What do you expect from ETHEREUM price in June 2025?

After Bitcoin increased to the highest new level ever in May, Altcoin Ethereum witnessed a renewal of commercial activity, and briefly traded at a multiple two -month peaks of $ 2789 on May 29.

However, with the wider market cooling over the past two weeks, the ETH price movement has been tightened and unified within a narrow range. Nevertheless, market analysts remain wide on a large scale on ETH prospects for the month of June.

Etherum Outlook’s look turns into a climb with increased ETF institutional flows

In an exclusive interview with Beincrypto, Temujin Louie, CEO of Wanchain, said that ETH expectations for this month are “increasingly thunderbolt”, driven by the flowing flows in ETHEREM (ETFS) and the stability of the renewable network.

“Continuous investment in Ethereum Etfs indicates that institutional interests are still strong, which enhances the credibility of ETH as a long -term origin. The last Pectra upgrade from Ethereum was a great success, and that internal conflicts within the ETHEREUM Foundation may have been calm; investor confidence in both Ethereum as a network and ethy as a reservation origin.”

Moreover, Dominic John, an analyst at Kronos Research, emphasizes this optimism, focusing on the growing effect of ETF flows on the currency prices. According to John:

“ETH ETFS has greatly formed modern price actions, indicating an increase in institutional attention that enhances market liquidity with dual fluctuations. This wave of demand, associated with strong basics such as Stablecoin power and solid signals on the chain, tightening supply and supporting constant attention.”

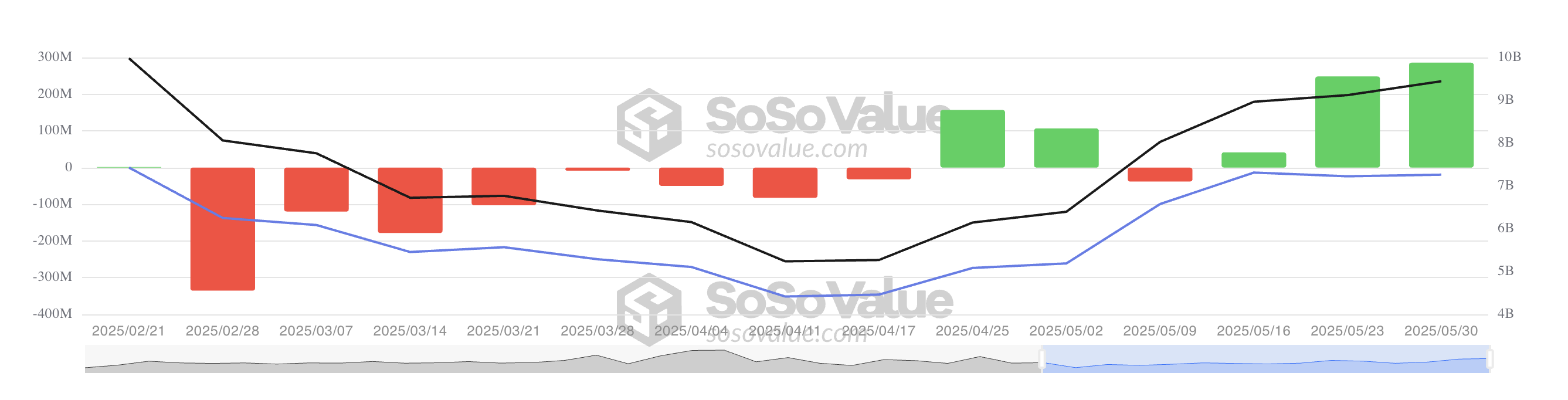

According to Sosovalue, the ETH -backed investment funds have seen an increase in weekly flows since May 16. This week, the total net flows in these investment vehicles amounted to $ 286 million, highlighting the increasing confidence among institutional investors.

If this continues, it may create upward pressure on the price of ETH, which leads to a break above its narrow range in June.

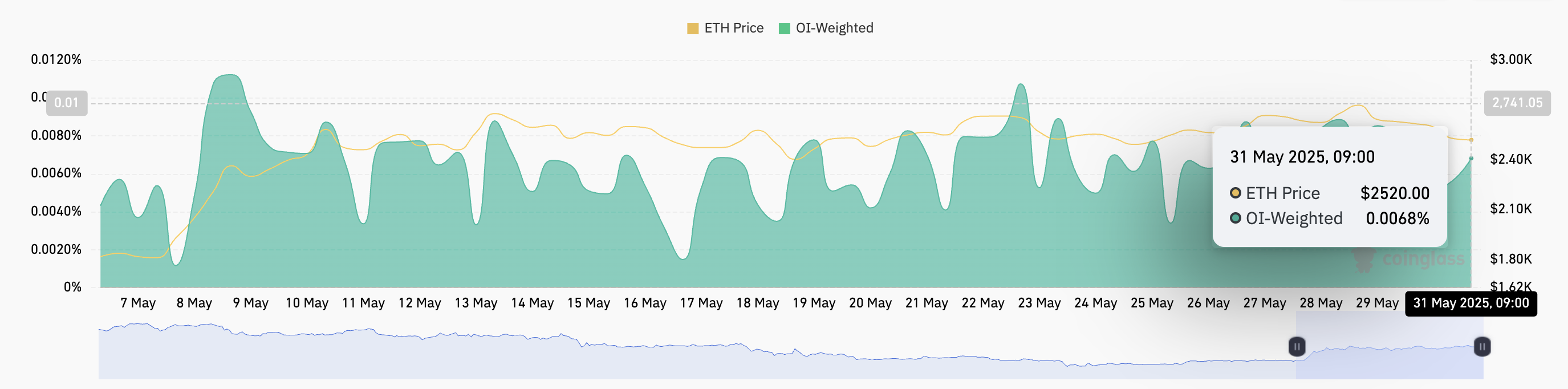

In addition, the positive financing rate of ETH supports this upward view. As of this writing, the ETH financing rate sits 0.0068 %, reflecting the continuous confidence of merchants who want to pay a premium to maintain their long jobs.

The financing rate is used in permanent future contracts to ensure that contract prices are compatible with the immediate price of the asset. When the asset financing rate is positive, traders pay long positions those who hold short positions. This indicates that the market morale is rising, as more market participants are betting on increasing prices.

ETH’s continuous positive financing rate is in line with important institutional flows to ETH -backed investment funds. Another layer of emphasizing that the market participants are putting in a position of more upward trend in June.

There is hunting

Despite ETH ups in June, these analysts warn that the conditions of the wider macroeconomic economy can pose risk of the short term performance of the original.

Louis stressed that although ETH basics are still strong, the pioneer altcoin “is still vulnerable to macroeconomic conditions.”

“Despite the current upward momentum, the encryption market as a whole remains a speculative, and the inflation data is sharply responded, interest rate expectations, federal reserve policy transformations, and other external factors. While ETHEREUM’s basics are still strong, short -term prices can quickly reversal by stray macroeconomic trends.”

John also added that the next FOMC meeting in the Federal Reserve on June 17 is one to search for it.

“The wider overall trends, especially inflation data and the FBI policy, remain a pivotal price. The permanent axis can enhance ETH, especially with sustainable ETF flows. However, the hawks’ position may continue in fresh fluctuations, even with the presence of stablecoin dominance, the return of the return, and growth continues to grow in indicating that the strength in bacteria.

With ETH June entering with increased optimism, investors must see the macroeconomic signals closely, as the ETH price path is likely to form in the coming weeks.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.