Distinguished code is distinguished while the whale manipulates Trump Ukraine on Polymarkket

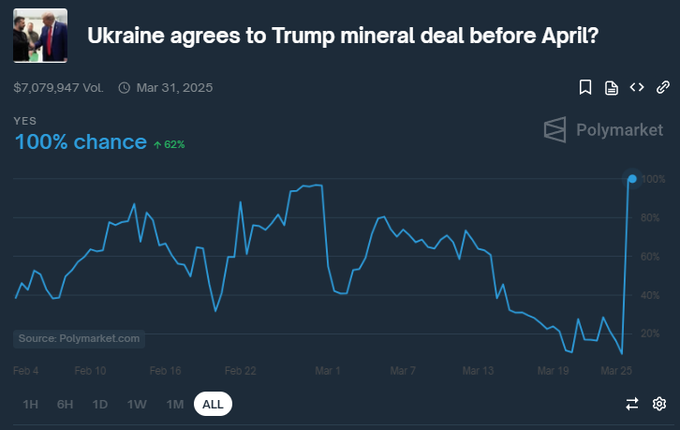

The decentralized prediction platform suffers from polymarket in a fire amid the manipulation of the market, which includes a bet of $ 7 million.

Users expect whether Ukraine will sign a metal deal with the United States before April.

Meanwhile, the chances of “yes” results increased intensively to 100 % between March 24 and 25.

The wonderful jump occurred despite the validity of the agreement.

Details show that a large UMA holder uses 5 million icons (about 25 % of the total voting power) to influence voting results through several accounts.

Meanwhile, she was forced to manipulate the results of “Yes”, with the whale of Oma, a large profit net.

Polymarket confirmed that the whale falsified the results, but he kept the victims that he would not respond because “it was not a platform failure.”

Polymarket base does not retract

Polymark policy has sparked not to retreat, as many criticized the betting platform.

Users expect recovery as the losses involve the manipulation of the market.

However, Polymarket states that governance mechanisms, which were working as designed, affected the result, not the technical defect.

We realize the situation related to the rare Ukrainian land market. This market has been resolved against the expectations of our users and our clarification. Unfortunately, since this was not a failure in the market, we are not able to make the recovered amounts.

One user believes that the accident goes beyond the issue of governance because it revealed the Oracle Integity disaster.

The manipulative step sparked a discussion about Oma’s governance where whales can determine the results of the vote.

The event can be pushed to UMA and other Blockchain to review their governance models to prevent such exploits.

ABED trusts in the Spropia vote will resolve governance issues.

He criticized the vote based on the distinctive symbol as whale control decisions, which led to bluger.

Spring voting includes the distribution of voting powers evenly by making additional votes more expensive.

Such an approach would prevent wealthy players from influencing the results.

Some believe that polymarket should provide safety mechanisms like strict challenges of high -risk bets and one user vote.

However, these incidents reveal obstacles related to the budget of transparency and decentralization.

Polymark’s treatment reflects the need to enhance governance protocols that prevent the use of the user while maintaining the basic principles of Defi.

Oma price outlook

Altcoin kept climbing amid pollarkket controversy.

It gained more than 3 % over the past 24 hours to trade at $ 1.42.

The prevailing performance in UMA reflects the revival of the wide wide market.

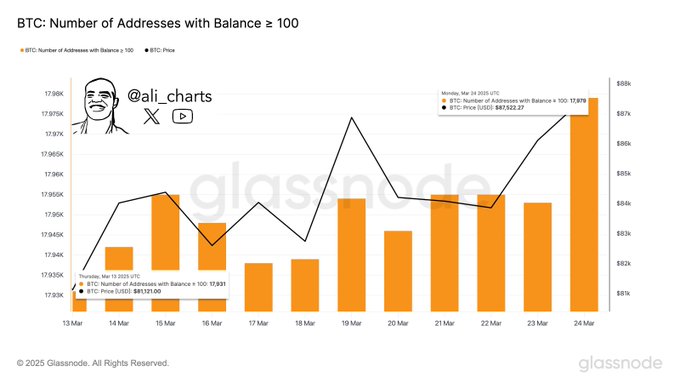

Bitcoin is trading $ 88,000 while closing the decisive obstacle at $ 90,000.

Renewable signals from new investors on a large scale indicate confidence in the continuous BTC storms.

Analyst on Chart (quoting Santiment) noted that 48 new portfolios carry more than 100 Bitcoin origin.

Great accumulation by whale entities alludes to biological moves in price procedures in the near term of Bitcoin.

The broad base gatherings are likely to absorb the expected UMA fluctuations and support the fixed height.

Expectations show the distinctive POST UMA symbol while the whale manipulates Trump Ukraine’s vote on Polymarket first on Invezz