The withdrawal deepens less than $ 65, as traders cut profits

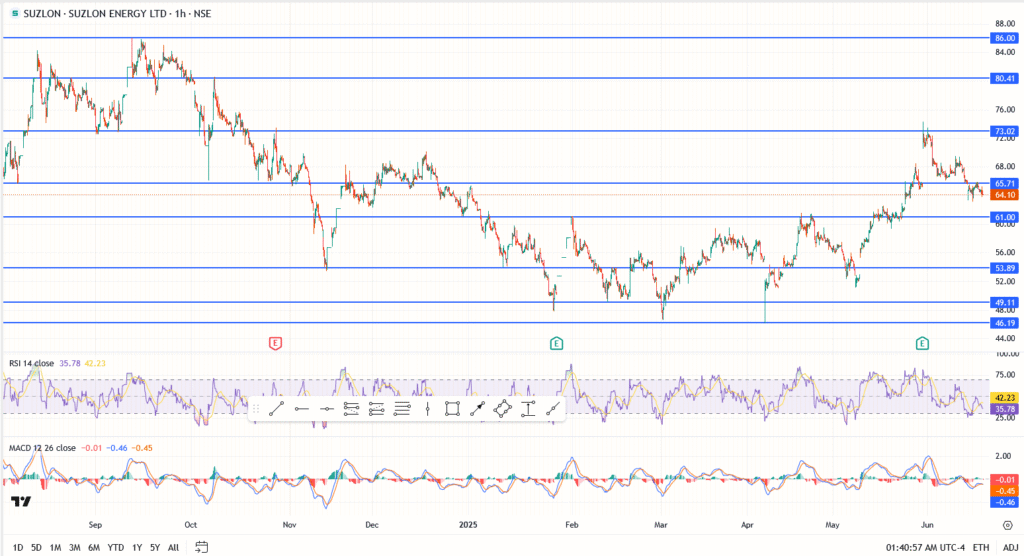

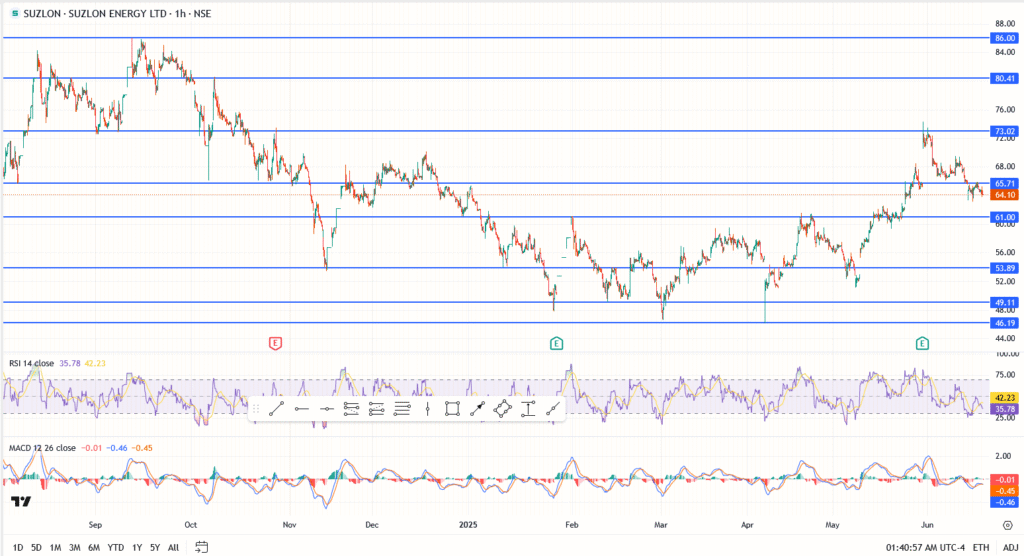

Suzlon Energy (NSE: Suzlon) does not attract a lot of attention to buying this week. The arrow was lastly allocated about 64.10 dollars, just less than this important area of $ 65.70 as the bulls tried to stick. It is not a collapse, but the momentum has clearly dried up. After sharp climbing in April and May, this looks like a market that starts from gas more than any sudden change in the direction.

To date, the decline appears technically. There is no new address. There is no new discount. No bad numbers either. SUZLON numbers for the whole year stand up: 10,871 rupees of Rs.

Why is the price of a STAAM STAM for STAM this week?

This is not the sale of panic, it seems more like tired. Traders who installed the large transition from its lowest level in March. The broader market took a cautious tone this week, and its Suclon gathered, with the shares increased more than 50 % in just two months. Even the bulls will admit that it was due to the break. Moreover, the reduction of last week of Geojit did not help feelings. Yes, the target was raised to $ 77, but the call has turned from “buying” to “accumulation”, which sends a mixed message. It is the type of thing that tends to put traders in the short term to stop.

Suron stock price scheme

- Current price: $ 64.10

- First Resistance: $ 65.70

- Next resistance areas: $ 67.70, then 69.70 dollars

- Immediate support: $ 62.25

- Dearing support: $ 59.90

- RSI: 42 – side bias

- MACD: still shows negative pressure

To date, buyers have not appeared in strength. As long as we stayed straight than $ 65.70, the edge tends to the sellers.

Suzlon prices expectations: healthy basics, but a lack of deficiency

There is no need to panic if you carry Suzlon Energy (NSE: Suzlon) with a long -term vision. The basics of the company are still intact. The debts are almost wiped, the free cash flow is strong, and its 5.6 GW orders book is placed before delegating the new RLM Local content.

What we see now is more likely to reset more than reflection. But price procedures need to confirm this. Unless the bulls can restore $ 65.70 with condemnation, the arrow is likely to remain stuck in a narrow range. Less than 62.25 dollars will turn the tone to shortly in the short term.

At the present time, the price of the stock of Suzlon does not collapse. The basics did not change, but it is clear that the momentum was. Until traders see a new catalyst, this temporary suspension may continue.