WBC ELLIOTT wave analysis and Eliott Wave expectations [Video]

![WBC ELLIOTT wave analysis and Eliott Wave expectations [Video] WBC ELLIOTT wave analysis and Eliott Wave expectations [Video]](https://i3.wp.com/editorial.fxsstatic.com/images/i/Equity-Index_S&P500-1_Large.jpg?w=780&resize=780,470&ssl=1)

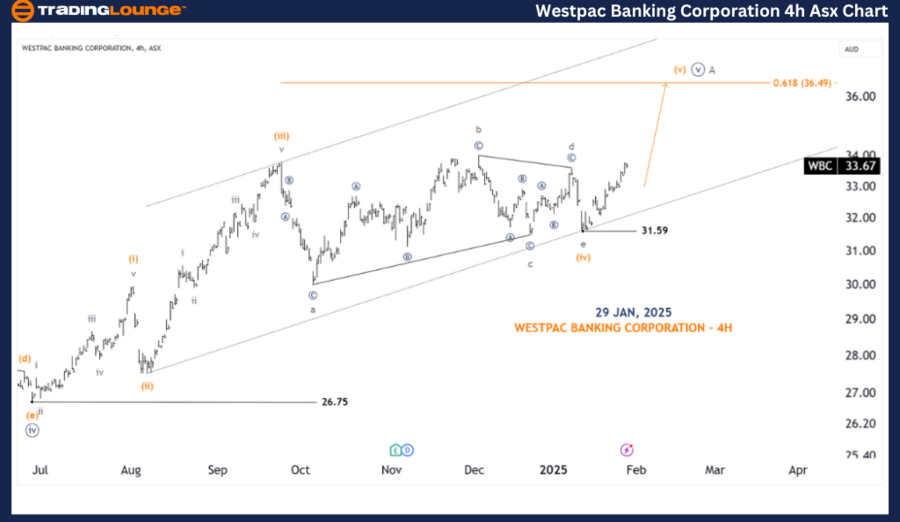

Asx: Westpac Banking Corporation – WBC Elliott Wave Technical Analysislound.

Greetings,

Today’s Elliott WAVE wave analysis provides an updated view of the Australian Stock Exchange (ASX) that focuses on Westpac Banking Corporation (WBC).

Our analysis indicates that ASX: WBC may have completed a triangular style, indicating an upward movement. This evaluation also sheds light on the main price levels to help traders determine whether this scenario remains valid, and when it is nullified, and when the direction of the bullish confirmation appears.

WBC (1D scheme, semilog scale)

-

job: The main trend (micro -marine).

-

situation: Motivation.

-

building: batch.

-

position: Wave (T) – orange from the wave ((T)) – the marine.

details:

Our analysis determines a triangular pattern, where the fourth wave was recently completed at 31.59. This setup follows the orange wave (V), which has begun to be revealed in an upward direction. The target price is expected to reach about 36.49 or high, such as the upper edge of the channel.

In order for this scenario to remain valid, the price must remain above 31.59.

WBC (4 -hour graph)

-

job: The main trend (small degree, gray).

-

situation: Motivation.

-

building: batch.

-

position: Wave (T) – orange.

details:

The formation of the triangle appears to have been completed, with the price of the end of the wave D -gray. In the short term, the price is expected to move towards the nearest goal at 0.618 Fibonacci percentage from the wave to the wave (I).

conclusion:

Our Eliott Wave analysis of ASX: Westpac Banking Corporation – WBC provides basic visions in the current market directions, helping traders to make informed decisions. By setting critical price levels that achieve the health or nullification of our waves, we enhance confidence in our expectations.

By integrating these technical factors, we offer a professional and objective perspective on market trends, which leads to the equipment of merchants with implemented visions to make effective decisions.

Technical analyst:

Hua (Shane) Cuong, CEWA-M (Master’s Naming).