Ethereum 2025, 2026 predictions

The story stands out

- Today’s Ethereum price is 1,882.09490168.

- The ETH price with a possible increase can reach $ 5,925 in 2025.

- The price of ETHEREUM can reach a height of $ 15,575 by 2030.

ETHEREUM launched the final Pectra test, Hoodi Testnet, to improve the user experience, solve previous test failures, and allow gas payment options. This is the last 3 tests, and the developers agreed to set the Pectra 30 -day upgrade date of the successful Hoodi Testnet program.

On the other hand, Custodia Bank partner with Vantage Bank to repeat request deposits in dollars through the version of Avit Stablecoin on Ethereum Mainnet. Moreover, Ethereum leads symbolic assets with $ 3.3 billion of real assets on its network.

Will Ethereum outperform Bitcoin in the next Crypto Bull? With the transformation of ETHEREUM 2.0, the expansion of layer 2 solutions, the increasing Defi adoption, this article is analyzed the main prediction of ETH prices, market dynamics, and technical trends that make up the future of ETHEREUM.

Read ETHEREUM Prices in Coinpedia Now to set the goals of the next price until 2030.

summary

| Coded | ethereum |

| code | Eth |

| price | 1,882.09490168  4.39 % 4.39 % |

| The maximum market | 227,092,638,744.09 |

| Trading offer | 120,659,504.7582 |

| Trading | 15,157,290,384.7609 |

| Ever | 4,891.70 dollars on November 16, 2021 |

| Low | 0.4209 dollars on October 22, 2015 |

Ethereum 2025 predictions

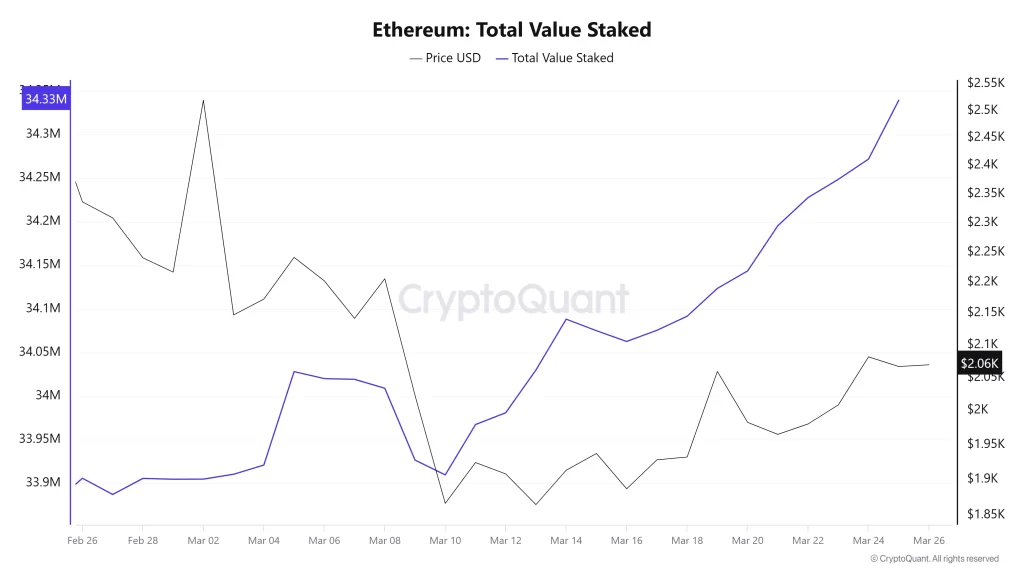

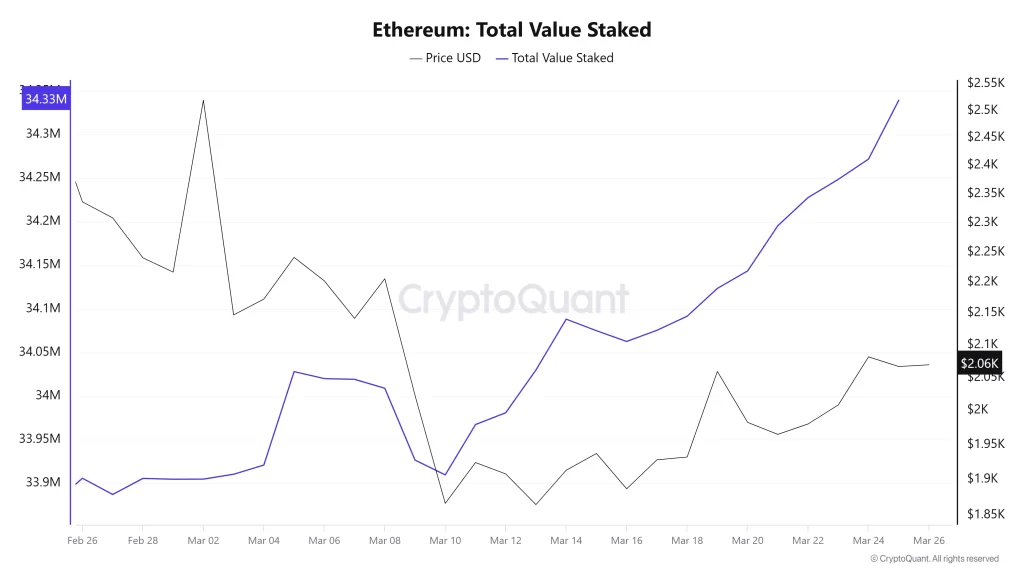

Ethereum Blockchain will launch the Pectra upgrade soon. This upgrade is combined with two pre -planned updates – Progue and Electra – in comprehensive strengthening. The upgrade will bring new improvement proposals, enhance expansion and performance. Access to ETH 2.0, according to QuantityThe total fake value in the time frame for one month is currently 34.33 USD

The ETHEREUM price is expected to maintain its upward path and constitute higher levels. Moreover, with increased adoption, newer promotions, and network growth, ETH currency price can break a sign of $ 5,000 and exceed the highest new level ever at $ 5,925.

On the contrary, the high uncertainty or any unpleasant global economic events can withdraw the ETH price to the lowest annual level of $ 2,917. Looking at the feelings of the market, the average price can settle at about 3,392 dollars.

| year | Possible low | Possible average | Potential |

| 2025 | $ 2,917 | 4,392 dollars | $ 5,925 |

Ethereum 2026 – 2030 targets

| year | Possible low ($) | Possible Mediterranean ($) | Possible high ($) |

| 2026 | 5566 | 5,713 | 6,610 |

| 2027 | 6800 | 7,246 | 8,705 |

| 2028 | 8,613 | 9,482 | 10,410 |

| 2029 | 10,192 | 11,111 | 12,994 |

| 2030 | 12647 | 14,163 | 15,575 |

ETH 20 prediction price26

By 2026, the Ethereum value is expected to reach a height of $ 6,610. On the other hand, the ETHEREUM price may decrease to $ 5566, with an average of $ 5,713.

Ethereum 2027 price forecasts

ETHEREUM 2027 is expected that the ETH price will be the highest new level ever at $ 8,705. However, a market -based correction may drive ETH to $ 6800, with an average of $ 7,246.

The prediction price of 2028

In 2028, the ETHEREUM chances that dominate the high encryption market, as the ETH price is likely the highest new level at 10,410 dollars. On the other hand, Altcoin may drop to $ 8,613, achieving an average of $ 9,482.

Ethereum 2029 price

It is close to its highest level at $ 12994 in 2029, the ETHEREUM price is expected to exceed the psychological barrier of $ 12,000. In the event of a correction, $ ETH may reach a decrease of $ 10,192, at an average price of $ 11,111.

ETH 203 predict0

The price of ETH Crypto is expected to reach the highest new level ever at $ 15,575 in 2030, with a possible decrease of $ 12647 and the average price of $ 14,163.

Prices of Ethereum 2031, 2032, 2033, 2040, 2050

Based on the historical market feelings and direction analysis of the largest altcoin according to the market value, here are the potential ETHEREUM price goals of the longest time frameworks.

| year | Possible low ($) | Possible Mediterranean ($) | Possible high ($) |

| 2031 | 14,645 | 16,301 | 17,958 |

| 2032 | 17,937 | 20153 | 22369 |

| 2033 | 21,125 | 25,501 | 29,877 |

| 2040 | 65346 | 94,512 | 123,678 |

| 2050 | 117,684 | 186483 | 255,282 |

ETHEREUM Prices in Coinpedia

With factors such as the growing ETHEREUM network, high flows, wider market restoration, and increased adoption, the ETH price is likely to give multiple length returns in 2025.

According to the ETHEREUM (ETH) price of the currency price in Coinpedia, Bulls can reach $ 5,925 in 2025.

| year | Possible low | Possible average | Potential |

| 2025 | $ 2,917 | 4,392 dollars | $ 5,925 |

Check the XRP Price Prepaity 2025, 2026 – 2030!

Market analysis

| Company Name | 2025 | 2026 | 2030 |

| Changelly | 4,012.41 dollars | $ 5,375 | 24,196 dollars |

| Coincodex | 6,540.51 dollars | $ 3,816.62 | 6660.08 dollars |

| Binance | $ 3,499.54 | $ 3,674.52 | 4,466.40 dollars |

*The above goals are the average goals set by the companies concerned.

- Also read:

- XRP Price Process 2030: Secrets Larsait vs. Ripple | XRP price to rise after 60 days?

- and

Do not miss any rhythm in the world of encryption!

Stay in the foreground with urgent news, expert analysis, actual time updates about the latest trends in Bitcoin, Altcoins, Defi, NFTS and more.

Common questions

The current ETHEREUM price is $ 1877.09.

The largest ALTCOIN price can pay a maximum of $ 6,925 in 2025. ETH is expected to cross a mark of $ 15,575 by 2030.

While Ethereum is reliable in its courageous basics, Bitcoin continues to control its adoption on a large scale.

Based on the current price direction, the ETH price can range between $ 1,800 and $ 2000.

The price of $ ETH is expected to rise with FUD stability and start the Altcoin season.

In the midst of the feelings of the broader market and strongholds of Bitcoin, the price of Ethereum Steam has lost its plans.

ETHEREUM 2.0 is an updated version of the current Ethereum Blockchain, which aims to increase the efficiency of the ETHEREUM network, expansion and speed.

According to the forecast at ETHEREUM 2025, the ETH price can reach a maximum of $ 5,925.

With its dominance in Defis and NFTS and its widespread emergence, Ethereum will continue the crown of the largest altcoin. With merging with ETH 2.0, the ETHEREUM contract will increase strength.

Yes, Ethereum will eventually welcome more projects that will be built on its series after its merging. It will also get many improvements that will mainly enhance the series.

As the altcoin season starts, short -term gains make Ethereum the option to buy a profitable. However, the long -term promises of this Blockchain Blockchain make it a long -term encryption investment.

According to the last ETH price analysis, ETHEREUM can reach the maximum price of $ 123,678.

By 2050, the price of one ETHEREUM can rise to 255,282 dollars.