S & P 500 expectations: The indicator carries its breath – what’s the next?

- Discover the technical expectations of the S&P 500 after their attention amid optimistic updates from the United States, in addition, how the dollar index is performed

Yesterday, all US shares and dollars increased in response to the announcement that the United States and China have reached a commercial deal.

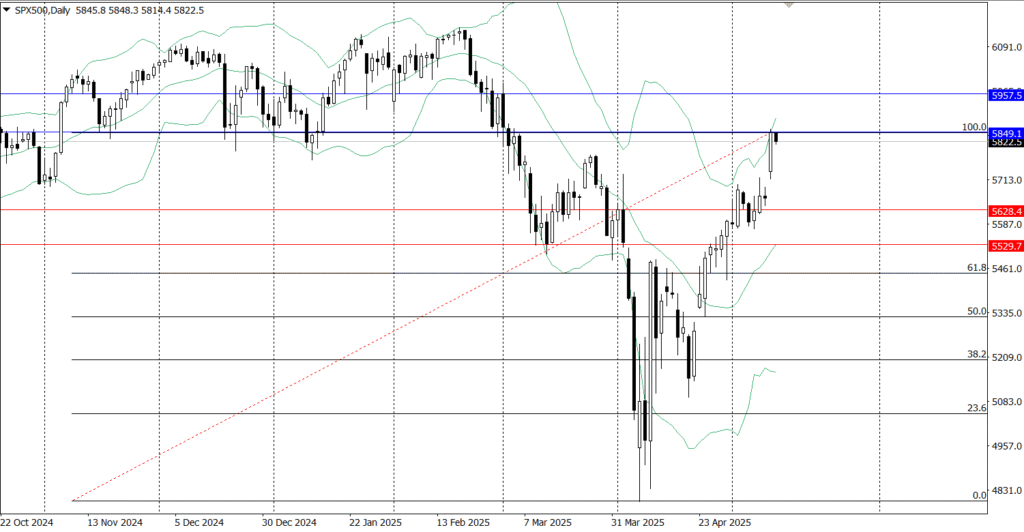

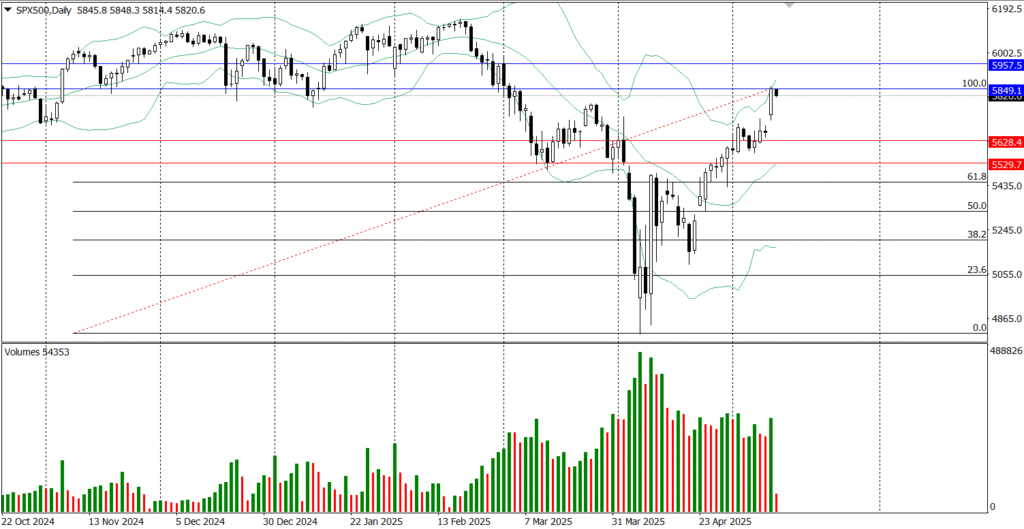

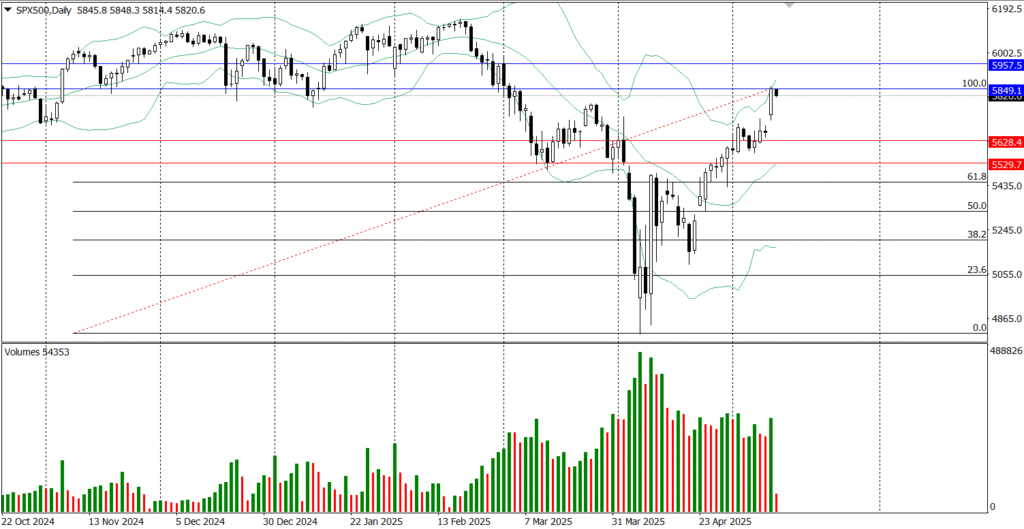

According to the S&P 500 (IndexSP: .inx), price fluctuations were not as expected, however, the S&P 500 exceeded a good and strong price level yesterday. So let’s take a look at the potential upscale and when it may be accessed, as well as the downward scenario.

At the time of writing this report, the S& P500 holds under the pressure of the strong resistance level at $ 5849.1, that is, the outbreak of this level may open the door to reach higher levels and confirm the bullish scenario.

On the other hand, if the index remains below the aforementioned resistance level and puts a clear daily closure less than $ 5780, this might confirm the declining scenario.

However, we will not confirm anything for a few days as long as the folders are not impressive in the S&P 500. Also, the future of the S&P 500 decreased by 25 points, which is 0.4 % by 07:33 GMT. S & P 500 a counter -ball off its lowest level after the collapse of the customs tariff

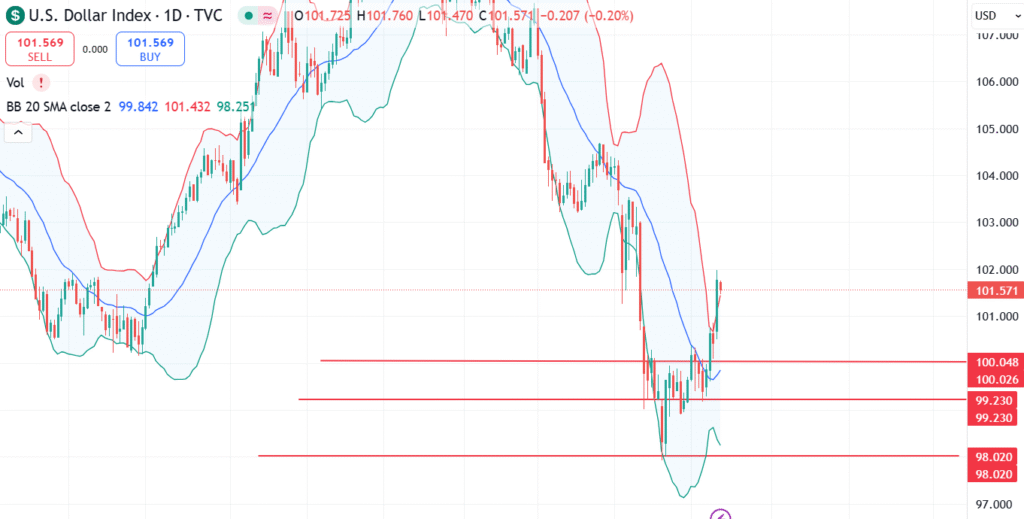

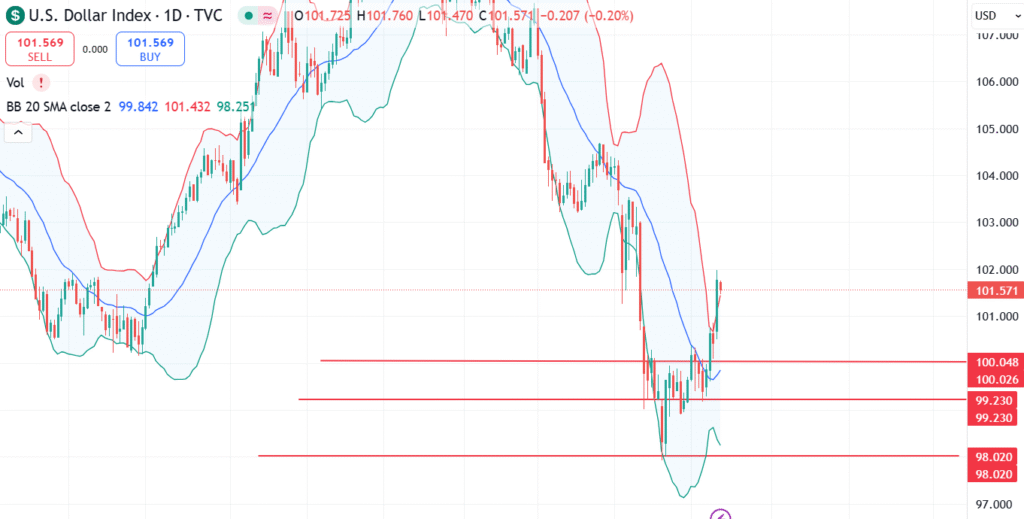

US International Index Price Expectations

This index measures the value of the US dollar against a basket of six global currencies, which has declined from its highest levels since April 10 to reach 101.60 today in the early morning. In response to the optimistic announcement of the commercial deal between the United States and China, it supports the US dollar.

See too

Technically, the US dollar index still indicates a declining feeling, because the index has not yet confirmed feelings of strong difficulty above the psychological level at 100.00, and therefore any destruction may be offered 99.23, the lowest level on May 7, and the next goal of watching is 98.02, a decrease on April 22.

On the upper side, if the index applies a clear day above the resistance level at 103.35, it may expose it to reach additional higher levels at 104.31, and the gains may reach 104.71, which is above March 27.

Blogs are over.