Why cannot Bitcoin break $ 111,000? Whale data has the answer

Bitcoin returned to 105,900 dollars after Israel stopped Iran on Tuesday. However, sudden panic and vinegar of the latest bitcoin whales get more fluctuations in the largest encrypted currency.

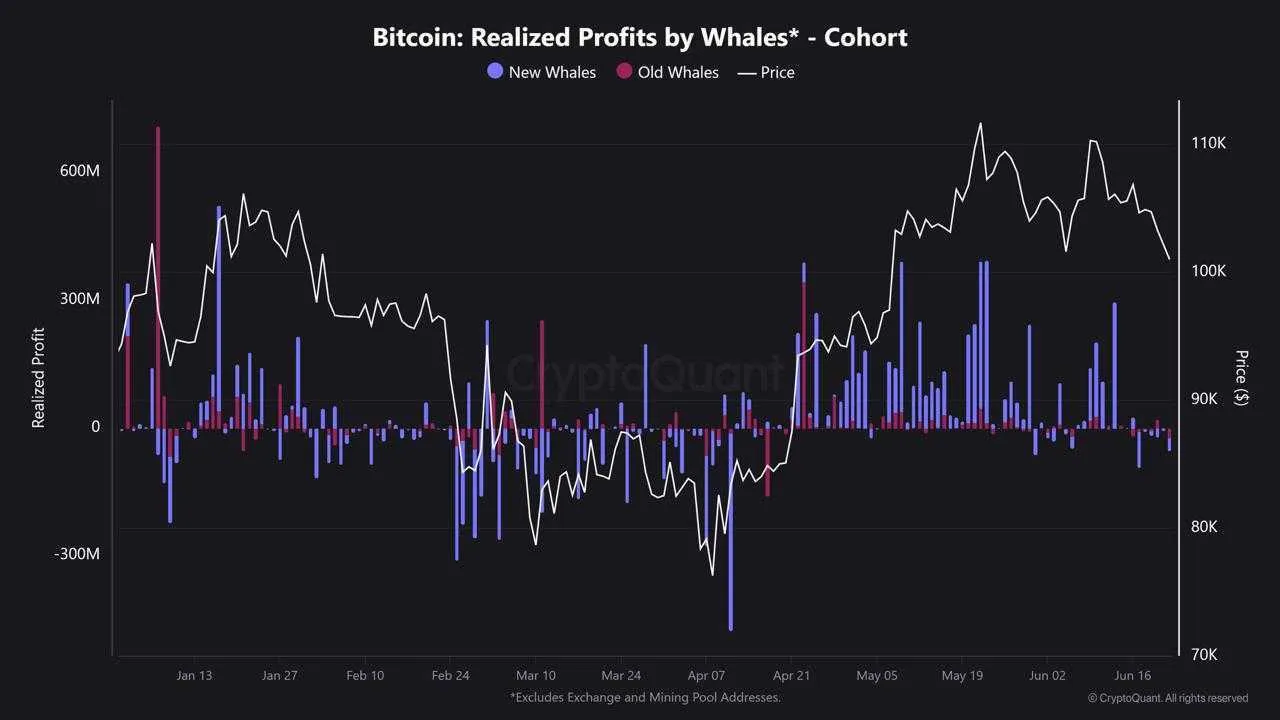

Cryptoquant highlights the large losses achieved by the new whales as a major motor. These investors have sold bitcoin hard under pressure, inflating the market decline.

How the new whales lead the last fluctuations from Bitcoin

Since mid -June, bitcoin has been widely flipped. It started in June near $ 107,000, rose above $ 110,000, and decreased less than $ 100,000.

Between June 14 and June 22, the whales achieved about $ 228 million of bitcoin losses, according to Cryptoquant Analyst Ja Marton. A significant increase occurred on June 17, with $ 95 million losses in one day.

Most of these losses – $ 85 million due to new whales, compared to only $ 8.2 million of older whale investors.

Another noticeable rise appeared on June 22, with a total of $ 51 million, divided equally between new and old whales.

The new whales, which have recently entered the highest price levels, seem more likely to sell amid geopolitical tensions. Its rapid exits intensify price fluctuations and enhance resistance at critical levels, especially near $ 111,000.

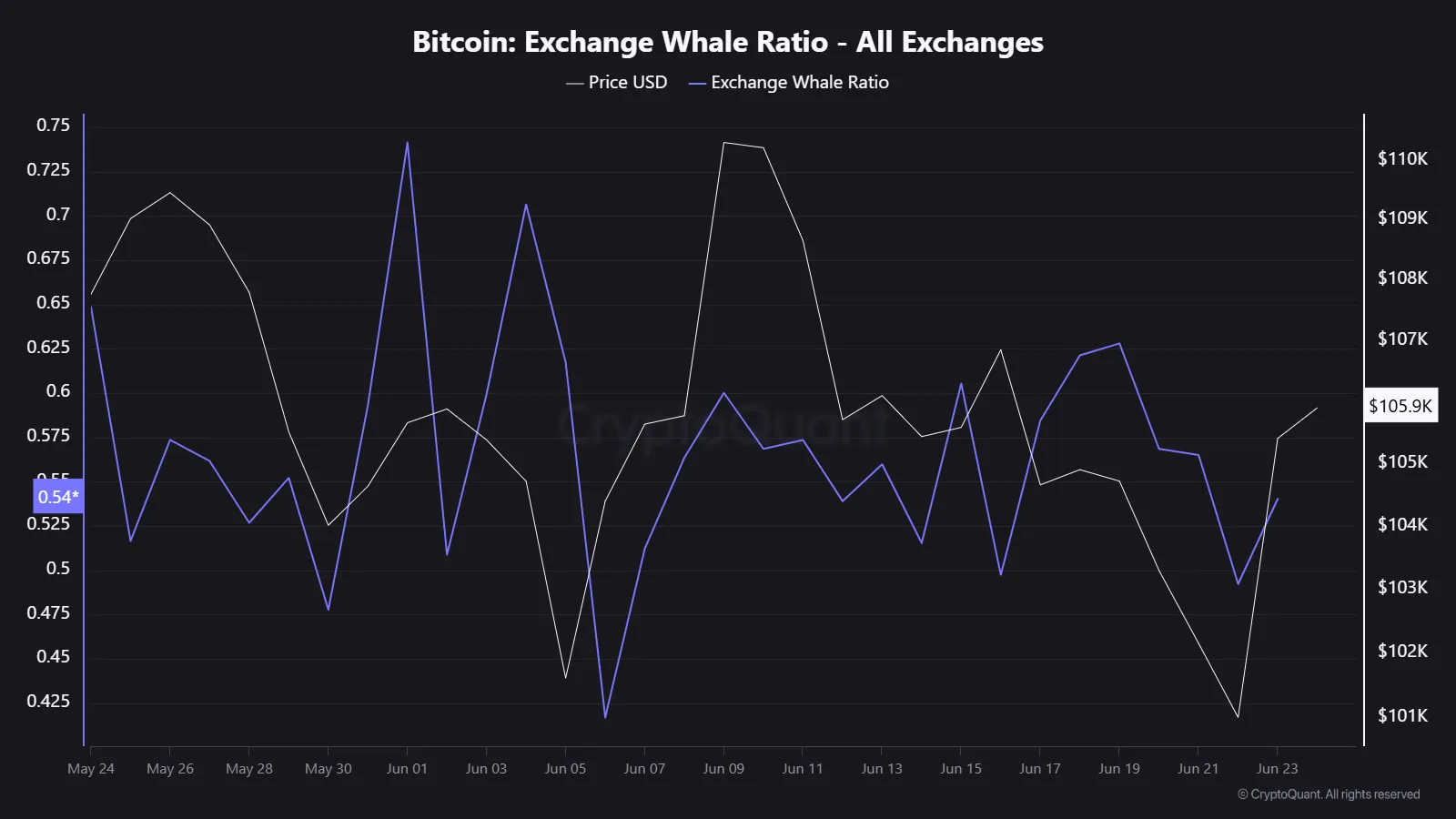

The percentage of exchange whale shows the pressure pressure

More support for this trend, the percentage of the Cryptoquant exchange whale remained high to most of June.

This indicator is a measure of whale activity on exchanges. A high percentage indicates that the whales are deposited with bitcoin activity for exchanges, usually before selling.

Data shows that this percentage rises around Bitcoin’s attempts to break more than $ 110,000. Whales appear to be prepared for sale orders at this level, which limits potential upward momentum.

The percentage decreased shortly when Bitcoin fell to less than $ 102,000, and then rose again when the prices recovered about 105,900 dollars.

This activity indicates that whales constantly manages the risks, creating the pressure pressure and uncertainty in the market.

Geopolitical uncertainty is anxious whale anxiety

Modern geopolitical events-including the Iran war and the declaration of subsequent ceasefire-have increased the nervousness of the market.

The latest investors seem to be a particularly sensitive whale, and they quickly interact with negative headlines.

Such a rapid sale leads to more fluctuations. Reformer traders face margin calls, amplifying low prices and hindering the upscale momentum.

To keep the outbreak above $ 111,000, analysts say that the sale of the whale should facilitate. Low losses achieved and reduce exchange flows will indicate improved market confidence.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.