What happens when you pay to accelerate the encryption treatment?

Links table

Abstract/zusammenfassung

Leaflets

Thanks and appreciation

Chapter 1: Introduction

-

introduction

1.1 Overview of the thesis contributions

1.2 The thesis of the outline

Chapter 2: The background

2.1 Blockchains and smart contracts

2.2 Rules for setting the priority of the transaction

2.3 Determining the priorities of the transaction and the transparency of the dispute

2.4 The decentralized judgment

2.5 Blockchain expansion with layer solutions 2.0

Chapter 3. Rules for setting the priority of the transaction

-

Standards for defining treatment priorities

3.1 methodology

3.2 Standard commitment analysis

3.3 Investigation of criteria violations

3.4 Dark transactions

3.5 final notes

Chapter 4. Determining the priorities of the transaction and the transparency of the dispute

-

Determine the priorities of the transaction and the transparency of competition

4.1 methodology

4.2 on the transparency of the competition

4.3 on the transparency of priority

4.4 Final notes

Chapter 5, the decentralized judgment

-

Decentralization

5.1 methodology

5.2 attacks on governance

5.3 Carrier’s governance

5.4 final notes

Chapter 6. Related work

6.1 Rules for setting the priority of the transaction

6.2 Defining the priorities of the transaction and the transparency of the dispute

6.3 The decentralized judgment

Chapter 7. Discussion, restrictions and future work

7.1 Treatment arrangement

7.2 transaction transparency

7.3 The voting force distribution to amend smart contracts

conclusion

\

Pursuit

Appendix A: An additional analysis of the standards for defining the priorities of transactions

Approach B: An additional analysis to determine the priorities of transactions and the transparency of the dispute

Approach A: An additional analysis of the distribution of the voting force

index

Approach B: An additional analysis to determine the priorities of transactions and the transparency of the dispute

B.1 Special ETAREUM Treat

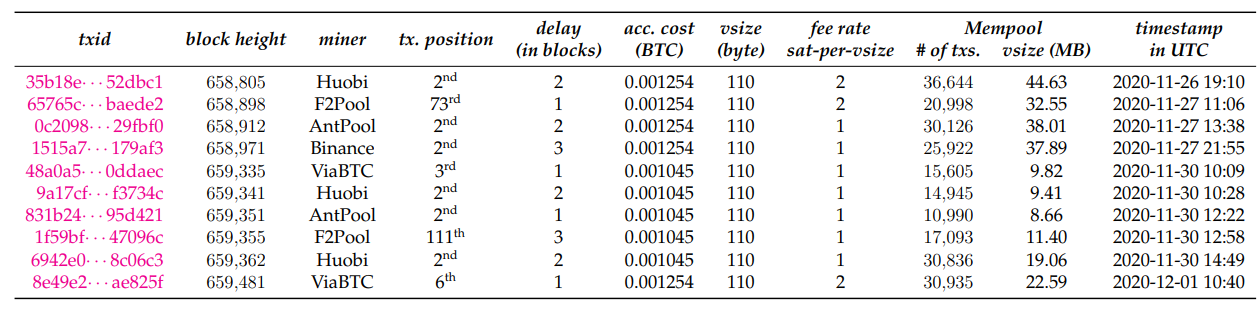

We conducted 4 active experiments as we released 8 ETHEREUM transactions; Half publicly released and the other half through a special channel network known as Taichi Network (Sparkpool, 2021). B.1 table summarizes transactions in our experience. Spark Pool and Babel Pool included all special transactions (two transactions for each of them) were sent directly to these miners through Taichi.

B.2 liquidation with chainlink Oracle updates

In AAVE, of 1154 packages, 994 (86.14 %) includes the One Lainlink Oracle update followed by filter. There are 52 (4.51 %) with two Oracle updates followed by filtering. Of the 1301 complex Oracle updates with filtering, 282 (21.68 %) are USDC-ETH, 203 (15.60 %) is USDT-eTH, 169 (12.99 %) is Dai-eth, 70 (5.38 %) is Susd-He, and 6.61 % (4.61 %) is the link. In the compound, of 641 packages, 548 (85.49 %) contains onlink Oracle, followed by one filter, while 39 (6.08 %) includes two oracle updates followed by references. Of the 751 ophlack updates with references, 311 (41.41 %) are ETH-weD, 128 (17.04 %) are BTC-weD, and 53 (7.06 %) are UNi-weD.

\

\

B.3 mining gathering rates

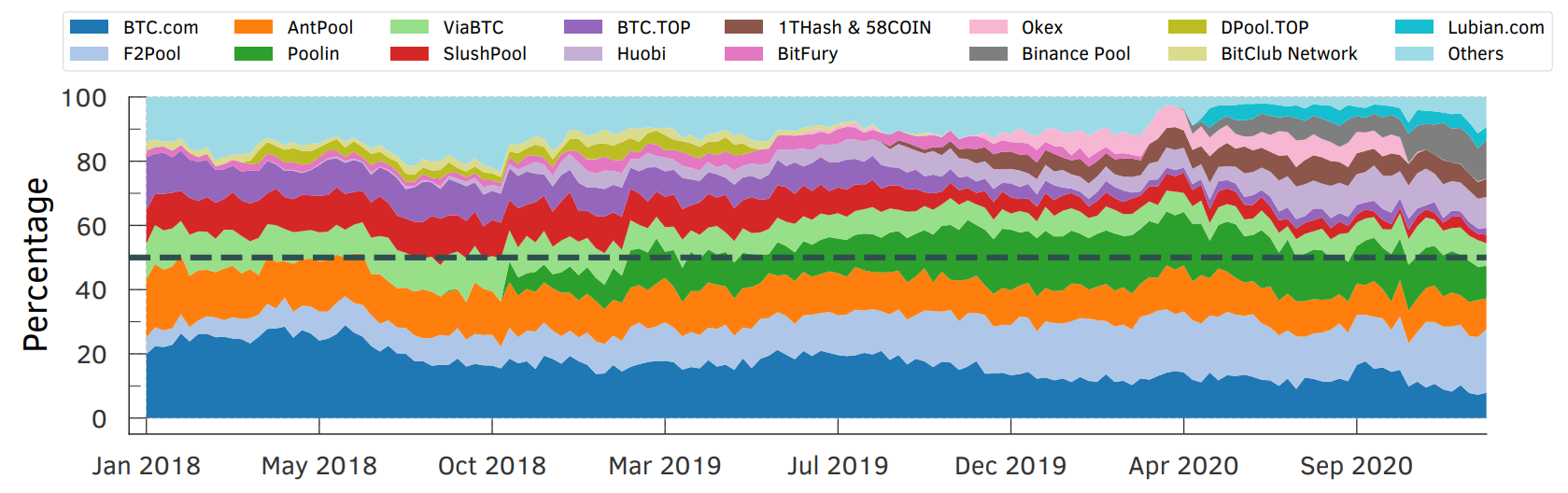

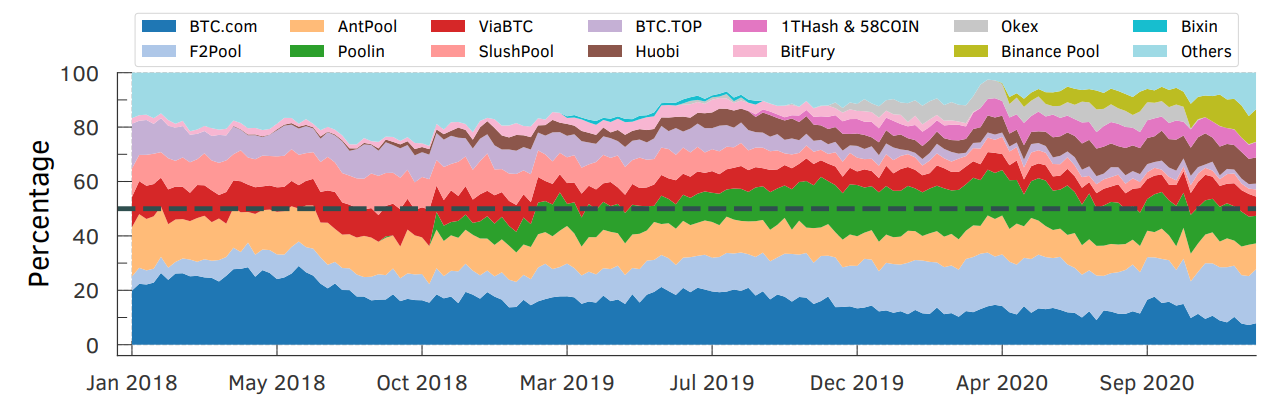

In Figure B.1, retail rates for Bitcoin mining complexes such as BTC.com, F2Pool and Antpool alone formed nearly half of the retail rate in May 2018, and nearly a year later, for example, from March 2019, along with billiards, the four mining pools alone account for more than 50 % of the network division rate. At the end of 2020, the new MPOS started, for example, Lubian.com and Binance Pool, Bitcoin Mining, helping to improve decentralization in Bitcoin. However, BTC.com, F2Pool, Antpool and Poolin still represent nearly half of the retail rates that show that some mining pools control a large part of the Bitcoin retaliatory rate.

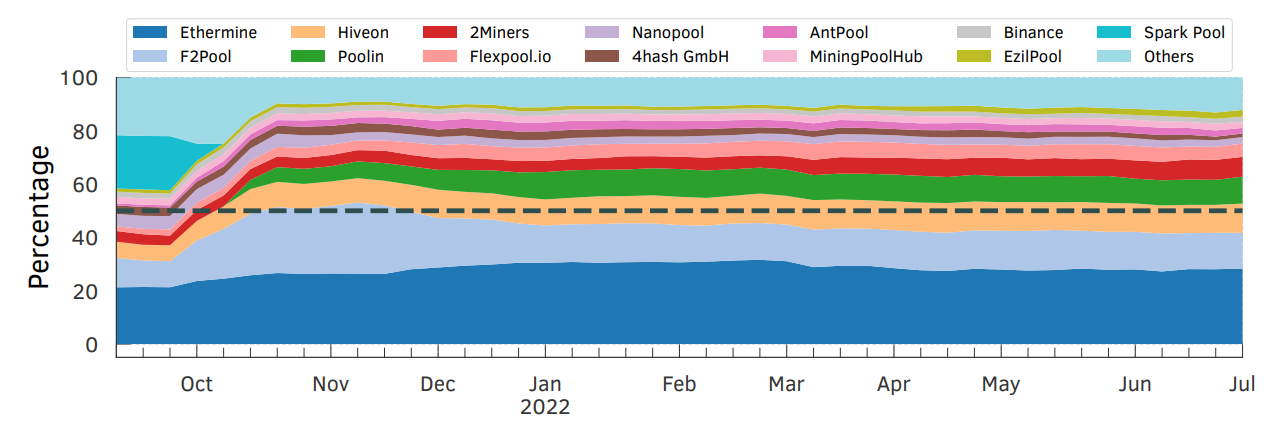

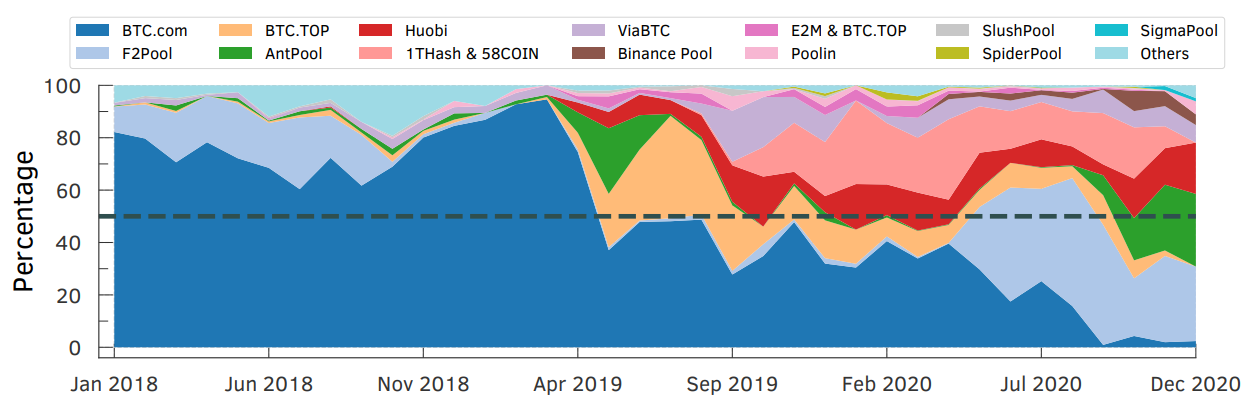

\ Retail rates from ETHEREUM mining gatherings, unlike Bitcoin, do no Show high contrast (see Figure B.2). We also noticed that Park Pool, the second largest group of ETHEREUM mining, was suspended on September 30, 2021, due to regulatory requirements in response to Chinese authorities (Helen Partz, 2021).

\

\

B.4 Experiment to accelerate Bitcoin treatment

We managed an active bitcoin treatment experience as we paid 205 euros to VIOBTC (VIOBTC, 2022) to accelerate 10 transactions from 10 different shots of our MEMPOLL. To determine these transactions, we have achieved whether Mempool has been crowded (that is, more transactions awaiting more than the following block will be able to include), with at least 8 MB size. After that, we only looked at the low-price transactions of the fees-less or equal to 2 SAT-Per-Belte-to ensure that these transactions are unlikely to be included soon in a later block. After that, we have sorted the remaining transactions by size to reduce the cost of the experiment as the acceleration service costs are suitable for the volume of the transaction. Finally, we choose the transaction with the smallest size in the byte for our active experience.

Most of these ten rapid transactions are included in almost the next block, indicating the efficiency of acceleration. Also, these transactions were incorrect

\

\ Of the non -institutional transactions, which indicates that miners have already given them (see Table 4.3). Moreover, we noticed that although we only sent accelerated transactions via VIOBTC, I also participated in other mining gatherings in confirming accelerating transactions.

B.2 table shows the transactions used in our experiences. At a time when we conducted our experiences, if we classify miners who included these transactions based on their daily strength of the retail rate such as (d) and strength with the weekly retail rate (W), we will have Huobi (D: 8.1 %; W: 9.3 %), Binance (D: 9.6 %; W: 10.3 %), F2POL (D: D::: 19.9 %; 12 %;

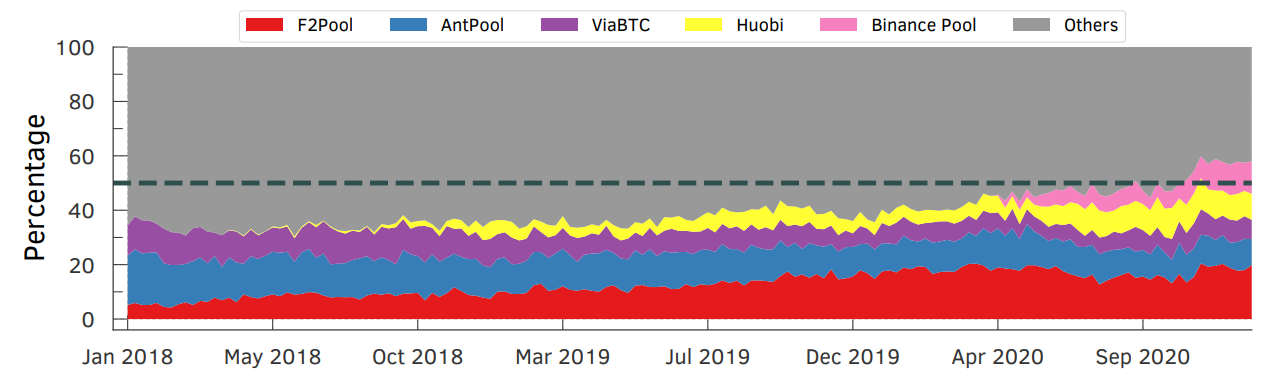

\ Moreover, BTC.com (BTC.com, 2022), one of the leading Bitcoin mining gatherings, provides transactions speeding services and allows users to verify whether the transactions have been accelerated through their platform or partners services. From our data collection, we have chosen those who have a SPE larger than or equal to 1 % (12,983,282 transactions in total) and verified if it is said that it is accelerated by the BTC.com Application interface. Of these transactions, 14,104 have been accepted. The results we find also shows that transactions acceleration services have become very common among Bitcoin mining pools (as shown in Figure B.5). Between 2018 and April 2019, only BTC.com and F2Pool alone formed most of the accelerating transactions. However, as of December 2020, we see that BTC.com explains a very small part of accelerated transactions, with the Antpool, Huobi and F2Pool account for most accelerated transactions.

\

\

\

:::information

author:

(1) Jonnatan Messenger Peixoto Affonso

:::

::: Information about this paper Available on Arxiv Under CC by 4.0 verb license.

:::

\