Max Kaiser, Warren Buffett, and Michael Sailor

Welcome to Mooring Crypto News – the main blaming of the most important developments in encryption for next day.

Get coffee to see the market from the eyes of financial experts via Trafi and Crypto. Looking at the most firm financial channels, there is an increased overlap, with Bitcoin (BTC) inadvertently from Tradfi problems.

Crypto News of the Day: Max Keizer says that Bitcoin and Saylor are the future

Warren Buffett presented the final status of Bitcoin, as the American investor is considered to be a CEO of Hathaway.

Waiting for the approval of the Board of Directors, Buffett can step down at the end of the year, allowing Greg Abil, the vice -president of insurance operations, to become a new chairman of the Berkashire.

This revelation came at the meeting of the annual shareholders of Hathaway on May 3, 2025, as Buffett also provided a flagrant warning about the long -term value of the US dollar.

He pointed out that each system in the end prevents its currency. According to Varne Buffett, government decisions make paper money lose value over time.

“In the end, if you make people control the currency, you can issue paper money, and it will do so,” Pavite He said The shareholders are in Omaha.

https://www.youtube.com/watch?

Without naming alternatives such as Bitcoin, the 93 -year -old investor warned against detaining the assets denominated in a currency he said to reduce the value of government policy systematically.

He added: “The natural path of the government is to make the currency deserve less over time … Some places turn in breaths … It is not evil, it is only their work.”

The investment icon said that if his late partner, Charlie M.UNGER, had to choose a second area next to the stocks, and he would go to foreign currencies.

These statements suggested openness to unconventional origins. Bitcoin’s lawyer and Max Keizer’s broadcaster responded to observations in an interview with Beincrypto.

MAX Keizer explains Buffett comments as checking the authenticity of the implicit thesis behind Bitcoin.

“The CEO and co -founder of Microstrategy Michael Saylor is Warren Buffett in the twenty -first century. He saw what Pavite described and building his strategy around him,” Keser began.

Keizer criticized FIAT currency systems and central banking services. The pioneer of Bitcoin varied in the investment approach that Silor focuses on Bitcoin with what he described as Buffett’s dependence on traditional financing (Trafi).

“Warren Buffett built his empire on the printing of money. Most of his property over the years was in banks, insurance companies and financial services,” Kaiser claimed.

In his opinion, Buffett benefited from a political crane in Washington, especially during the 2008 financial crisis. During this time, Kaiser says, says [Buffett] Investments in Wall Street institutions are in line with government -led rescue efforts.

The role of Buffett was documented during the 2008 financial crisis

During the market shrinking, Perkshire Hathaway has invested extensive Earn praise as an installation force.

Meanwhile, Michael Sailor has followed a significant different approach. Under his leadership, Microstrategy (now strategy) began obtaining Bitcoin in 2020 as part of the Corporate Treasury. The company has referred to concerns about the long -term mobility of Fiat currencies.

As of early 2025, the company owns more than 200,000 BTC, with a value of dozens of dollars at the current market prices. The US encryption news publication recently revealed one of the latest Bitcoin strategy purchases.

Pavite has always criticized Bitcoin, describing it as “in the name of the square mice” in 2018. However, some in the area of digital assets interpreted his recent comments on the work of the currency as agreeing with the basic arguments presented by Bitcoin supporters.

Based on his remarks, the American and improved investor is concerned about the US financial policy.

His comments hinted that although he may not like bitcoin, he clearly understands the reason for his existence. Feelings on X show that members of society have noticed this.

The responses indicate that if Warren Buffett understands the money and its faults are manifested in the form of Fiat, then why not support Bitcoin as a solution?

“Warren Buffet is talking about Bitcoin’s virtues without mentioning Bitcoin,” one of my users on X Mockery.

Meanwhile, others hope to replace potential Pavite as CEO Siri, the next Hathaway president, to lead the company in a different direction, and may be adopted Bitcoin.

A spokesman for the Hathaway Berkshirey immediately responded to a request to comment on Kaiser’s notes.

Elsewhere, in line with the Buffett statement on foreign exchange, QCP capital analysts cite a noticeable footnote in the Taiwan dollar on Monday.

They cite this as the most severe TwD step, along with the gains in other APAC currencies with strong surpluses in the current account. According to analysts, speculation about a possible trade deal in the United States, Taiwan, has pushed this gathering, as well as defecation flows in the insurance company, which prompted NDF from TwD to its widest since 2008.

While the Taiwan trade surplus supports TWD, capital flows have historically balanced them. This shift reflects a dislocation of foreign currencies such as 2023 JPY bearing relaxation.

For Crypto, this step indicates potential macro fluctuations, as gold increased by 3 % and BTC in a bilateral path linked to global capital flows and commercial diplomacy.

“On the market where the connections are destroyed, FX may again be the canary in Coalmine,” books QCP analysts.

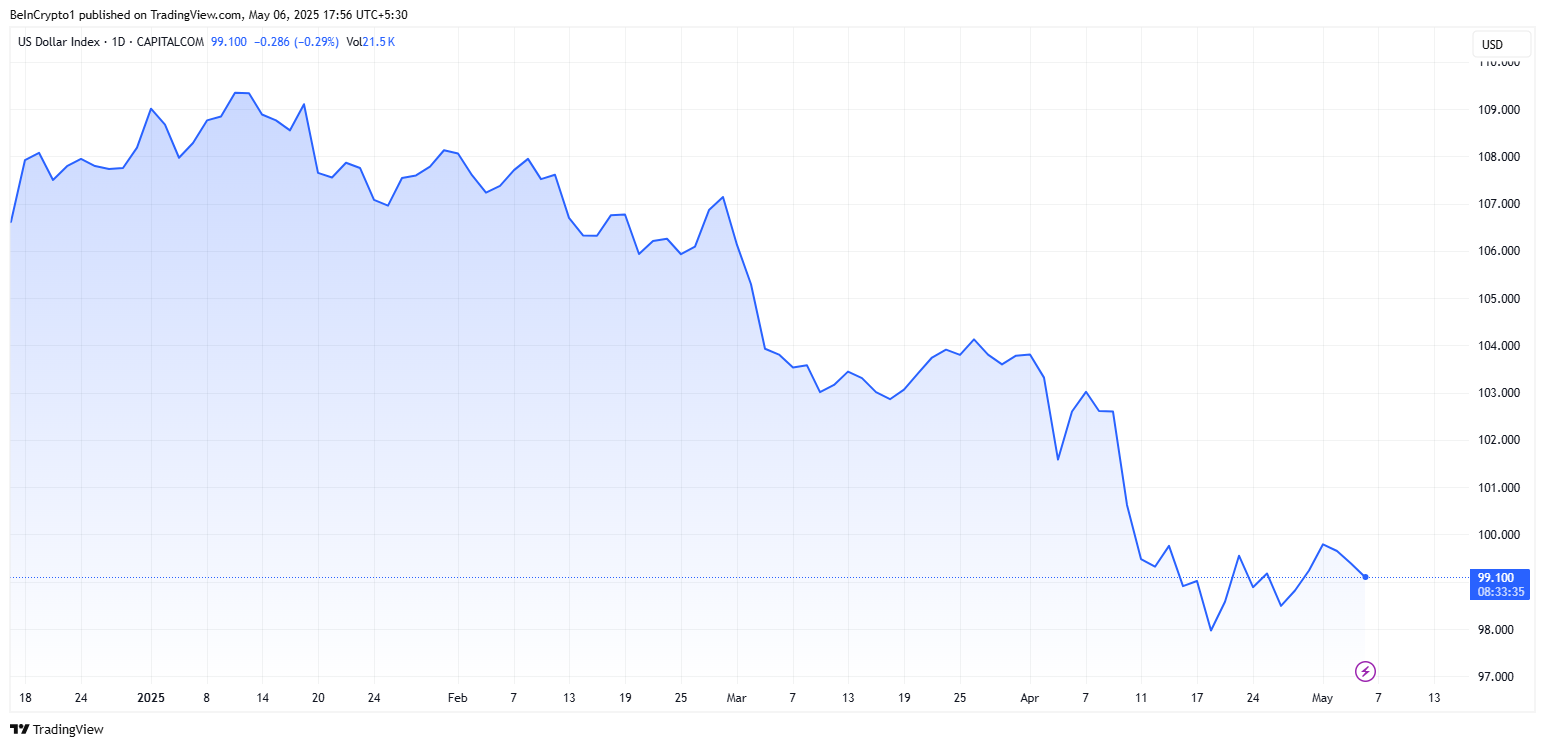

Today’s scheme

The graph has displayed the direction of the US dollar index (DXY) since 2025, which reflects the fluctuations in the value of the US dollar against a basket of major currencies. It indicates a declining movement from February to May, with a slight modern recovery.

Alpha

Here is a summary of more encryption news that must be followed today:

- Powell’s tone at FOMC press conference can lead to large market movements, with analysts dividing the impact of his observations.

- The average daily trading volume in XRP was $ 3.2 billion in the first quarter of 2025, with a peak of $ 16 billion, driven by strong institutional demand and retail.

- A new discussion draft introduces a framework to reduce market concentration and enhance innovation. The draft law explains the jurisdiction between SEC and CFTC, with a focus on decentralized systems and the provision of regulatory clarity of digital asset markets.

- Speculation grows more than XRP prices, citing the rights of the large code from Ripple and monthly sales.

- The Cantor Fitzgerald’s transparent management of Tether’s shots has decreased significantly, and Tether grew from the largest liquidity risk in Crypto to a stable institutional investment.

- Bitcoin briefly outperformed stocks in April 2025, indicating capabilities such as Macro’s hedge, but it was cohesive with shares by the end of the month.

- GIMINI RLUSD Stablecoin was included from Ripple, trading empowerment, deposits, clouds, and determining a milestone in its adoption.

- The Kenya Supreme Court ruled for privacy, and ordered the deletion of biometric data collected from users.

- POMP.fun Design ETHEREUM in 2025 fee revenues, and received $ 296.1 million from YTD and the weekly graphic leadership for nine weeks.

Overview of stocks before the market

| a company | At the end of May 5 | A pre -market overview |

| Strategy (MSTR) | $ 386.53 | $ 380.78 (-1.49 %) |

| Coinbase Global (Coin) | 199.40 dollars | 196.50 dollars (-1.45 %) |

| Galaxy Digital Holdings (GLXY.TO) | $ 26.51 | $ 26.18 (-1.23 %) |

| Mara Holdings (Mara) | 13.09 dollars | 12.81 dollars (-2.14 %) |

| Riot control platforms (riot) | 7.90 dollars | $ 7.79 (-1.39 %) |

| Core Scientific (Corz) | 8.75 dollars | 8.51 dollars (-2.74 %) |

Disintegration

In adherence to the confidence project guidance, beincrypto is committed to unprepared and transparent reporting. This news article aims to provide accurate information in time. However, readers are advised to independently verify facts and consult with a professional before making any decisions based on this content. Please note that the terms, conditions, privacy policy have been updated and the evacuation of responsibility.