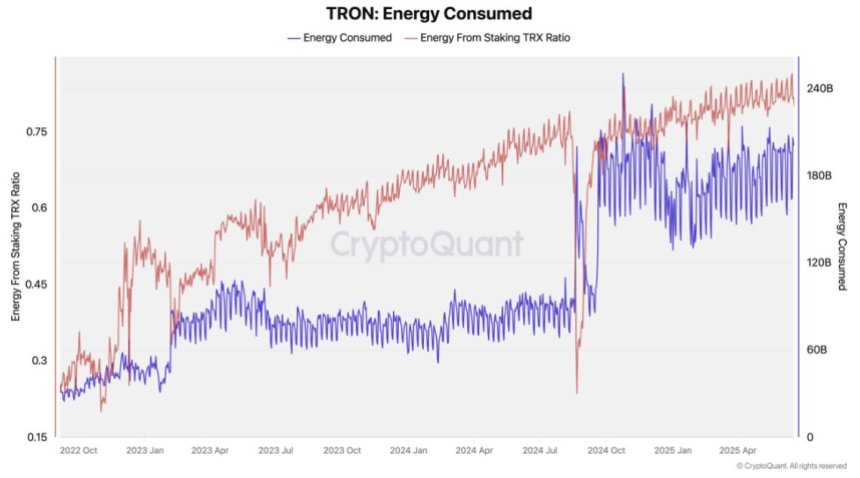

Tron Energy Usage 108 % is used – smart nodes are accelerated

The cause of confidence

The strict editorial policy that focuses on accuracy, importance and impartiality

It was created by industry experts and carefully review

The highest standards in reports and publishing

The strict editorial policy that focuses on accuracy, importance and impartiality

Morbi Pretium Leo Et Nisl Aliguam Mollis. Quisque Arcu Lorem, Quis Quis Pellentesque NEC, ULLAMCORPER EU ODIO.

Tron (TRX) has become the investor’s attention again with the main developments surrounding its future. On Monday, the SRM Entertainment included on the Nasdaq Stock Exchange (SRM.O) confirmed a strategic agreement with the founder of Ton Justin Sun. The deal will witness that SRM gets TON TOKENS and the same as “Ton Inc.” And Sun on board as a consultant, which makes Tron closer to becoming a public circulating entity. This represents a historical transformation of the Blockchain industry and is placed in a unique space between encryption projects.

Related reading

However, the market wallpaper is nothing but calm. The high geopolitical tensions in the Middle East have caused severe fluctuations across risk origins, including TON. While the price of the symbol may turn significantly, long -term measures indicate the force inherent in the network.

According to the new Cryptoquant data, the total daily energy consumption in TON-is an important measure for the implementation of the smart nodes and user activity-by 108 % on an annual basis. It is now in 200 billion energy units per day, compared to only 77 billion per year. It is worth noting that 80 % of this request stems from TRX Stake, indicating a strong participation in the protocol and a significant increase in smart nodes reactions. Together, these factors emphasize the increasing importance of Tron as a technical platform and the Blockchain Foundation that faces generally.

Tron is trading near the main demand amid the withdrawal of the broader market

TON is currently testing the level of demand for the key after correcting 9 % of its last height near $ 0.295. The price rose shortly on Monday after the announcement of Tron’s plans to the public through a deal with the SRM Entertainment listed in Nasdaq. However, the excitement was short -term. With the overall economic uncertainty and the escalation of conflicts in the Middle East, the entire encryption market entered an alternative to a replacement phase, which led to the withdrawal of TRX less than the levels circulated before the news.

Despite the difficult circumstances, the basics on the chain paint a more flexible image. Cryptoquant data It shows that the TON network activity is still strong, as energy consumption-to implement smart contracts-is used by 108 % on an annual basis. The total daily energy use exceeds 200 billion units, compared to only 77 billion at the same time last year.

This increase in energy use indicates the increasing demand for operations on the chain and the implementation of the smart nodes. More importantly, about 80 % of this energy demand comes from TRX Stake, indicating the strong user’s commitment to the network and increasing sharing in decentralized applications.

The difference between the TRX strength on the series and the current prices indicates that the recent withdrawal may be more about the strain of the wider market than any deterioration in the basics of TON. If the fluctuations are stabilized, these strong activity standards can help in a Tron’s position for strong recovery.

Related reading

TRX PRICE carries the direction line support despite the volatile reflection

TON is currently trading at $ 0.2730, indicating a modest decline of 9 % of $ 0.295, which was reached earlier this week after announcing a deal related to SRM Entertainment. The price procedure in the scheme reflects this volatile reaction-after TRX has been sharply recovered, and is now integrated over the moving average for 50 days (blue line), which was a dynamic support during the past two months.

Despite this withdrawal, the structure is still optimistic. TRX continues respect for the long -term rising trend line that has been formed since early March, while maintaining the lowest higher levels. The size of the size increased during the initial assembly on the advertisement, but it has since returned to pre -fee levels, indicating the fading of the noise in the short term and returning to the basics.

Looking at the broader setting, the moving averages remain for 100 days and 200 days (green and red lines) tilted up, which reflects a long -term momentum. The support range will be from 0.269 to $ 0.253, which is determined by this MAS, a key if the additional negative pressure is achieved.

Related reading

The rest of more than $ 0.295 will nullify this short -term decline and may ignite the move about $ 0.32. On the contrary, failure to keep the direction line can lead to a deeper decline. Currently, TRX carries a structure – there is still a justification for the most uncertainty in the market.

Distinctive image from Dall-E, the tradingView graph