Why is Ethereum Etfs very popular after Pectra?

Ethereum Ethereum ETFS has registered 15 consecutive days of net flows, raising $ 837.5 million since May 16.

The flow chain began a week after the Pectra upgrade from ETHEREUM, which increased the EIP-7702 transactions to nearly 1000 of the daily portfolio features without changes to the address.

Ethereum ETFS has a flow chain of $ 837.5 million

These flows constitute about 25 % of all net flows since the money launched in May 2024. The Eter Ether ETFS series represents the longest flow period without interruption since late 2024.

according to Data From Sosovalue, IT Spot Ethereum ETFS puts the highest cumulative flow value so far, with a total of now $ 3.33 billion.

The ETHEREUM ETF market leads the ETHEREUM ETF market in individual flows, which contributes about $ 600 million during this increase. While Etha is proud of the highest flows, the double offers for Grayscale, ETHE and ETH bears a greater asset base, at $ 4.09 billion in AUM compared to the total Etha.

Meanwhile, Fedelity offer tracks of $ 1.09 billion, while other money remains less than $ 250 million. It is worth noting that the increase coincides with an increase of 38 % in the ether price over the past thirty days.

The main engines include renewable institutional interest, optimism about the ethereum basics in the long run, and the last pentra upgrade of the network. Against these backgrounds, analysts are optimistic about ETHEREUM price expectations.

Nevertheless, JPMorgan analysts have indicated that despite the high institutional allocations, the user’s activity on the Ethereum network has not yet accepted the upgrade.

“The number of daily transactions nor the number of active addresses has not seen an increase in the aftermaths of the material,” wrote JPMorgan analysts, led by Nikolaos Banegeertegoglu, in the latest report.

If the current pace persists, the line can cross the billion dollars by next week. Such a result will confirm that the acute axis in feelings after a relatively silent start of the traded investment funds.

ETFS Bitcoin declined after record levels

While Ethereum ETFS continues to collect momentum, the same thing can be said to their counterparts in Bitcoin. Spot Bitcoin ETFS witnessed the latest flow of flow on May 29, when $ 346.8 million came out of the market in one day.

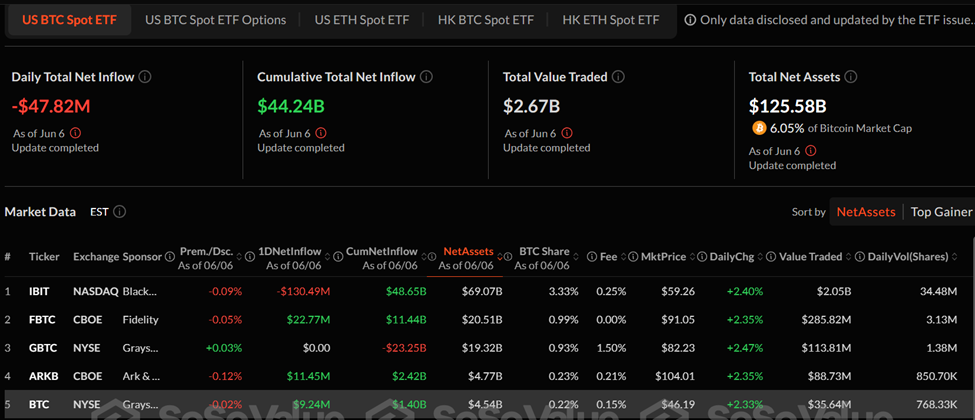

Since then, Bitcoin ETF flows have turned volatile, and cumulative flows have decreased by more than one billion dollars. This ranges from $ 45.34 billion on May 28 to 44.24 billion dollars from the trading session on Friday.

IBIT from Blackrock is the pioneer of the category with a wide margin, and runs $ 69 billion of assets. FBTC’s FBTC and Gramesale GBTC follow $ 20.51 billion and $ 19.32 billion in AUM, respectively.

The market also witnessed a short disturbance after a hot exchange online between President Donald Trump and Elon Musk, which led to a wider sale in the encryption and stock markets.

The lights on innovation and innovation ETF

With the acceleration of the investor’s interest in Ether ETFS, some analysts argue that future flows will depend on whether exhaustion functions have been presented. James Sevart, ETF analyst in Bloomberg, recently High Regulatory solutions that are used to launch circulating investment funds that support attention.

ETF Provider Rex has already applied Ethereum and Solana Stoke Etfs, and this first -like products may reach the United States within weeks.

The increasing demand is also reflected in the broader ETHEREUM accreditation measures. According to Santiment, ETHEREUM holders now exceed 148 million.

This indicates a long -term conviction in the first place. Relatively, Bitcoin 55.39 million has pregnant women, while other famous origins such as Dogecoin, XRP and Cardano have a report between 4 and 8 million welding.

As Eter ETFS is now stronger for her, the lights are firmly on whether this momentum can continue.

Perhaps, the possible offers supported by the next wave of institutional adoption may pay.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.

While the encryption markets try to gather at the end of the work week, encryption networks continue to grow over time. Below is the total amount of owners of the specified upper covers:

While the encryption markets try to gather at the end of the work week, encryption networks continue to grow over time. Below is the total amount of owners of the specified upper covers: ethereum

ethereum