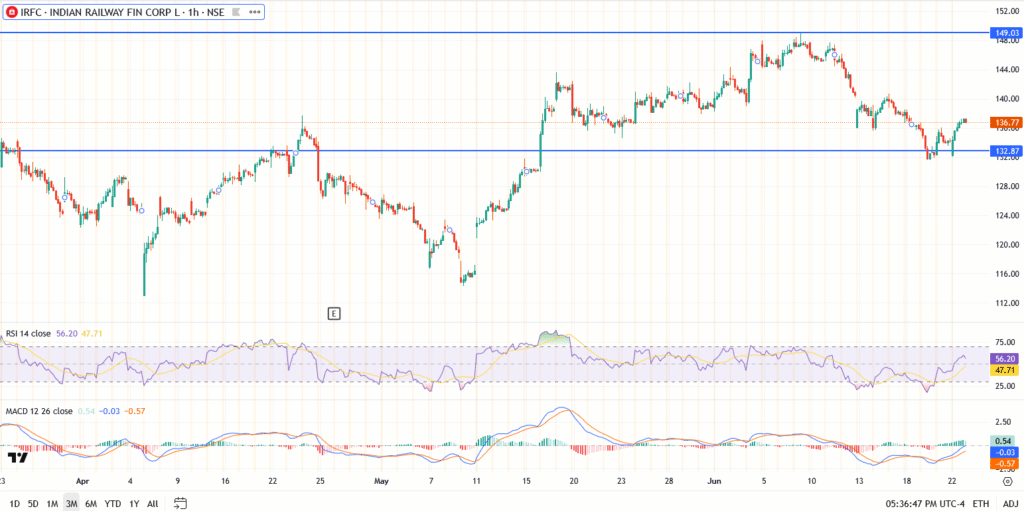

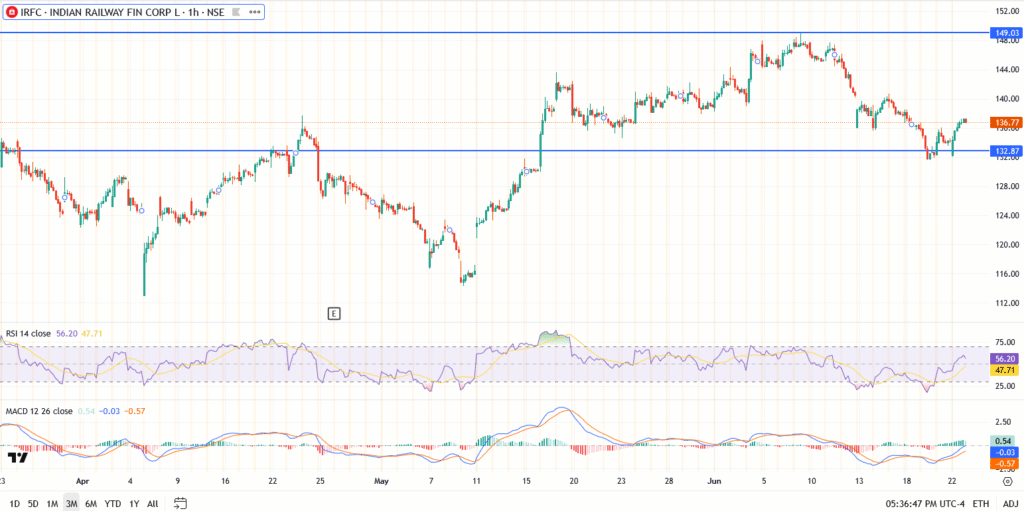

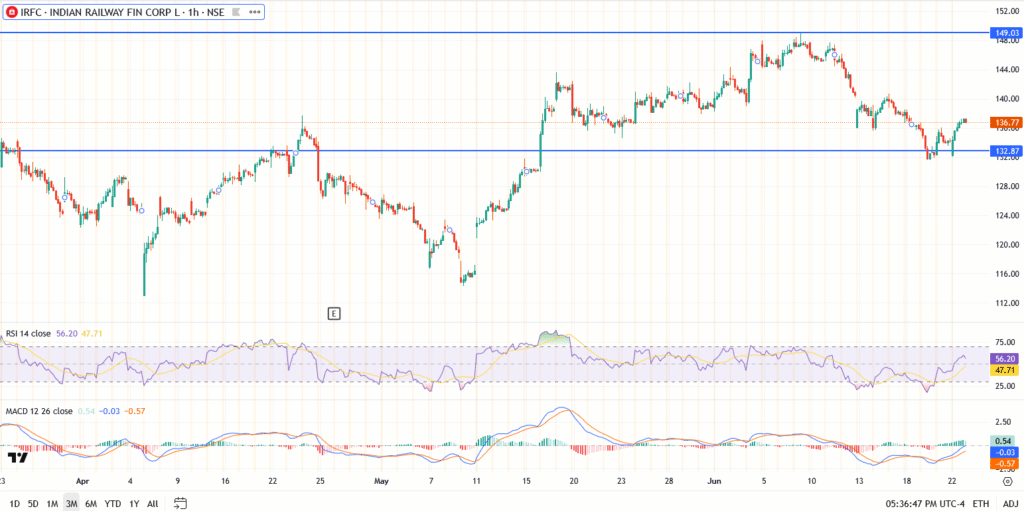

The IRFC share slides to less than $ 137 as the bulls take a break, is this just a temporary stop?

IRFC shares opened the week on the back foot, sliding to $ 133.50 in early trade before returning about $ 136. The stock decreased about 0.5 % for today, and although this may not seem dramatic, the timing is important. Traders were monitoring a break of more than $ 140. Instead, the price stops directly.

This comes after a strong tour in recent weeks, with the support of the government’s railway optimism. But with the absence of a new operator this Monday, the momentum clearly cools.

What weighs on stocks?

The company’s profits in the four quarter were a mixed bag, as the total income was stronger at 6723 rupees, but net profits fell by 1.15 %, which led to the brilliance of some line. Analysts are not aligned as well. Some still see a long -term rise of about 200 dollars, but others decline sharply, and warn of excessive value.

Add to this the fact that modern ads, such as a 60,000 -rupeering donation plan for 26 and NTPC loan with a value of 7500 rupees, has already been digested by the market, and you have an arrow that works on a decrease in fresh fuel.

IRFC share levels to watch

- Current price: 136.77 dollars

- Resistance: $ 140.00 and $ 149.00

- Support: 132.87 dollars, then 128.00 dollars

The relative strength index is held in 56 years, not the peak of purchase, not in the sale. MACD is roaming, but it does not send a clear bullish sign yet. It looks like a temporary stop, not panic.

conclusion

This is not a collapse. It is slowing down. IRFC is still associated with one of the most important infrastructure themes in the government, and the long -term setting has not changed. But in the short term? Traders want fresh fuel. Without it, the stock may be swept away between $ 132 and $ 140 before choosing the direction. Keep it in the monitoring menu, but wait a stronger size before entering.