What happens every year after half?

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Bitcoin (BTC) also enters The third quarter (Q3) from 2025The bullish feelings grow, nurtured by historical patterns after the half that has been distinguished and repeated with the beginning Explosive market movements. The encryption analyst now refers to the repeated trends observed in the previous sessions, where the Q3 was often a launch platform for large BTC prices after each year in half.

Bitcoin post -year -in -year point to the explosive Q3

Luka, the formerly (Twitter) encryption expert, has multiplied the expectations for a large bitcoin price in the next quarter. he Argue The expected monotheism expectations in bitcoin, based on the fruits and market behavior that was seen in 2023 and early 2024, fail to calculate a critical worker: 2025 is a After a half years.

Related reading

analyst It indicates Consistent pattern observed every year after half all the time Bitcoin history. In his planned analysis on June 26, Luka notes that the third quarter of these years has constantly showed strength, with no historical precedent for weakness, which enhances the issue Al -Shamali collapse.

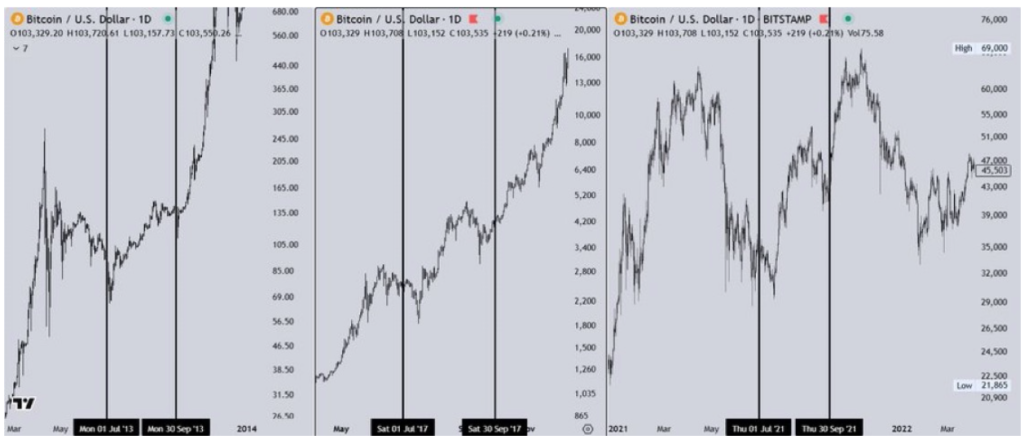

The chart compares the performance of the Q3 during the years after the year 2013, 2017 and 2021. In each case, Bitcoin entered the third quarter with a moderate or corrective price, only to gather significantly in the weeks that followed.

The left panel of the graph in 2013 appears after half, as Bitcoin moved from less than $ 100 in July to more than $ 680 in November. In 2017, the middle painting shed light on a similar path, as BTC erupted from less than 2800 dollars in the early third quarter to more than $ 16,000 by the end of the year.

The last session in the year 2021, which appears on the right plate of the plan, witnessed a ram for the Q3, which took Bitcoin from less than $ 39,000 in July to the previous one. The highest level ever exceeds $ 69,000 in November.

It is worth noting that Luca confirms that this consistent historical behavior is not by chance, expecting that a similar gathering can be revealed in the current session, during the next few months. While it is Confess the The possibility of short -term withdrawalAnd it confirms that the bitcoin market structure is still firmly optimistic, with a momentum still prefers more upward trend.

The analyst predicts $ 140,000 – higher than $ 160,000 bitcoin

Moving forward, Luka’s scheme reveals the technical factors that are in line with its upscale thesis. Based on the main levels of Fibonacci, the analyst Projects Which – which Top next session of BTC It decreases between 140,000 dollars and 160,000 dollars, which is a goal Secure It can be achieved at the end of Q3.

Related reading

While recognition that the exact goal can turn depending on how technical technologies develop, the expectation of the Bitcoin gathering remains imminent. With BTC is now trading about 107,423 dollars after a recovery from the previous Less than $ 100,000 declinedA possible transfer to $ 140,000 or even 160,000 dollars would represent a large profit of about 30.35 % and 48.97 %, respectively.

Distinctive image from Unsplash, tradingvief chart