The signs of the upward market indicate an increase

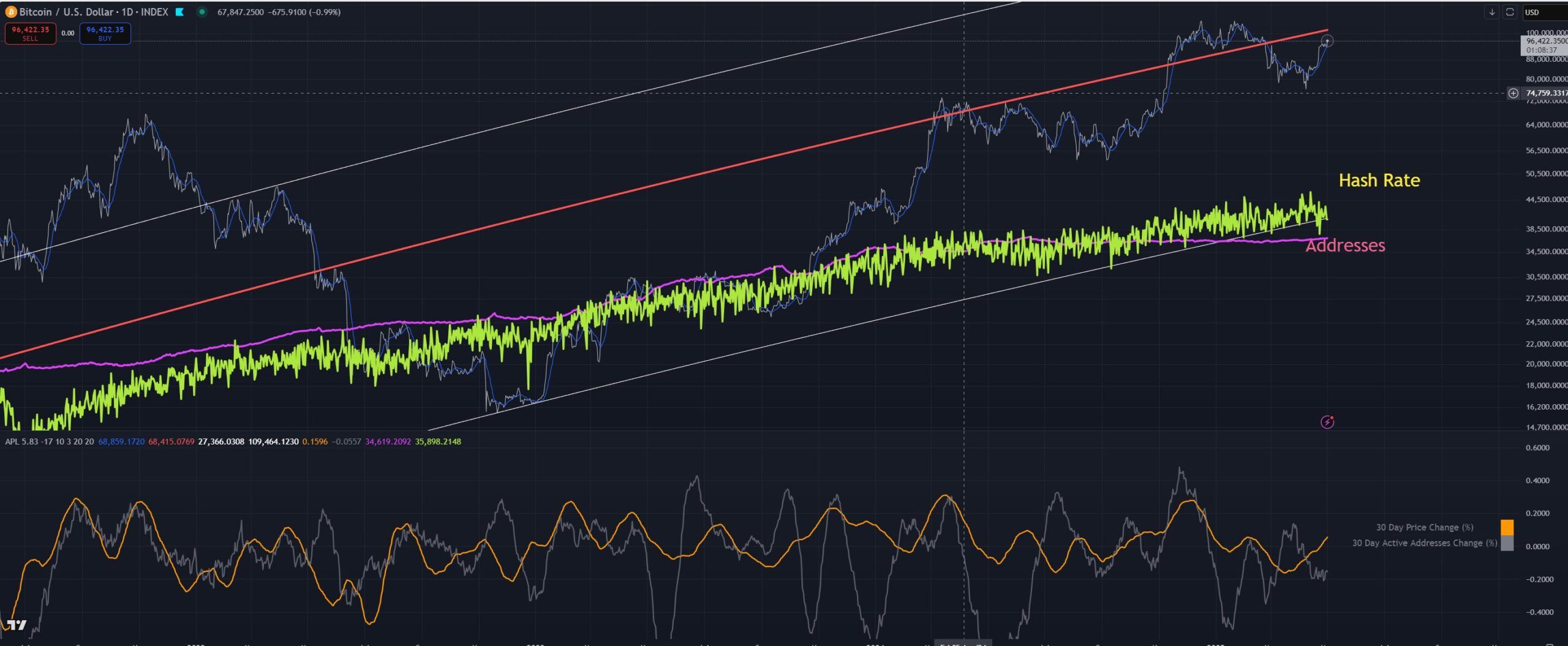

Bitcoin (BTC) displays signs of a potential upward trend in May, driven by major indicators. Experts have highlighted factors such as mining workers economics, network retailers, long -term accumulation, and global liquidity, which indicates that the increase in prices may be on the horizon.

This comes at a time when the cryptocurrency continues to recover from its first lowest level in April, an increase of 14.6 % during the past month.

Will Bitcoin Bull Run return?

In the latest X (formerly on Twitter), the analyst and founder of Wim Media Robertlove indicated the average cost data in the Miner Team team for Blockware to predict that Bitcoin may be on the threshold of the bull market.

He pointed out that the price in general is not less than this average for long periods, because it represents the threshold in which miners may stop operations if it is not profitable.

“In a rational economy, assets are rarely traded without the cost of their production,” Prederlove note.

He highlighted that the index was accurately determined by six bottoms between 2016 and 2024. Especially since it indicates another bottom, indicating that the increase in prices in Bitcoin may be imminent.

Macromicro Data More support. At the time of writing this report, the average average of 30 days (MA) for the cost rate of BTC 1.05.

This indicated that miners are working on average over the past month. Therefore, this can lead to an upward price movement where miners work on a loss, and tighten the supply.

Bitcoin division price, which establishes bitcoin value based on historical history The relationship between its price and the retail rate, adds to the upcoming expectations.

Analyst Giovanni commented on X that the model is currently at the Bitcoin support level.

The analyst said: “The fact that the BTC assessment on the retail rate is at the level of support means that we may have reached a type of local bottom,” the analyst said.

Additional market signals enhance a possible gathering condition. Breedlove noted that long -term holders have accumulated about 150,000 BTC over the past thirty days. This suggested that the pressure pressure decreased in the range of $ 80,000 to $ 100,000.

Since fewer people are ready to sell bitcoin at these levels, the price may face ascending pressure as the demand remains strong, but the supply of bitcoin is available.

“In essence, the price of bitcoin is just a function of supply and demand. After an increase in the price of bitcoin, you begin to see the inaugural coins in the past. Add.

Moreover, the global liquidity of the global dynasty expands the capital of the capital available for investment in Bitcoin. This is further strengthened by the boxes circulating on the stock exchange (ETFS), Bitcoin Treasury, and convertible bonds.

These financial compounds provide easier to new liquidity to enter the Bitcoin market, where the gap between traditional financing and encrypted currencies.

And not only the pharmaceutical liquidity that increases – the liquidity of all currencies Fiat is in height, and bitcoin are global origins, ” I mentioned.

Recently, Beincrypto has also highlighted some BTC’s ups. The clear demand of the currency turned into positive, which means an increase in activity in interest or purchase of Bitcoin.

In addition, the percentage of the market value to the achieved value (MVRV) increased from the historically important average at 1.74. This movement has previously proven to be a reliable indicator of the early stages of the emerging market for Bitcoin.

Amid these upward signs, the performance of BTC prices was very noticeable. After a short period of time to less than 75,000 marks in early April, the price continued to recover.

Last week, BTC witnessed an increase of 4.3 %. At the time of the press, the Bitcoin trading price was 97,048 dollars, which represents daily gains 2.3 %.

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.