Update the price of encryption March 14: BTC, ETH, Link, Hype and PI

The encryption market showed flexibility today, March 14, 2025.

Most of the higher digital assets recorded slight gains in the background of the total economic transformations and organizational developments.

It includes flexible shows by Bitcoin (BTC), ETHEREUM (ETH), ChainLink (Link), Hyperleliquid (Hype).

It is worth noting that there are slight declines for PI (PI) and Mantra (OM), which determine the gains after a significant increase earlier in the week.

Here are the price updates for some coins over the past 24 hours.

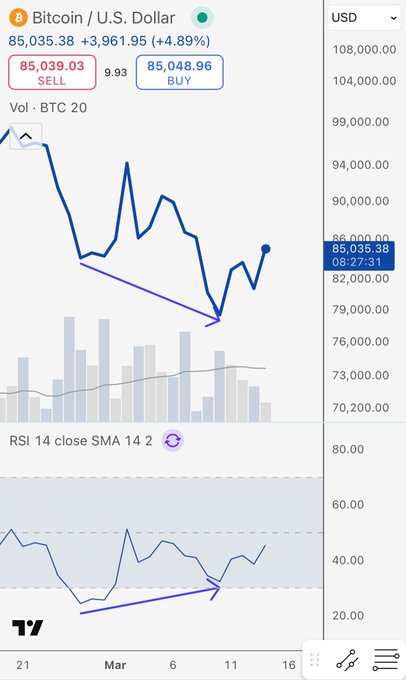

Bitcoin (BTC) breaks $ 84,000

Bitcoin has continued its upward path, climbing 5 % in the past 24 hours to trade at a price of about 84,400 dollars.

The increase comes in the wake of President Trump’s executive order on March 7, which ordered the use of BTC seized to enhance the American national reserve.

Amid the supportive position, optimism was high. However, some analysts warn that the broader economic concerns – such as possible tariff wars – can calm down.

The dominance of the market in BTC is still strong, as the trading volume continued with the continued institutional interest.

Scott Milker, nicknamed the wolf of all streets, says that Bitcoin Awards appear Signs of difference.

$ BTC There is no perfect daily signal, but the bullish difference with Oversool Rsi is the closest to. In all my years of trading and using different strategies, this is the only one that I really see at this stage. He was moving on this for years.

Ethereum price- key level

Ethereum has witnessed a modest increase of 4.3 %, hoping near $ 1930.

The second largest encrypted currency was moved according to the maximum market limit through the continuous developments in decentralized financing (Defi) and the expectation about the evaluation options for the money traded on the Stock Exchange.

However, the work of ETH prices was less volatile and the bulls still reduce the level of $ 2,000.

While the market is careful, the face in feelings among merchants can help buyers restore the main level. Pain means re -testing support levels.

Sweets indicate that the reflection is likely.

ChainLink (Link) offer bulls

ChainLink Aurge recorded 12 % on March 14, trading at $ 14.45 at the time of this report.

The growth of the Oracle network is associated with its growing role in the ecosystems of the smart nodes.

One of the positive leaderships in recent weeks has been speculation about ChainLink’s path with US support for innovation.

While no big catalyst appeared, the LINK price is a noisy holder.

Read more here: What Cashe

Liquid height (noise)

The liquid rise has emerged as a prominent performance, as it jumped 16 % in 24 hours to reach 14.41 dollars

Permanently decentralized future growth pushes this step as in the latest developments around it.

Hype climbing reflects a broader trend to acquire Altcoins traction as investors diversify beyond BTC and ETH, although their fluctuations are still a discussion point.

However, Altcoin has decreased by 26 % in the past two weeks and threw more than 58 % of its value since its peak at $ 35 in December 2024.

Why did the noise price rise today? Read more here.

The best losers today

PI (PI) leads the list of the best metal currencies that reach the pressure pressure during the past 24 hours.

The PI icon, among those who exploded recently, decreased by 5.6 %, as buyers fought near $ 1.55.

Mantro (om), a decrease of 2 % and Tron (TRX) by 1 %, is the best losers among the 100 largest coins depending on the maximum market. Other coins include Pare Aell (Elf) and SOLV (SOLV).

Update the public market

There is an escalating movement for many higher metal currencies, with this after a shrinkage earlier in the day.

For each CoinMarketCap, the total high value in the encryption market increased by 3.83 % to $ 2.75 trillion as of 1.20 pm Easter.

The market is looking to ignore previous concerns about selling American stocks. Some analysts note that the pain could continue amid tariff fears.

However, despite the trade war, Trump’s profitable policies, including strategic bitcoin reserves, inject confidence.

Chainlink and Hyperlequid benefited from positive feelings, and the latter after a prominent gossip on social media due to a huge modern liquidation event.

As of the writing of this report, the total open interest reached more than $ 93 billion and 5.9 %.

Meanwhile, the total coding liquidation For all Coinglass It was slightly more than 200 million dollars, the global daily volume of $ 83 billion, a decrease of about 6 % over the past 24 hours.

Update post -encryption prices March 14: BTC, ETH, Link, Hype and PI appear on Invezz