Why could be $ 250 the next goal

Solana (SOL) offered a promising recovery on Wednesday, as it rose by 4.95 % during the day to restore $ 230. This recovery comes after a series of three -day challenges, which witnessed the decline in the distinctive symbol by 15 %, and weighs due to the total economic uncertainty.

The broader encryption market received a batch after the US Federal Reserve’s decision to stop the high interest rates, providing a wave of optimism over digital assets. Solana’s prices are consistent with this improved feelings, as traders seem to be eager to benefit from his recent decline.

Market data refers to upward feelings

According to TradingView data, the Sol code was opened today at $ 227, as it gathered for a period of $ 238 before settling near $ 232. This step can indicate the formation of a local bottom, which puts the stage for the continuous upward arrangement. Weight derivative market data adds to the upward state.

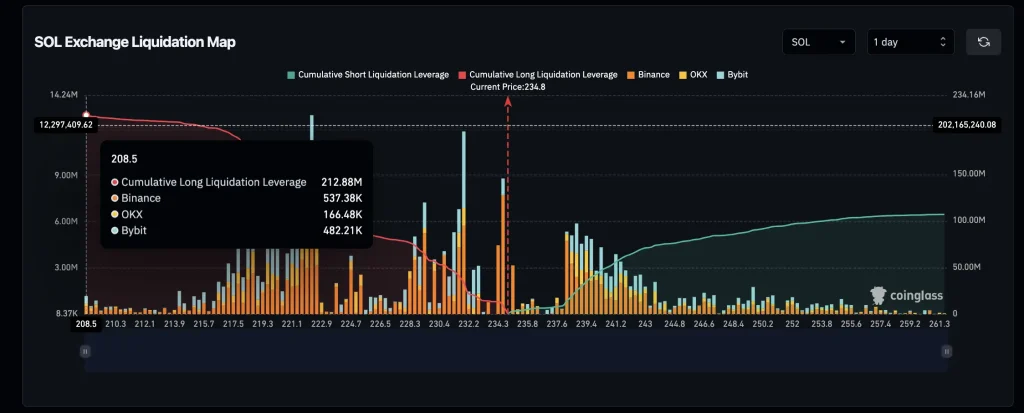

Coinglass filter map Reveal Increasing the long centers tied to the symbol of Solana, with $ 212.88 million in long contracts compared to $ 106 million in short positions. This bullish deviation indicates that long positions represent approximately 66.7 % of the leverage, the increasing confidence among merchants who are betting on more upward trend.

More importantly, when the long leverage rises after a long decrease – as shown in the decrease in the encrypted currency by 15 % – it often indicates a possible bottom. Market makers can benefit from this imbalance by paying high prices to liquidate short positions, adding momentum to an upward step.

The main levels of viewing

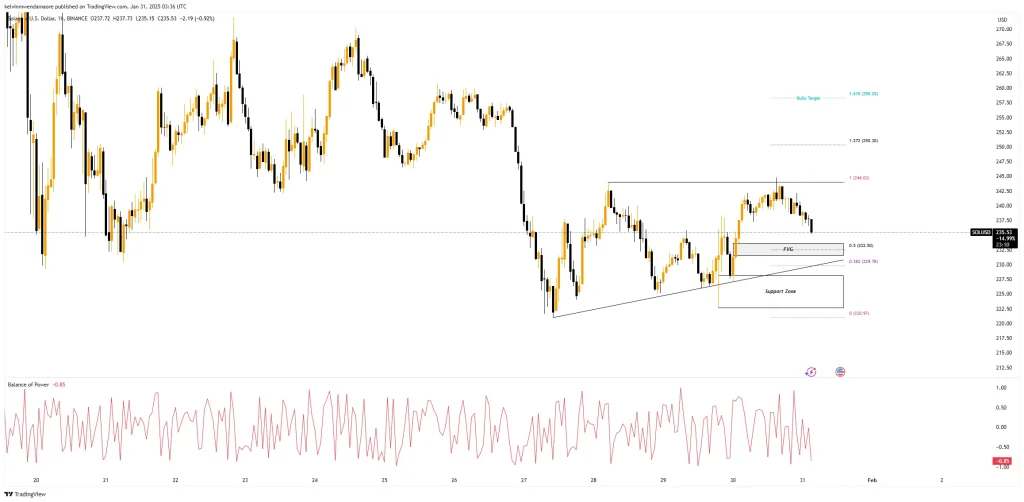

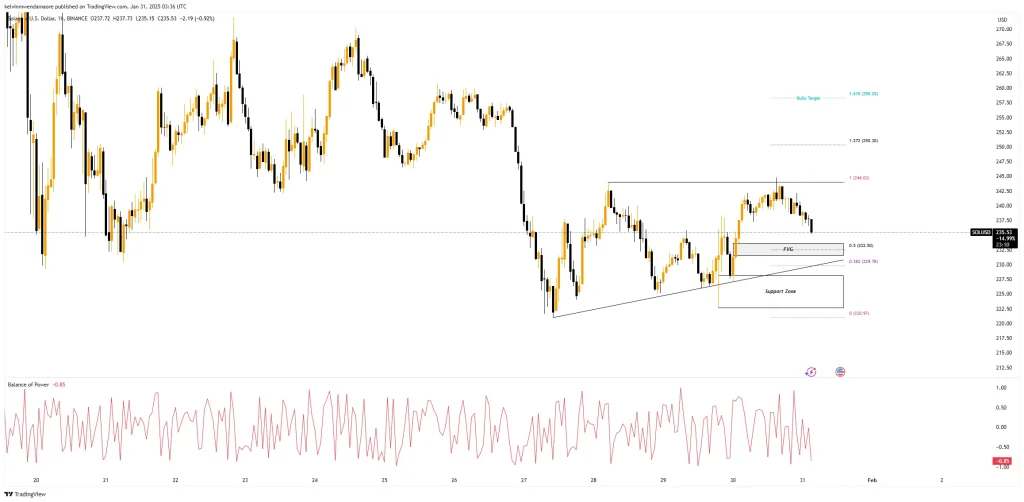

The 52kskow market analyst on Twitter highlighted that the price of Solana is standardized higher than a lower height (LH), which is the decisive level that sparked the recent decrease. The analyst notes that the weekly open recovery near $ 240 is vital for bulls to build a momentum about $ 250.

$ Sol 4h

The constructive chart on what I thinkThe price currently being combined above the previous LH with LED to low oscillation

~ Possible HL DevelopmentAn open weekly note here, a very key to the open recovery because this would allow buyers to create a batch to $ 250

Admission above Vah & … pic.twitter.com/p7wtyr5ahn

– Deviation δ (@52kskow) January 30, 2025

The graph also shows the sound profile, indicating that the Cubel currency value (VAH) and 270 dollars are major resistance areas. A fracture above these thresholds can pave the way for a large conversion.

In low time frames, the Solana symbol is merged after its recent recovery, and it is held over a critical support area ranging from $ 222 and $ 230. This region, which is enhanced by the Fibonacci retreat levels, works as a major defense of buyers and suggests a possible base for more upward trend.

The main technical advantage is the fair value gap (FVG) directly above the support area, which represents the liquidity pocket. If the cryptocurrency remains above this gap, this may lead to a mobilization of about $ 244, which is the following resistance. Breaking this level may pay about $ 250 and perhaps higher to $ 258.

Currently, sellers have slight control, as shown in the Energy Balance Index, but buyers can restore momentum by keeping the main support levels. For traders, watching $ 230 for support and $ 244 for resistance is necessary. The collapse of more than $ 244 will confirm a bullish step, while the loss of $ 230 may risk a decrease in a decrease.

Also read: Bitcoin’s Bull Run Mirors 2015-2018 – Will the date be repeated?