Why does the S&P 500 rise towards its highest level ever and what it can break

The S&P 500 (SPX) rose firmly above 6000 marks in the early session on Tuesday, as the upscale momentum extended last week and confirmed the flexibility of investors despite the political opposite winds and recent evaluation. The measurement index is now flourishing with a new standard area, supported by the strength of technology, low fluctuations, and fears about the “S& P 500 SNUB” controversy.

The markets were initially fluctuating after the reports suggested that the institutional portfolios are illuminating the main indicators due to weight concentration. But this anxiety has proven short -term.

A strong American job report on Friday added more fuel to the gathering, prompting the S&P 500 to 2.4 % of its highest level ever. Traders are now clearly focused on macro winds, especially hopes for lowering prices and improving profit expectations.

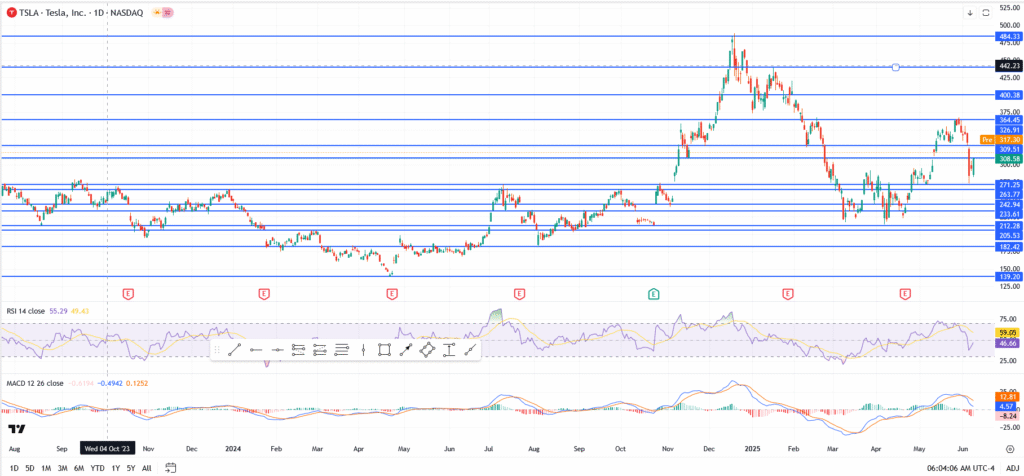

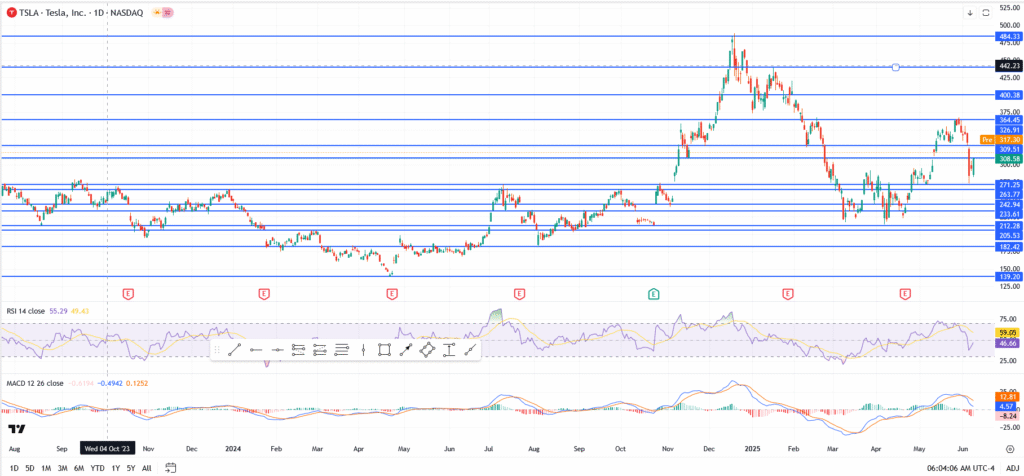

S&P Technical levels: Horrent power

- The index cleared the psychological barrier 6000 with conviction

- The immediate resistance is located in 6,015.64 – tested this morning

- If it is breached, the next upward goal is located near 6,147.43

- The closest support: 5,874.44, then 5,783.44

- RSI RISING in 65.47 – is about to peak, but not extend

- MACD is still optimistic firmly with a positive scope expanding

With the price movement remaining over the March-April resistance area, the bulls remain firmly controlled. Daily closure above 6,015 can lead to a new wave of institutional flows.

Fed, Consumer Prices Index Data to adjust the upper leg tone

The FOMC inflation report for this week can verify the authenticity of the penetration or the restoration of short -term fluctuations. But from now, the market message is clear: the appetite of the risk alive and in good health.

See too

If the head of the Federal Reserve Powell keep the door open to reduce September, the gathering may extend about 6,150 and beyond.

At the present time, the path of resistance remains the lowest.