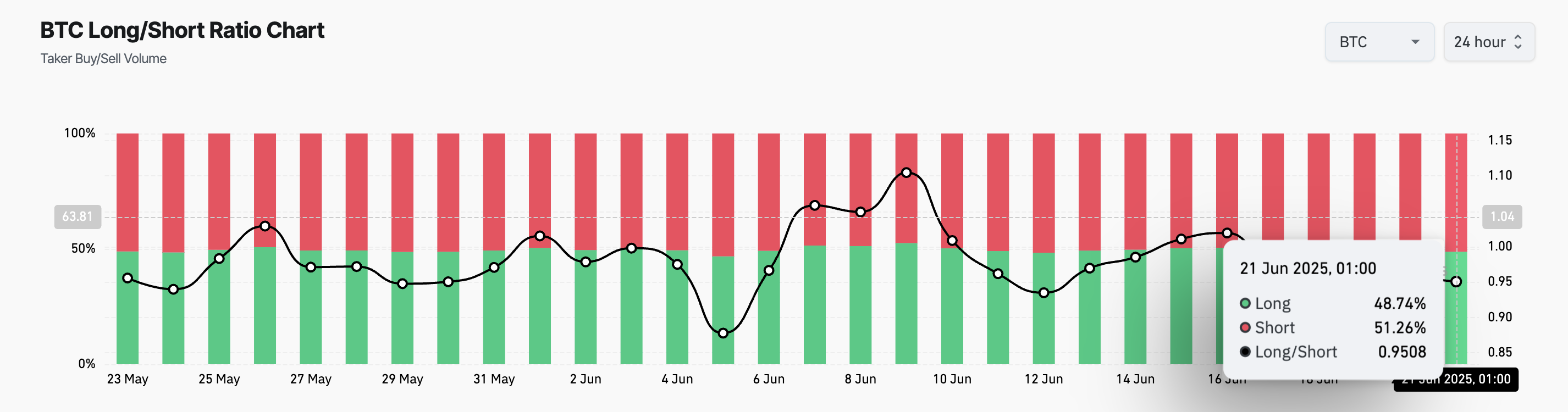

According to Coinglass, the long/short metal coin – a main measure of the TRADER Transaction – has been significantly tended to short pants since June 17, indicating an increasing belief that the last BTC gathering may lose momentum. At the time of the press, the ratio is 0.95, indicating that more traders are betting on Altcoin.

This ratio compares the number of long and short situations on the market. When the long/short percentage of the original is higher than 1, there is longer than short situations, indicating that merchants are often betting on the increase in prices.

On the contrary, as shown with BTC, less than one indicates that most traders determine low prices. This reflects the increasing homosexuality and the increasing expectations of the constant negative movements in the short term.

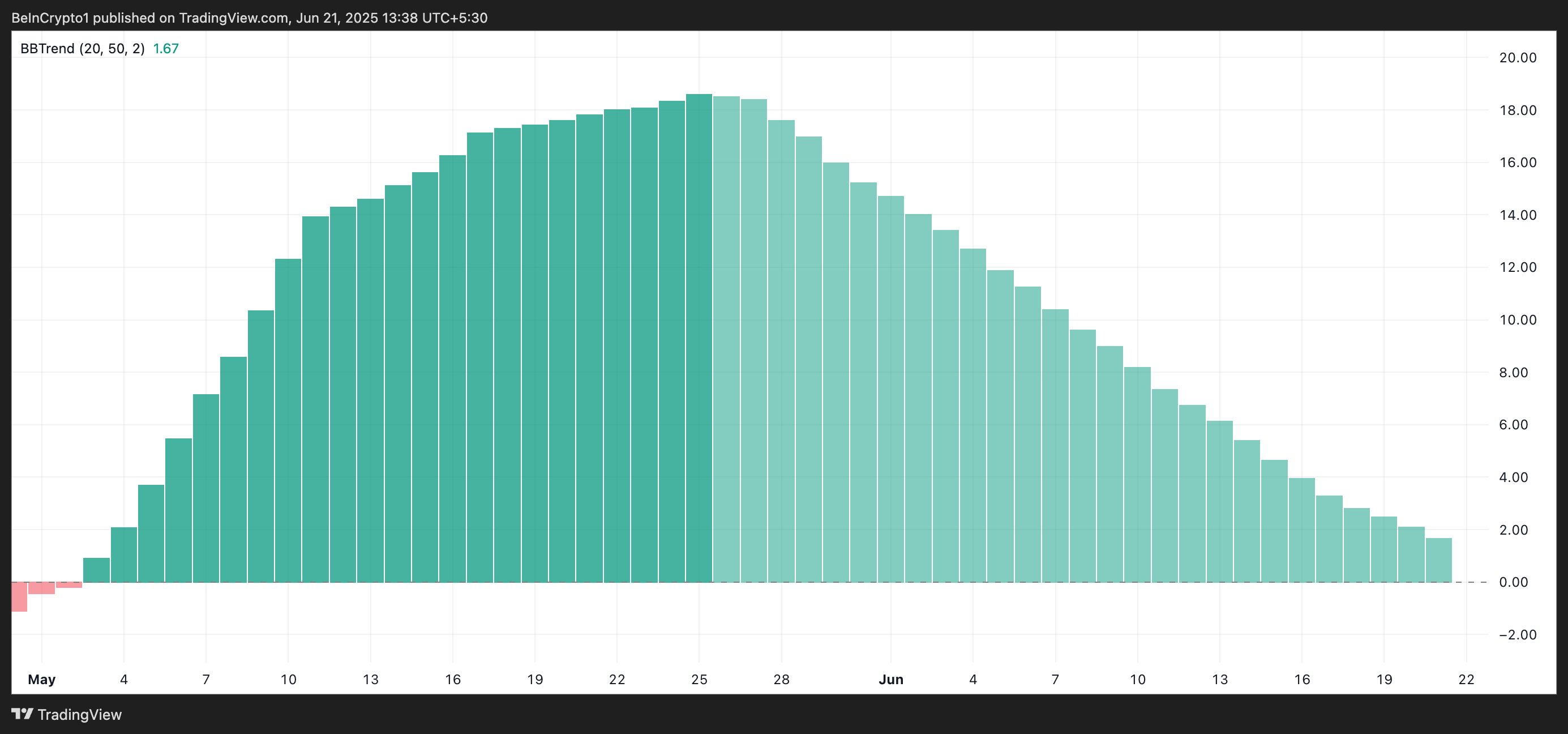

Moreover, the daily chart readings of the BTC BBTRand index enhance the landfill. With the weakness of the BTC price momentum, the size of the green graph decreased steadily, indicating a decrease in the purchase of pressure and loss of upward strength.

Bbtrend is used to measure the strength and trend of price trends. It looks like a graphic graphic bars – green when the direction is difficult and red when it is dumping.

When Bbtrend turns into a negative or shrinking the green tapes, the bullish momentum fades, and the original may enter the stage of unification or confrontation.

Negative BBTRand constantly indicates that the sale pressure dominates, which increases the possibility of the BTC extending price.

BTC slips to the lowest level in the two weeks: Will you support $ 102,000?

Yesterday, the BTC price fell to the lowest level in 15 days at 102,345 dollars. Although it has recovered and closed at 103,297 dollars, the downward pressure remains, with the currency decreased 2 % over the past 24 hours.

If the new demand persists, the BTC price may extend to a decrease of about $ 101,520. If the bulls fail to defend this decisive support level, the original may decrease to $ 97,658.

On the other hand, if the purchase pressure is enhanced, BTC can recover and try to break more than $ 103,952. A successful step after this level may open the door to a rare of about 106,295 dollars.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.