What do you expect the Bitcoin price (BTC) in June?

Bitcoin has witnessed a large rally over the past month, which represents the highest new level (ATH) at $ 111,980. This important price increase raised questions about the sustainability of bitcoin momentum, which is moving to June.

While some investors are optimistic about more gains, others ask whether the price will cool or if bitcoin holders will take a more careful path.

Bitcoin investors are heavily acquired

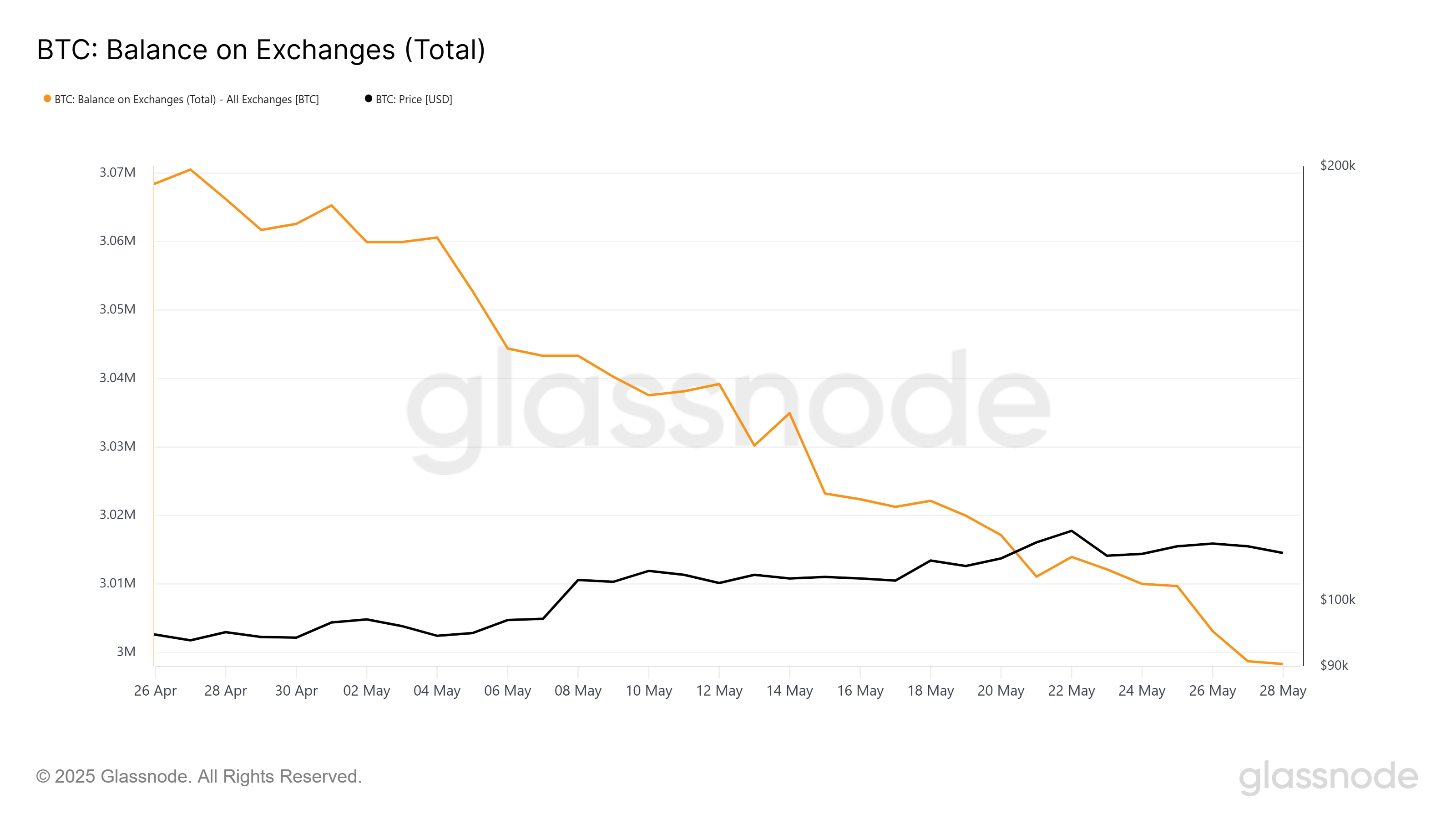

The morale in the market is currently moving in Bitcoin a strong accumulation. The balance on the stock exchanges decreased by 66,975 BTC, at a value of more than $ 7.2 billion, indicating that investors transfer their holdings of stock exchanges and private portfolios. This significant decrease in bitcoin indicates the exchanges of increased confidence in assets and faith in a greater increase in prices.

The motivation behind this accumulation is partially driven by FOMO (fear of loss), where new investors rush, but are also supported by a growing condemnation of Bitcoin’s long -term capabilities. However, Juan Pelic, Vice President of Search at Centora, recently discussed with Beincrypto how the factors that exceed the simple accumulation have affected the increase in bitcoin prices.

“Investors are formed to reach the risks in this spring through a narrow range of macro currents that all move in the direction of“ loaded financial conditions ”at one time. Inflation slides, and the dilution of central banks remains on the table, and also includes a risk that there is a risk forming, includes risk and also.

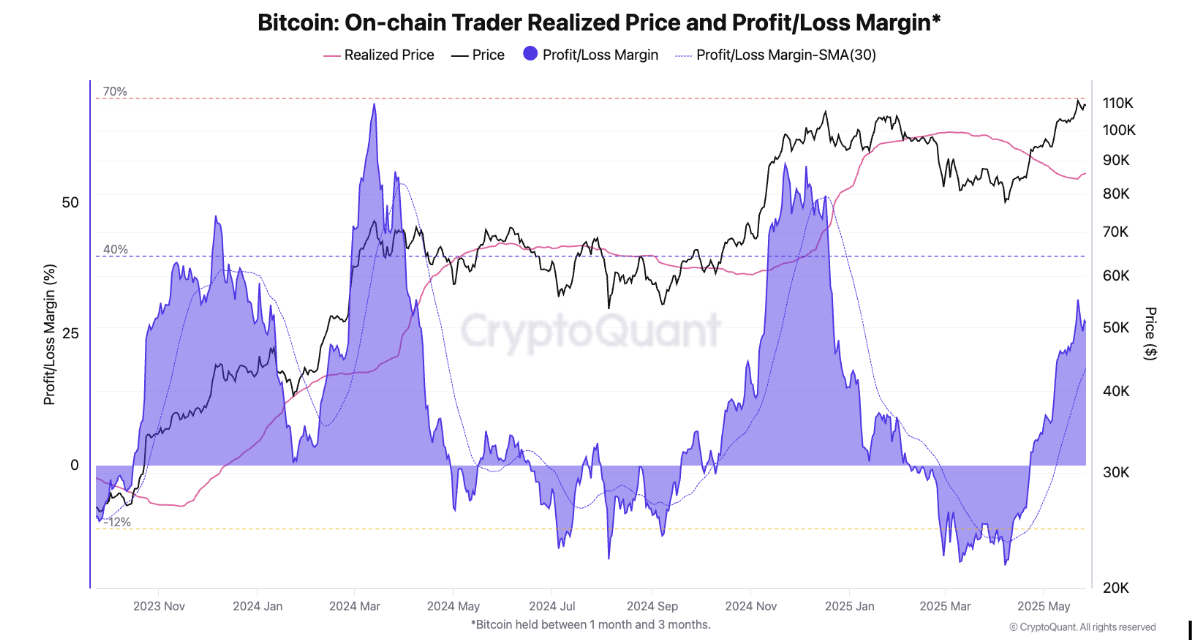

The data on the series reveals major indicators indicating that the macro bitcoin momentum is still strong. The trader on the series realized that the prices and the margin of profit/loss were conflicting, indicating that Bitcoin investors, especially those who bought 1 to 3 months ago, sit on large, unrealized profits. This data helps measuring the investor’s behavior and indicates that many of them still keep, and expect more prices.

Giulio Moreno, head of research at Cryptoquant, discussed with Beincrypto how the increasing profits between these short -term pregnant people can threaten Bitcoin.

“In the short term, there may be some profits from merchants because their unreasonable profit margins approach to feverish levels about 40 %. See the graph in which we appreciate the profit margin in the chain of Bitcoin merchants that reaches 31 % in the past few days (the purple region),” Moreno mentioned.

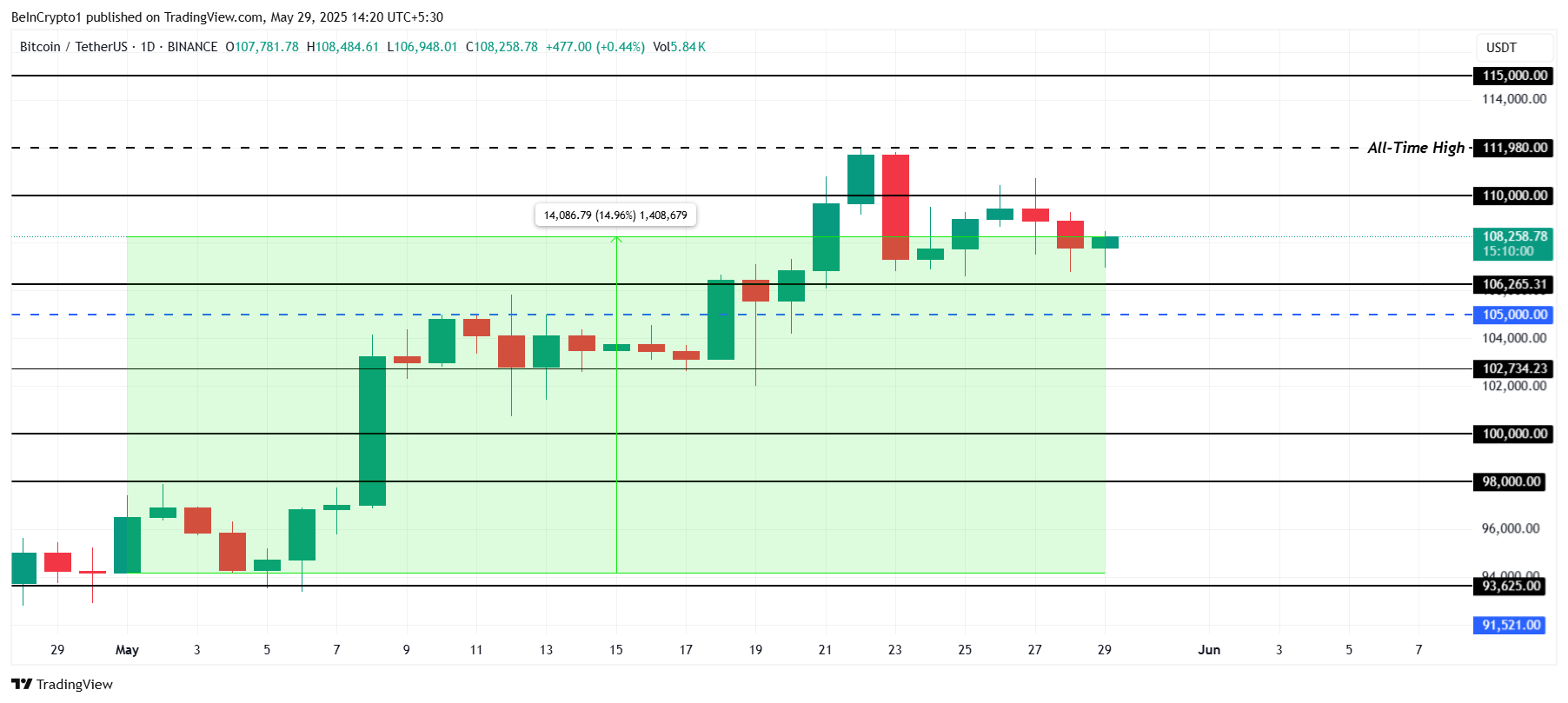

The BTC price aims to the highest new level

Bitcoin price increased by 14 % during the month of May, reaching the highest new level ever at $ 111,980. Bitcoin is currently trading at 108,258 dollars, as it tests the resistance level of $ 110,000. The next few days will be crucial in determining whether Bitcoin can keep its momentum.

If accumulation continues at the hands of institution holders and retail holders in June, the price may maintain its emerging direction.

Moreover, the “sale in May and going” strategy has proven ineffective for stock markets over the past year, as markets continue to rise despite the seasonal direction. Bitcoin’s association with stock markets, especially in light of the total economic conditions, indicates that it may continue to experience an upward momentum until June. Looking at the flexibility of Bitcoin, it is likely to push up in the midst of uncertainty in the broader market.

The Bitcoin price can eventually violate $ 110,000, proving it as a strong support level before exceeding ATH to target $ 115,000. However, if the profit is intensified, Bitcoin may face correction. Although the acute stagnation seems unlikely, Bitcoin may face some unification before continuing its upward direction, with support levels at 102,734 dollars and 106,265 dollars, providing the temporary store.

The post what can be expected from the Bitcoin price (BTC) in June? He first appeared on Beincrypto.