Weekly encryption summary: 7 % bitcoin decrease

It was a volatile week for Bitcoin as he fought to stay over $ 100,000 amid macroeconomic pressure.

The total market value of encryption decreased to the levels that were last seen in November.

This week alone, nearly 12 % decreased, reaching $ 3.38 trillion in the late Asian trading hours on Friday.

The professions adopted a cautious situation, which was reflected through the fear and greed index, which decreased 32 points of intense greed levels last week to enter the fear area in 44 when writing.

Altcoins has seen one of their worst weeks since the start of the bull race after the elections, with only one of 99 assets that managed to close the week in the profit.

What happened with Bitcoin this week?

Bitcoin hovers between $ 92,876 and $ 105,480 this week, as Bulls has repeatedly tested the psychological resistance of $ 100,000 three times but fails to penetrate, while maintaining the price less than six numbers.

Near the beginning of the week, a global trade war resulted in US President Donald Trump traders, which increased volatility.

The declaration of customs tariffs has sent shock waves across the market, which contributed to a sharp drop in Bitcoin to $ 92,460.

The disturbances reached their peak in the largest liquidation event on the date of encryption on February 3, as it wiping over $ 2.24 billion in height positions within 24 hours.

Although the price that was quickly recovered as Trump agreed to delay the definitions, Bulls failed to get more than $ 100,000 as new US recruitment data is added to uncertainty.

The stronger jobs numbers expected-183,000 jobs added in January, re-thinking about the next step in the Federal Reserve, while they abandoned the hopes of price discounts anytime soon.

Traders were also disappointed after David Saks, Trump Caesar Caesar, took the American digital assets strategy, but they did not stop confirming any plans to store Bitcoin.

By the end of the weekend, the fluctuation was defeated as the market awaited the report of non -agricultural salary statements, which came in weaker than expected.

The economy added 143,000 jobs in January, after the expected decrease 170,000, a significant decrease from 256,000 in December.

After the report, Bitcoin managed to restore $ 100,000 for a short period, as traders speculated that the more expected job growth could reduce the pressure on the federal reserve to maintain high prices.

What is the following for Bitcoin?

On February 7, analyst Miles Deutscher indicated that the flow of net Bitcoin exchange has reached its lowest level ever.

These signals usually indicate that more BTC transmits exchanges, as investors are likely to choose to keep it instead of selling.

The low exchange balance can reduce immediate sale pressure, which historically supports the stability of prices and a potential upward package.

Many of the purchase pressure came from whales, and Deutsher described the scenario as “transferring wealth from weak to strong hands.”

Bitcoin can be prepared in its next leg if Bulls can transfer a level of $ 102,000 in support, according to the Daan Crypto Trades.

Long -term forecast for Bitcoin said it is still positive for Bitcoin Bitfinex analysts in a recent report.

However, the possibility of short -term fluctuations driven by macroeconomic pressure was not excluded.

When writing, Bitcoin was traded at $ 98,116, a decrease of 7 % this week.

The slow week of countries

The Altcoin market fell more than 18 % this week, reaching $ 1.3 trillion. Bitcoin remained dominant power, with the Altcoin season index decreased by 20 points to 34.

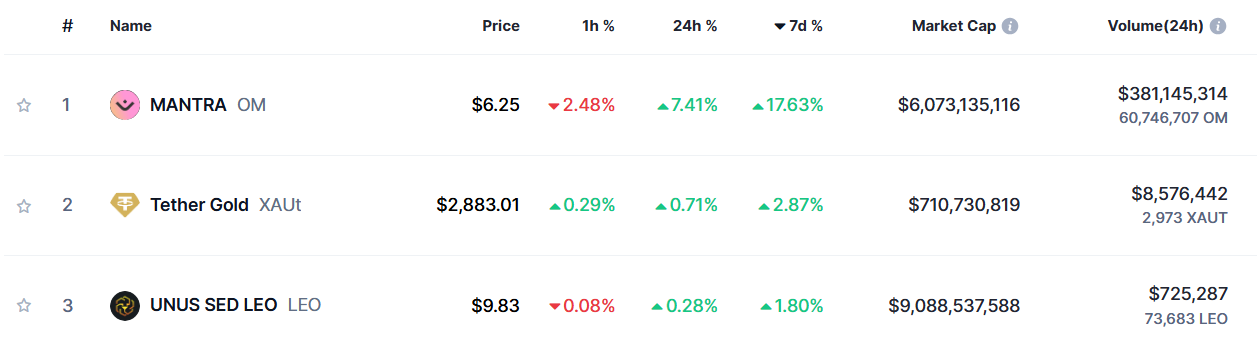

When writing, Mantra (om) was the only altcoin that recorded prominent gains, although the market was recovering.

OM has gathered 17.8 % over the past seven days, as it has led the gains among the 100 largest encryption origins in the market.

By the end of the week, the market ceiling rose more than $ 6.1 billion.

The cryptocurrency that focuses on RWA has also increased by 4000 % over the past year, making it one of the best coins among the 100 largest encryption origins depending on the maximum market.

source: Coinmarketcap

Most of the gains came with the continuing talisman of main players in the encryption space, including the republic, gain, and gain, as a bunch of a talisman series, and its dedication to the distinctive symbol of the assets in the real world.

Moreover, the network also benefited from partnership with DAMAC, one of the largest real estate companies in Dubai, which plans to distinguish more than a billion dollars from its real estate property on a talisman chain.

The most prominent of the most prominent other or non -gains this week has witnessed.

source: Coinmarketcap

The post Weekly Crypto Recap: Bitcoin decreases by 7 %.