What can be expected from the price of XRP after a rippal suit

XRP collects after SEC brought down a lawsuit against Ripple, which led to a 13 % price increased over the past 24 hours. Supports strong technical signals and increasing participation in the upscale momentum.

XRP activity also strikes record levels, with active addresses to the highest new levels. With traders digesting legal victory and positive market signals, XRP expectations are enhanced, which increases the chances of more bullish trend in the short term.

XRP DMI appears buyers in full control

The XRP DMI chart reveals a noticeable transformation in the momentum, with the ADX (the average trend index) to 20.4 from 15.64 after the news stating that the Supreme Education Council is declining a lawsuit against Ripple.

This indicates an increase in the direction of the market strengthening, as ADX tracks the total power of the direction without specifying its direction.

The recent increase indicates that the price procedure acquires a condemnation, especially since the market aims to positive legal developments surrounding the ripples.

ADX is often used along with Di and -Di +indicators, which help determine the direction of the direction. ADX usually emphasizes higher than 25 strong directions, while values that are less than 20 indicate a weak or group market.

In the case of XRP, Di +jumped from 18.3 to 39, while -Di decreased from 19.63 to 12.97, indicating a clear upward deviation.

This sharp height in the purchase (+DI) force supports along with weakening the Habbudian sign (-DI) the idea that XRP tries to maintain its upward and possibly direction. If this dynamic continues, you may see more bullish trend in the short term as it builds the upper momentum.

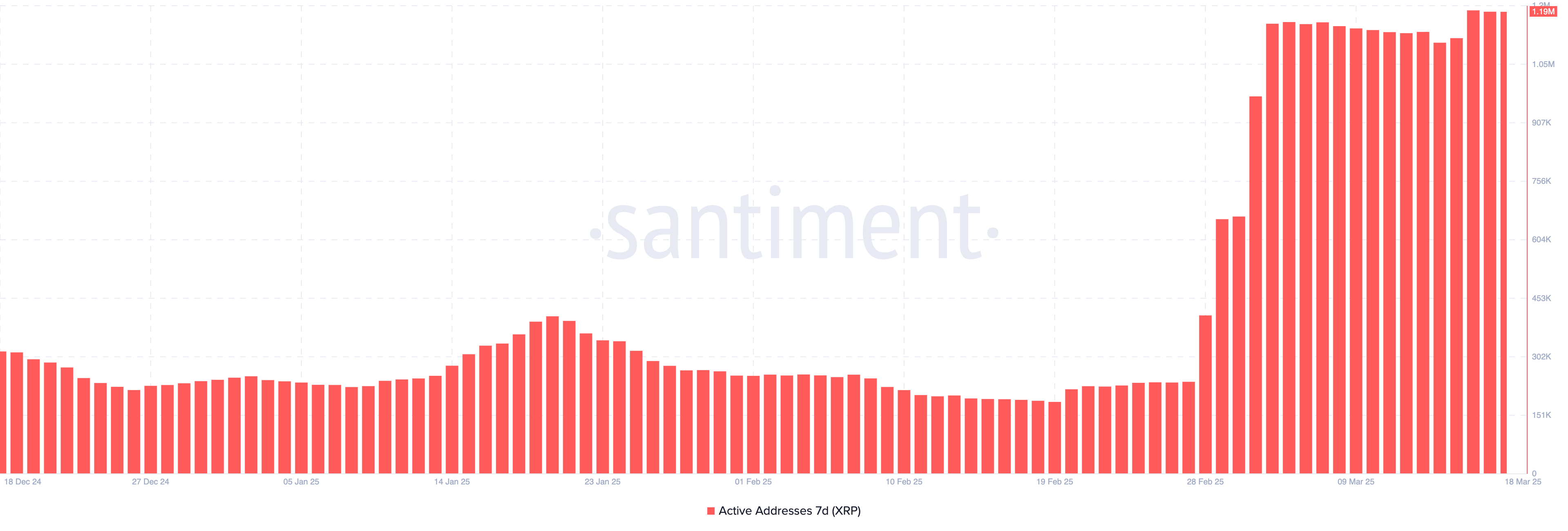

XRP active headlines reach new records

The XRP network has increased, as the number of active headlines has reached 7 days the highest level ever at 1.19 million. This is an enormous increase in 237,000 registered on February 27, which represents an almost five times a few times in a few weeks.

The rise in the active address indicates that XRP Blockchain is witnessing an increasing participation, whether from retail merchants, institutional players or speculative interest.

These high levels of activity are rarely seen and can indicate the interest and use of the increasing network.

Tracking the number of active addresses is very important because it provides an insight into the user’s sharing level and real demand for Blockchain.

In general, the increase in active headlines can indicate that more participants deal or interact with the network, which are often associated with stronger liquidity and exceeding prices. In the case of XRP, this increase in the activity can work as a bullish sign, which alludes to increased attention and possibly renewable capital flows.

Although it does not guarantee an immediate estimate of prices, this strong network share can help support the price of XRP and reduce the risk of the negative side, especially if the technical or other basic factors are associated.

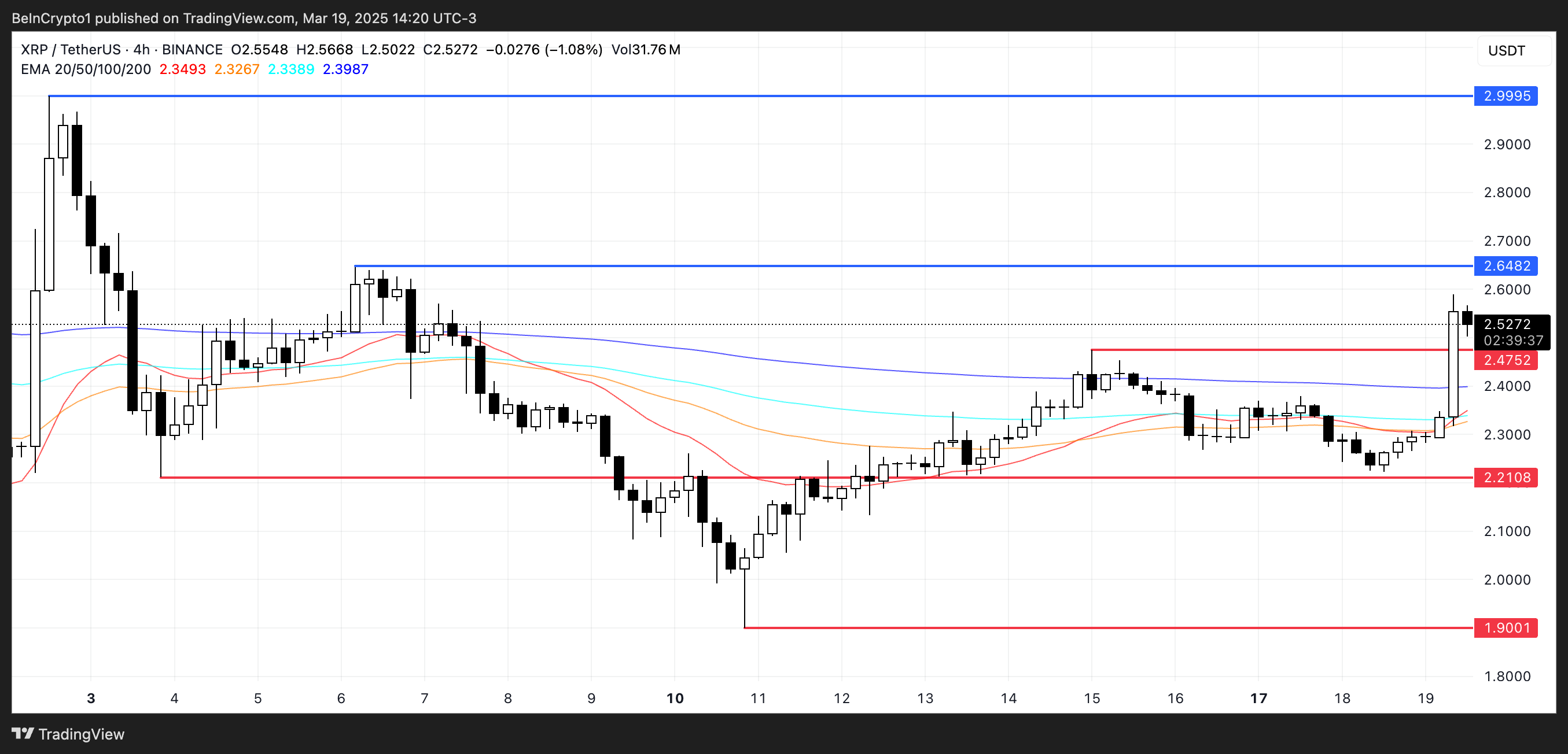

Can XRP reach $ 3?

EMA lines currently refer to a new golden cross soon.

If this scenario is revealed, the XRP price may first challenge the resistance at $ 2.648. If the purchase of momentum increases its enhancement, the price may pay about $ 2.99, which may exceed the barrier at $ 3.

On the contrary, the renewed declining trend can form if the difficult momentum fails to achieve it and the XRP price conflicts to keep it above its current range.

In this case, the main support level at $ 2.47 will become clear. The collapse below this XRP threshold can be offered for more negative risks, a $ 2.21 test and may lead it to $ 1.90.

Disintegration

In line with the guidance of the confidence project, this price analysis article is for media purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always perform your research and consult with a professional before making any financial decisions. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.