Veteran merchant warning of XRP crashing style “School Book”

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Este artículo también está disponible en estñol.

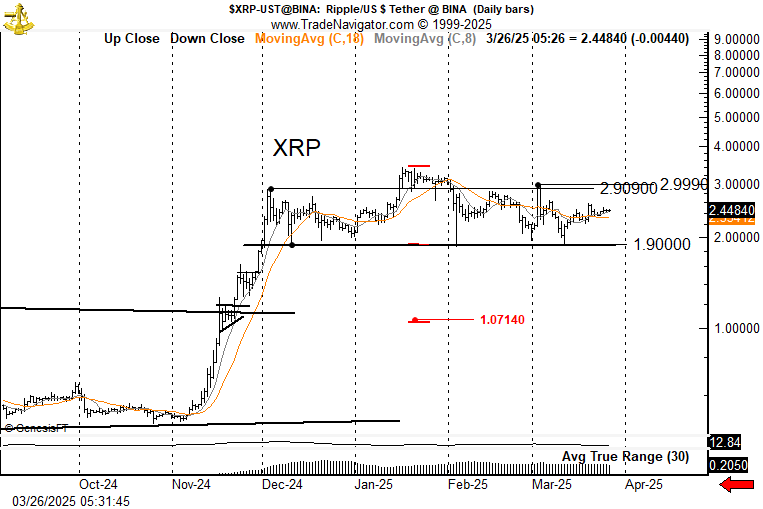

In an update published via X, veteran market analyst Peter Brandt shared an amazing technical look at XRP/USDT, setting a classic formation (H&S) in the daily scheme that indicates a possible spread towards a $ 1.07 region.

Brandt table XRP tracked daily bars from mid -October to late March on Binance. XRP rose from less than $ 0.50 in late October to more than $ 1.00 in mid -November. After the formation of a bull mark, the original continued with the highest strongly, as it built a local summit of about $ 2.90 in early December before the last stage began up to $ 3.40 in mid -January.

The 8 -day moving averages (C, 8) and 18 days (C, 18) – were displayed in orange and black, respectively – burned around the brand of $ 2.44, where the price is currently sitting.

XRP can be disrupted if this happens

Two prominent horizontal levels framing the current trading area. The first is the $ 1.90 floor, which works as an approximate H & S neckline and has been repeatedly worked as support. Second, the roof of $ 2.90 to $ 2.99, which is a clear horizontal resistance range where XRP struggled to keep upward momentum.

Brandt states that a decisive break is less than $ 1.90 “will not be perfect for length”, while any bullish breach exceeds $ 3.00 can force sellers exposed to reconsider their positions. On the graph, the left shoulder is near the handle of $ 2.90, followed by a higher peak at $ 3.40, creating the “head”.

After that, the right shoulder appeared closer to the $ 3.00. The neckline is about $ 1.90. If XRP collapses less than the neckline with sufficient size, the Brandt scalp goal – suggests a decrease to about $ 1.07. This price describes the target of the red arrow, indicating the risks of the potential negative side inherent in the classic H& s styles.

Brandt averages for 8 days and 18 days converge about $ 2.44, indicating an inherent momentum at the current levels. The average real range for 30 days (ATR) is measures near $ 0.205, which means that daily price fluctuations compared to the explosive procedure seen during the rise of XRP from late 2024 to early 2025. However, a break exceeds $ 3.00 or less than $ 1.90 can provoke renewal regeneration in length.

Brandt emphasizes his lack of a personal share in XRP, explaining that he only transmits what is seen as a declining “textbook” style: “I have no interesting interest up. H&S projects to $ 1.07. Do not shoot the Messenger.

At the time of the press, XRP was traded at $ 2.35.

Distinctive image created with Dall.e, Chart from TradingView.com