Delayed open benefits in Bitcoin despite the price of more than $ 100,000 – the Analysis Company suggests caution

Bitcoin’s price over the past week was largely compensated, as the first cryptocurrency regained its place above 100,000 psychological dollars. This last explosion of the upper momentum reflects a healthy healthy feeling among investors.

On Friday, May 15, the price of bitcoin was 103,800 dollars – its highest level since January. However, the latest data on the series shows the lack of an investor activity in the derivative market, and it is usually seen when the BTC value strikes this level.

BTC PRICE RALY is about to hit a road barrier?

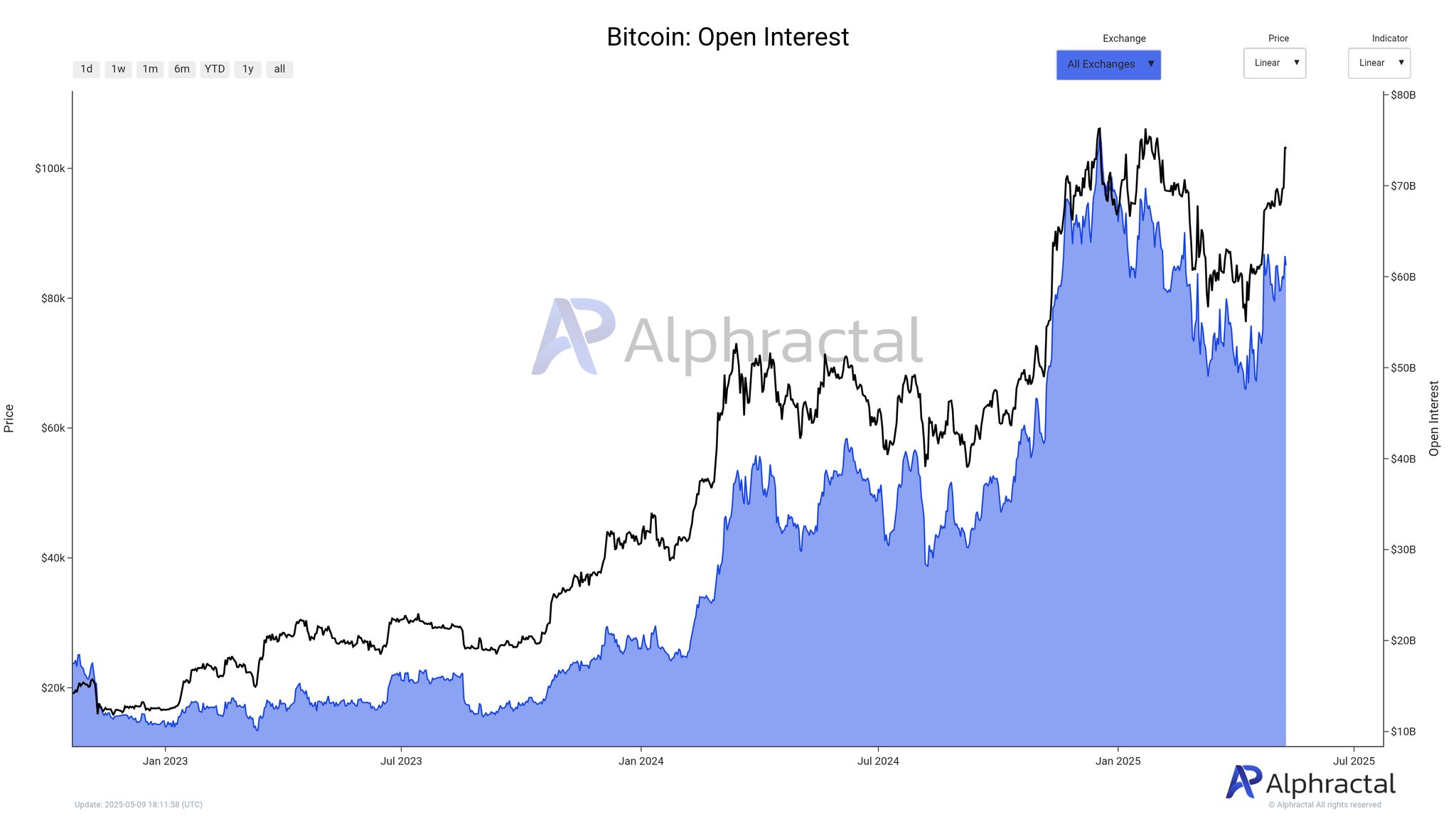

In a recent publication on the social media platform X, Crypto Alphractal analysis platform subscriber Open interest (OI) has not moved completely with Bitcoin price during the past few days. The open interest meter measures the total amount of money that flows to BTC derivatives at any specific time.

The high open interest is often a bullish sign of the first cryptocurrency, especially as it indicates the flow of fresh capital in the market. Ultimately, this trend indicates the improvement of investor morale and the high trader’s confidence.

According to the data from Alphractor, the current OI total for Bitcoin (at a value of about $ 103,000) is estimated at 61.3 billion dollars. The last time BTC was at this huge price, the open interest was more than $ 68 billion.

Source: @Alphractal on X

With the existing open interest in the current Bitcoin than OI was the last price at $ 103,000, Alphractor noted that this trend indicates a decrease in the financial lever and the reduction of activity in the largest market in Crypto. Analysis Company also explained that this phenomenon can be caused by modern waves of liquidation or location.

In the post on X, Alphractal revealed other reasons that make the price of the leading cryptocurrency at risk of short -term correctional movement. The scale on the relevant chain that supports this landfill is the feeling of the stance of the whale.

The scale of the whale’s feelings is tracked in the position of the whale of both directional bias and trading behavior for adult holders. It usually reflects the identification of net whales, their morale in the market, as well as changes in open situations.

Chart showing a decline in the Whale Position Sentiment from 1 to around 0.7 | Source: @Alphractal on X

Alphractor concluded that the decrease in the feelings of whale position reflects the interest of big investors in closing long positions, thus transferring market morale. If the scale continues to decrease, the analyzes company concluded on the series that it may lead to stagnation of prices, or worse, correction.

Bitcoin price at a glance

From writing these lines, the BTC price is 103,035 dollars, which reflects any large movement in 24 hours. While the last upscale momentum indicates that the first cryptocurrency can reach the highest new level ever in the coming days, investors may want to be careful, given the recent notes on the series

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Distinctive image from Istock, tradingvief chart

Editing process For Bitcoinist, it is focused on providing accurate, accurate and non -biased content. We support strict resource standards, and each page is subject to a diligent review by our team of senior technology experts and experienced editors. This process guarantees the integrity of our content, importance and value of our readers.