Whitebit (WBT) brackets for a symbolic opening of $ 1.19 billion

Whitebit (WBT) enters a critical stage today as it cancels more than 39 million icons of approximately $ 1.19 billion. Unlocked symbols will go to Whitebit boxes, and traders closely monitor any signs of the market reaction.

Despite the size of the event, the performance of the WBT prices left other symbols during the past week. With the major support of the technical indicators and indicators that show monotheism, the coming days will determine whether the WBT breaks up or faces renewable sale pressure.

Whitebit is waiting

Whitebit (WBT) faces a pivotal moment today as it cancels more than 39 million icons of approximately $ 1.19 billion.

The team will allocate the distinctive closed symbols for Whitebit boxes, while traders closely monitor the market for the impact of potential prices or distribution activity.

While WBT has recorded a profit of 6.5 % over the past seven days, this performance is going on the wider market trends and significantly weakened by the main symbols related to exchange. Society is still cautious, as large cancellation openings often bring increased volatility and potential sale pressure.

When compared to her peers, it is clear that WBT is not composed. The Binance (BNB) increased by 10 %, Bitget Token (BGB) increased by 9.4 %, CRONOS (CRO) increased by 15 %, and UNISWAP (UNI) increased by 40 % in the same period. This relative delay indicates that there is no strong momentum or condemnation of the investor before opening.

WBT indicators are a unification signal forward

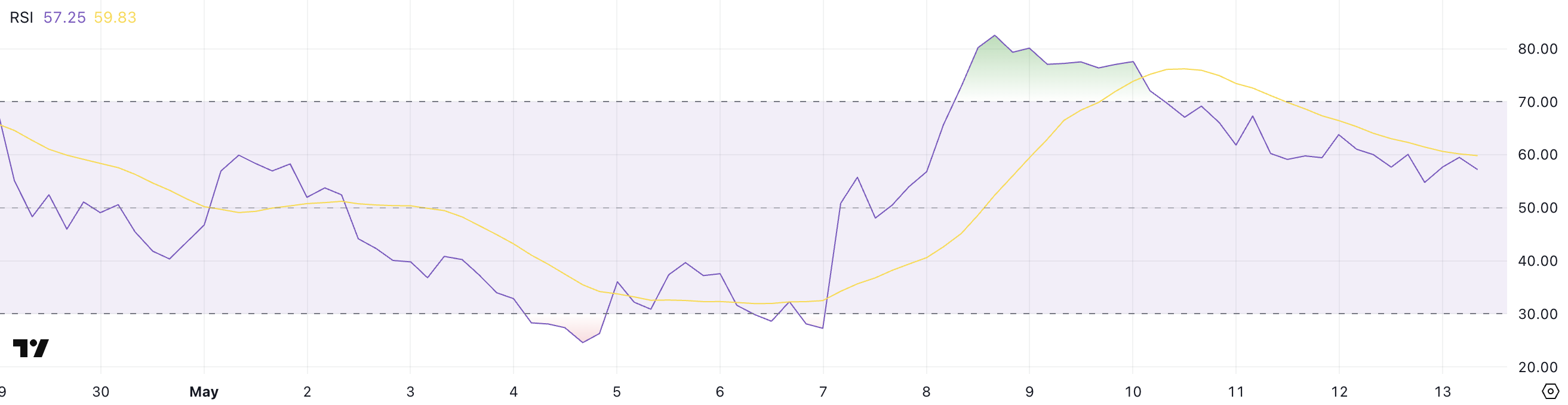

RSI fell from Whitebit to 57.25 from its highest level from 77.57, after staying over 70 between May 8 and May 10. This indicates cooling the momentum before opening the distinctive symbol.

RSI (Relative Power Index) is the momentum index ranging from 0 to 100. The above values indicate that the original has been made, while 30 references may be exaggerated.

At 57.25, WBT is now in a neutral area. This may mean that the last gathering loses strength, but it still leaves room for another movement up if the feeling improved after attention.

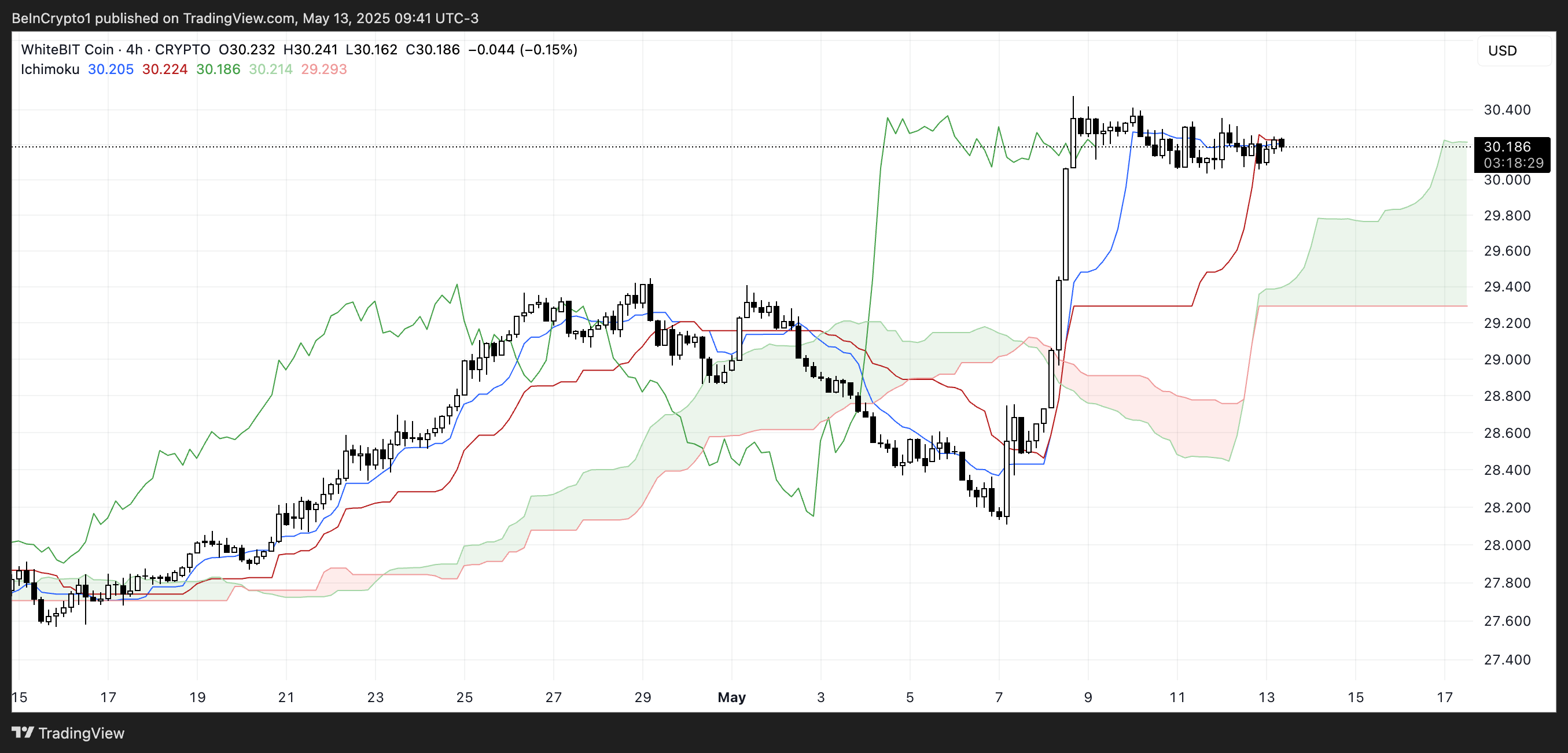

The Ichimoku cloud of Whitebit shows a neutral to slow. The price procedure is currently higher than the cloud, which is usually a bullish mark.

The Blue Line (Tenkan-Sen) and the Red Line (Kijun-Sen) are tightly flat and aligned, indicating the unification and shortage of short-term momentum.

If the price remains higher than the cloud, the trend remains intact, but the decrease in the cloud can convert short -term look in the short term into a neutral.

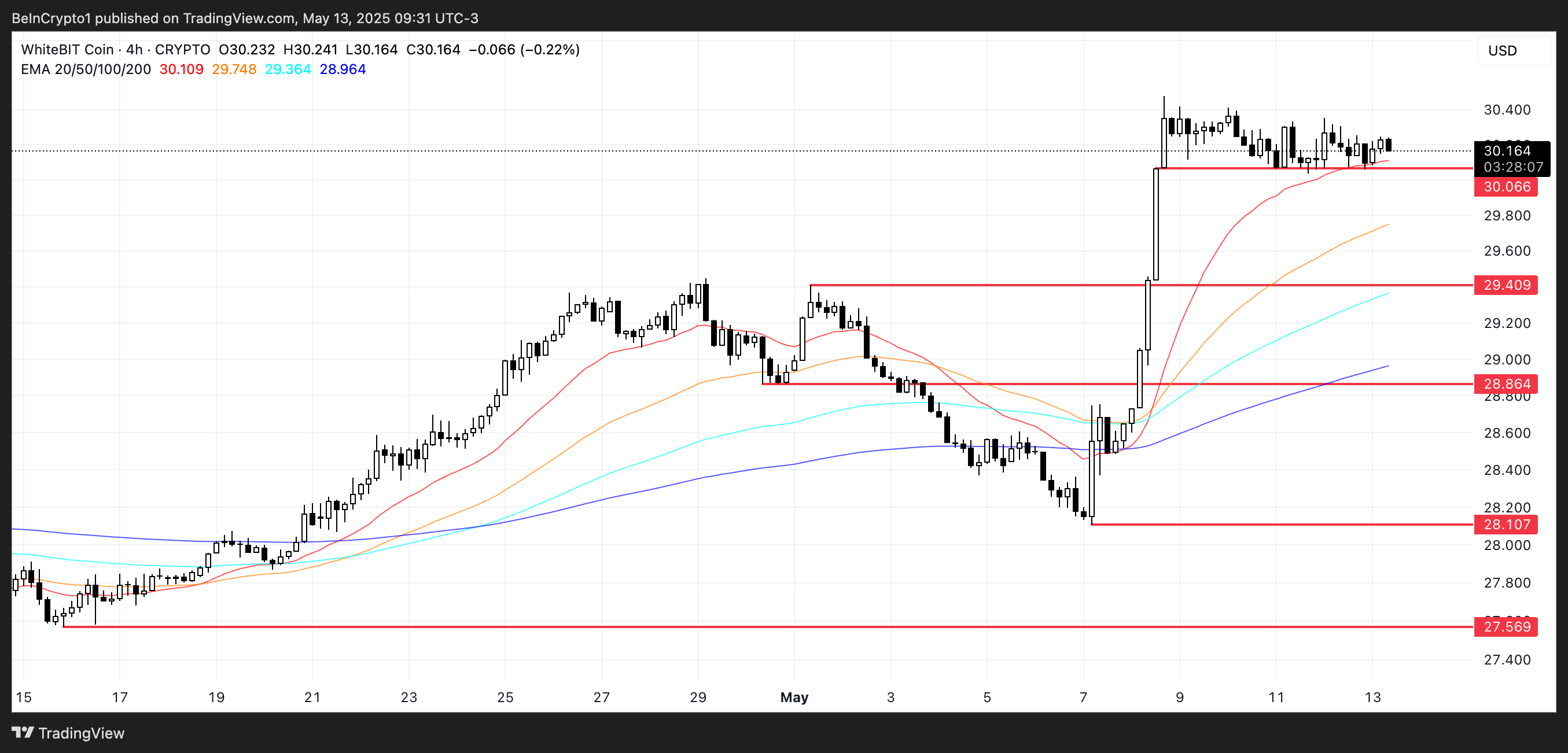

Whitebit holds the main support near ATHS – collapse or collapse forward?

Whitebit is trading near its highest levels ever, and it is constantly attached to the unification of prices for four days. The level of $ 30.06 has been a major support yet, as it has succeeded in retaining the downward pressure.

If this support is tested again and fails, the negative goals include $ 29.40 and $ 28.86, with deeper levels at $ 28.10 and $ 27.56 if the sale momentum increases.

On the upper side, a break above the current monotheism can lead to a new gathering. If the bullish momentum is building, WBT can exceed $ 31 and possibly test 32 dollar.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.